Global light vehicle market up as shortages ease

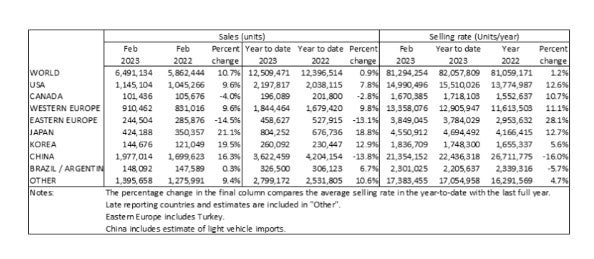

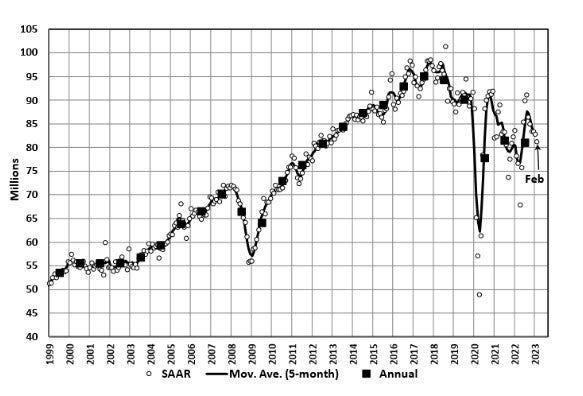

Although the world’s vehicle market was up in February – by 11% – versus last year, underlying demand fell back against last month’s running rate, according to GlobalData latest analysis of world markets.

The gain on last year’s pace reflects improving supply, whilst the dip against last month is partly due to the timing of the Chinese New Year and tax changes.

The Global Light Vehicle (LV) selling rate in February fell to 81 million units/year from January’s figure of 83 million units/year. While global supply-side constraints remain a drag on the sector’s recovery, raw monthly registrations increased to 6.5 million units — growth of almost 11% year-on-year (YoY).

The Chinese market in February was affected by the Chinese New Year and the termination of tax incentives in 2022. Both the North America and Western Europe markets saw YoY improvements in performance when compared against a very weak 2022, while Eastern Europe continues to suffer YoY negative growth.

A summary of market developments in the world’s regions follows.

North America

US LV sales grew by 9.6% YoY in February, to 1.1 million units. While the selling rate slowed to 15.0 million units/year, from 16.0 million units/year in January, the persistent supply-side issues have disrupted seasonality, making the selling rate a weak indicator of the market’s strength. February sales surpassed expectations, despite high average transaction prices at US$46,015, up by 4.3% YoY. Incentives are starting to increase modestly, at US$1,415 last month (+11.0% YoY).

Canadian LV sales fell 4.0% YoY, to 101k units, with the selling rate estimated to have declined to 1.7 million units/year in February, from 1.8 million units/year in January. Despite a subdued market, improved inventory levels are likely to support sales activity this year. In Mexico, sales increased by 28.4% YoY in February to around 102k units. The selling rate accelerated to 1.4 million units/year, from 1.2 million units/year in January.

Europe

The West European selling rate rose from 12.5 million units/year in January to 13.4 million units/year in February. In preliminary raw monthly terms, February registered 910k units, up 9.6% YoY. However, this is in comparison to a weak February 2022.

The East European selling rate also picked up from January to February. The Ukraine war still debilitates the LV market activity in the region, with preliminary raw registrations at 240k units, down 14.5% YoY. This fall is driven by Russia, where raw registrations fell by almost 60% YoY.

China

Preliminary February data indicates that, as expected, the Chinese market decelerated further. The February selling rate was 21.4 million units/year, down 9% from a sluggish January, and the lowest rate since the Shanghai lockdown in April 2022. In YoY terms, however, sales increased by 16% against a low base, due to the timing of the Chinese New Year. Weak sales in January and February can be attributed to the fact that two major tax incentives (for both ICE and NEV models) were terminated at the end of last year.

As sales are slumping, OEMs are now cutting prices and provincial governments are rushing to offer subsidies (primarily for new vehicles that are assembled in their own province). Following the big price cuts by Tesla, the price war has spread beyond EVs to ICE models. That should help boost sales in the coming months, as most economic activities have returned to normal after the pandemic subsided.

Other Asia

In Japan, the selling rate slowed to 4.6 million units/year in February but averaged a solid 4.7 million units/year in the first two months of this year. Thanks to an easing of global supply bottlenecks, OEMs ramped up production and thus increased deliveries. Yet, the semiconductor shortage is far from over, continuing to disrupt production. The waiting periods for most models remain long, ranging from a few months to a few years.

In Korea, the February selling rate reached a near two-year high of 1.8 million units/year, up 11% from a month ago. Sales were aided by the tax incentives for Passenger Vehicles (PVs) and the recently launched 2023 BEV subsidy program. The new scheme provides BEV sales with various cash subsidies, based on vehicle price, vehicle performance, after-sales service infrastructure, and battery energy density, and will likely give Hyundai and Kia an advantage over imported brands, such as Tesla and Mercedes.

South America

Brazilian LV sales fell by 0.8% YoY in February, to 120k units. While the selling rate accelerated to 1.9 million units/year, from 1.7 million units/year in January, this was still a disappointing outcome. In volume terms, it was the weakest February since 2005, but there were two fewer selling days than last year, while the annual Carnival celebrations could have impacted sales to some extent. While inventory continues to improve (187k units in February) affordability is still a concern as prices rise and consumers face economic uncertainty.

In Argentina, sales are estimated to have increased by 5.6% YoY in February, to 28.3k units, while the selling rate accelerated to 394k units/year, from 375k units/year in January. The result was very close to the previous six months’ average selling rate, as the market continues to tick over, albeit at a much lower level than in previous years, with economic headwinds and import restrictions keeping sales in check.

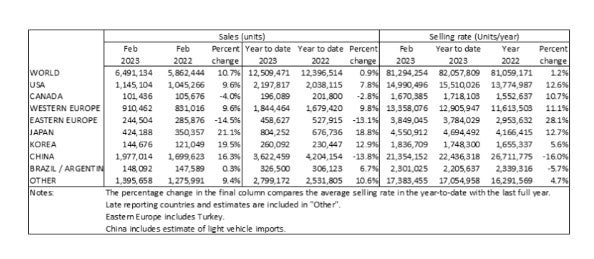

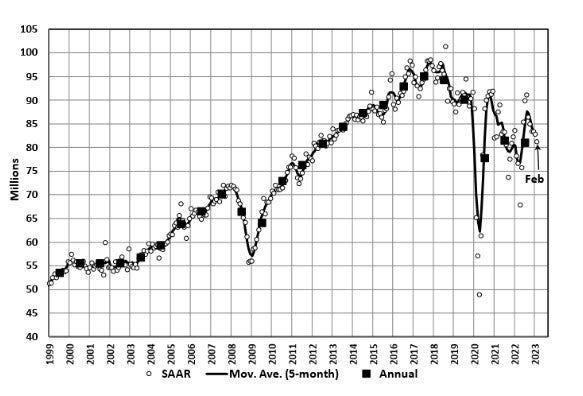

Although the world’s vehicle market was up in February – by 11% – versus last year, underlying demand fell back against last month’s running rate, according to GlobalData latest analysis of world markets.

The gain on last year’s pace reflects improving supply, whilst the dip against last month is partly due to the timing of the Chinese New Year and tax changes.

The Global Light Vehicle (LV) selling rate in February fell to 81 million units/year from January’s figure of 83 million units/year. While global supply-side constraints remain a drag on the sector’s recovery, raw monthly registrations increased to 6.5 million units — growth of almost 11% year-on-year (YoY).

The Chinese market in February was affected by the Chinese New Year and the termination of tax incentives in 2022. Both the North America and Western Europe markets saw YoY improvements in performance when compared against a very weak 2022, while Eastern Europe continues to suffer YoY negative growth.

A summary of market developments in the world’s regions follows.

North America

US LV sales grew by 9.6% YoY in February, to 1.1 million units. While the selling rate slowed to 15.0 million units/year, from 16.0 million units/year in January, the persistent supply-side issues have disrupted seasonality, making the selling rate a weak indicator of the market’s strength. February sales surpassed expectations, despite high average transaction prices at US$46,015, up by 4.3% YoY. Incentives are starting to increase modestly, at US$1,415 last month (+11.0% YoY).

Canadian LV sales fell 4.0% YoY, to 101k units, with the selling rate estimated to have declined to 1.7 million units/year in February, from 1.8 million units/year in January. Despite a subdued market, improved inventory levels are likely to support sales activity this year. In Mexico, sales increased by 28.4% YoY in February to around 102k units. The selling rate accelerated to 1.4 million units/year, from 1.2 million units/year in January.

Europe

The West European selling rate rose from 12.5 million units/year in January to 13.4 million units/year in February. In preliminary raw monthly terms, February registered 910k units, up 9.6% YoY. However, this is in comparison to a weak February 2022.

The East European selling rate also picked up from January to February. The Ukraine war still debilitates the LV market activity in the region, with preliminary raw registrations at 240k units, down 14.5% YoY. This fall is driven by Russia, where raw registrations fell by almost 60% YoY.

China

Preliminary February data indicates that, as expected, the Chinese market decelerated further. The February selling rate was 21.4 million units/year, down 9% from a sluggish January, and the lowest rate since the Shanghai lockdown in April 2022. In YoY terms, however, sales increased by 16% against a low base, due to the timing of the Chinese New Year. Weak sales in January and February can be attributed to the fact that two major tax incentives (for both ICE and NEV models) were terminated at the end of last year.

As sales are slumping, OEMs are now cutting prices and provincial governments are rushing to offer subsidies (primarily for new vehicles that are assembled in their own province). Following the big price cuts by Tesla, the price war has spread beyond EVs to ICE models. That should help boost sales in the coming months, as most economic activities have returned to normal after the pandemic subsided.

Other Asia

In Japan, the selling rate slowed to 4.6 million units/year in February but averaged a solid 4.7 million units/year in the first two months of this year. Thanks to an easing of global supply bottlenecks, OEMs ramped up production and thus increased deliveries. Yet, the semiconductor shortage is far from over, continuing to disrupt production. The waiting periods for most models remain long, ranging from a few months to a few years.

In Korea, the February selling rate reached a near two-year high of 1.8 million units/year, up 11% from a month ago. Sales were aided by the tax incentives for Passenger Vehicles (PVs) and the recently launched 2023 BEV subsidy program. The new scheme provides BEV sales with various cash subsidies, based on vehicle price, vehicle performance, after-sales service infrastructure, and battery energy density, and will likely give Hyundai and Kia an advantage over imported brands, such as Tesla and Mercedes.

South America

Brazilian LV sales fell by 0.8% YoY in February, to 120k units. While the selling rate accelerated to 1.9 million units/year, from 1.7 million units/year in January, this was still a disappointing outcome. In volume terms, it was the weakest February since 2005, but there were two fewer selling days than last year, while the annual Carnival celebrations could have impacted sales to some extent. While inventory continues to improve (187k units in February) affordability is still a concern as prices rise and consumers face economic uncertainty.

In Argentina, sales are estimated to have increased by 5.6% YoY in February, to 28.3k units, while the selling rate accelerated to 394k units/year, from 375k units/year in January. The result was very close to the previous six months’ average selling rate, as the market continues to tick over, albeit at a much lower level than in previous years, with economic headwinds and import restrictions keeping sales in check.