Paytm trims Q3 losses; Dream11 FY23 revenue grows 66%

Also in this letter:

■ Interview with Samsung’s Southwest Asia president and CEO

■ ETtech Deals Digest

■ Davos 2024: Tech chiefs hype AI’s potential

Paytm Q3 results: Loss narrows 43% to Rs 220 crore

Paytm founder Vijay Shekhar Sharma

Digital payments major Paytm on Friday said it has narrowed losses to Rs 222 crore for the quarter ended December, from Rs 392 crore a year ago and Rs 290 crore in the preceding quarter.

Key numbers:

- Revenue from operations in Q3 jumped 38% to Rs 2,850 crore.

- GMV rose 47% on year to Rs 5.1 lakh crore.

- Ebitda (before ESOP) improved during the quarter to Rs 219 crore, with a margin of 8%.

- Revenue from the payment services business rose 45% on year to Rs 1,730 crore.

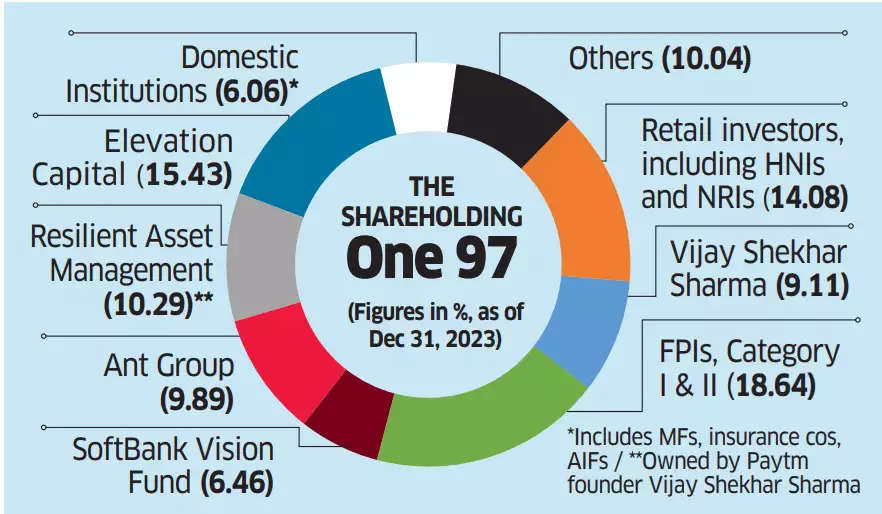

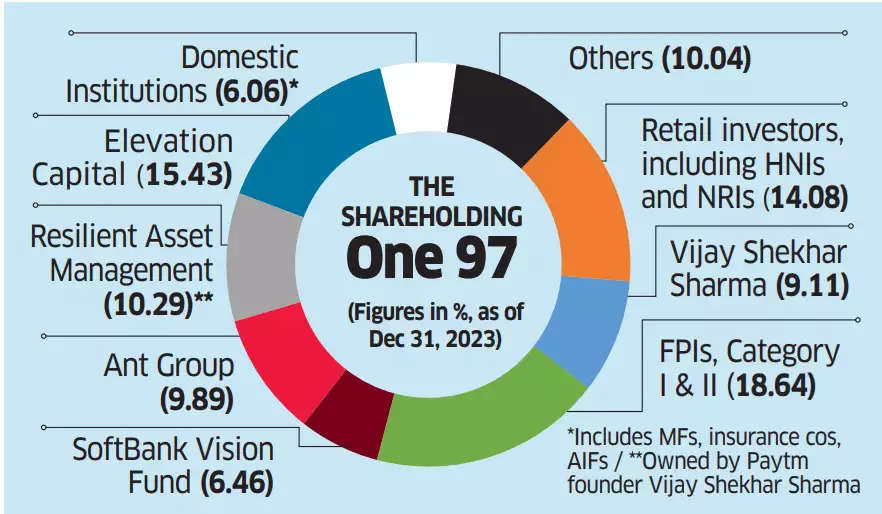

MF bets increase: We reported on January 13 that mutual funds upped their holdings in Paytm, in the December quarter even as one of its biggest investors, Japan’s SoftBank, pared stake. The filings showed that MFs held 4.99% in Paytm for the three months ended December, from 2.79% in the previous quarter.

Focus on profitability: The Noida-based firm has been trying to turn profitable and enter newer segments, and has built a large loan book. It is also laying off 1,000 employees over a few months to cut costs.

Paytm said on January 10 that it would invest Rs 100 crore in Gujarat International Finance Tec-City (GIFT City). It will also set up a development centre to build cross-border solutions which will house engineers to build a suite of financial products and services.

Meanwhile, SoftBank has reduced its stake in the company by 1.66% sequentially to 6.46% as of December-end. Long-standing investor Ant Group (formerly Ant Financial) held a 9.89% stake.

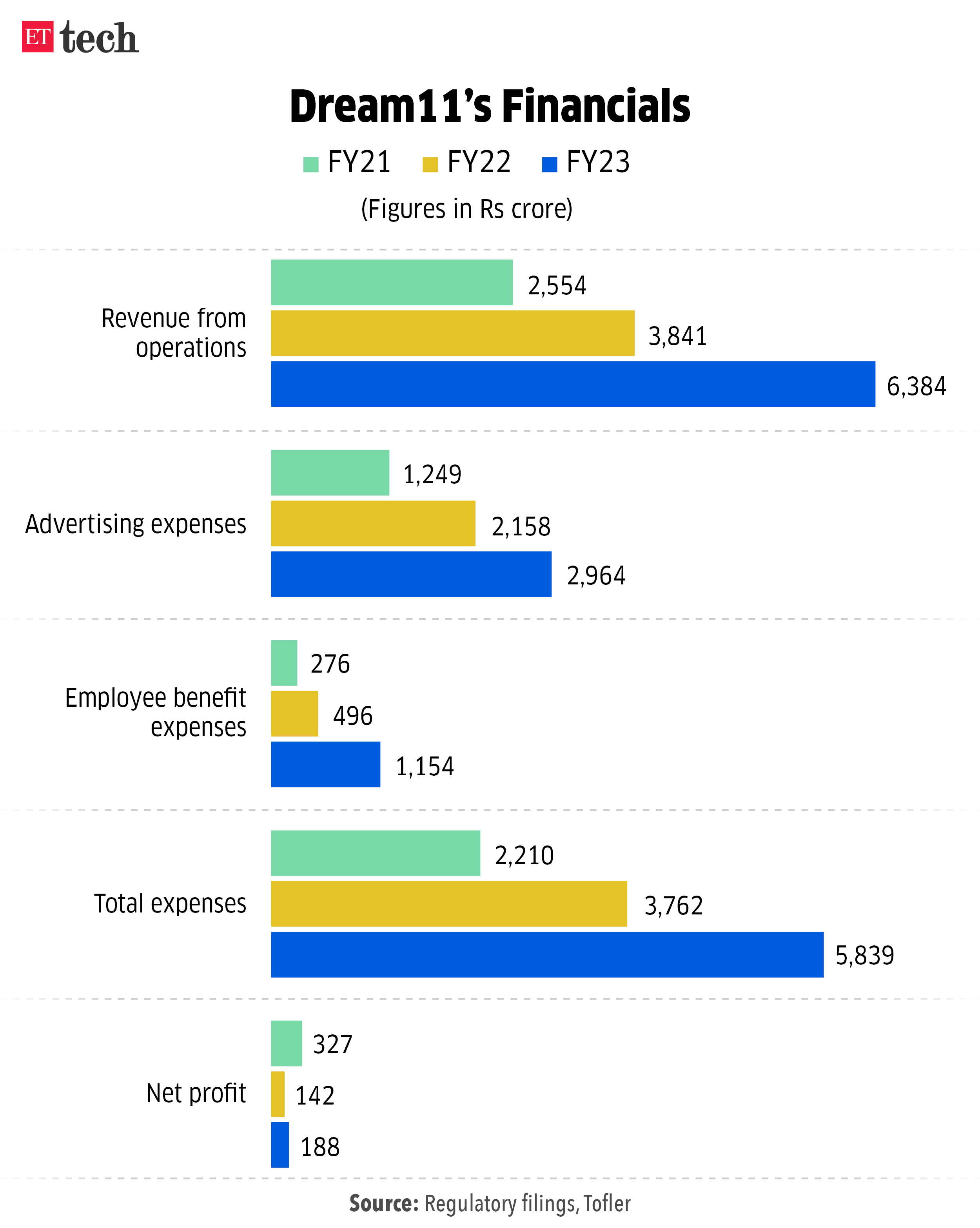

Dream11 FY23 revenue grows 66% to Rs 6,384 crore

Harsh Jain, CEO and cofounder, Dream Sports

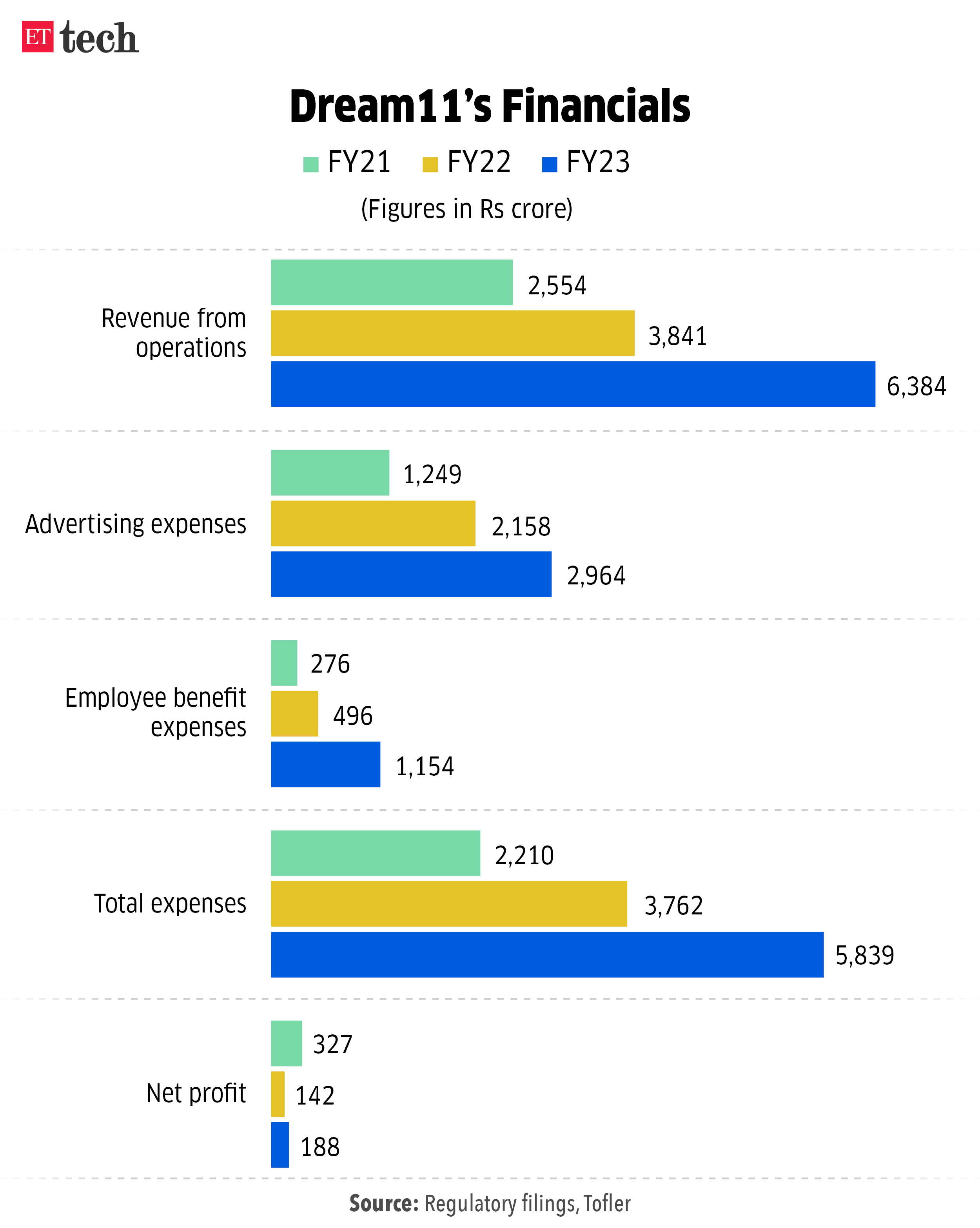

Fantasy sports platform Dream11 reported a 66% year-on-year jump in operating revenue to Rs 6,384 crore for the year ended March 31, 2023, regulatory filings from Tofler showed.

Key numbers:

- Net profit for the year increased to Rs 188 crore, compared to Rs 142 crore in FY22.

- Advertising and promotional expenses stood at Rs 2,964 crore, up 37% on year.

- Employee costs also increased over two-fold in the year to Rs 1,154 crore.

GST dues a concern: The company’s auditor, SR Batliboi & Co, noted that notices issued to Dream11 by goods and services tax (GST) authorities seeking more than Rs 28,000 crore in the past tax dues “may cast significant doubt on the group’s ability to continue as a going concern.” The company is currently in the process of contesting the government’s tax demand.

Also read | Dream Sports eyes diversification via investments, M&As to cope with tax blow

Catch up quick: We had reported in September that the Directorate General of GST Intelligence (DGGI) had issued notices worth Rs 55,000 crore to Dream11, Games 24×7 and Head Digital Works.

Also read | SC seeks response from taxman on ₹1L cr notices to e-gaming firms

Following the implementation of the new GST regime in October 2023, Dream11 revised its profit target for FY24 downward by 80%.

In comparison: Bengaluru-based bootstrapped online gaming firm Gameskraft reported a 25% spike in revenue from operations to Rs 2,662 crore in FY23. Gameskraft’s net profit rose 14.2% on year to Rs 1,062 crore.

Similarly, Mobile Premier League saw its net loss narrow significantly to $37.04 million in FY23, from $194.47 million in the previous year. MPL’s revenue grew 63% year-on-year amid a decline in expenses.

Also read | ETtech in-depth: Rario collapse, tax woes bring curtains down on Dream Sports’ venture arm

With AI, smartphones will become even smarter: Samsung boss

JB Park, president and CEO, Southwest Asia

Samsung’s plateauing mobile phone exports are tied to soft demand in global markets amid geopolitical uncertainties, JB Park, president and CEO, Southwest Asia, Samsung, told us in an interview. Park added that the second half of 2024 could see a revival as the issues settle.

On the Indian market: “India is the most strategic market for Samsung. Smartphone or consumer electronics penetration is still not 100%. So, that is going to be the number one priority—how do we reach out to consumers who still do not have a refrigerator or TV or washing machine?”

Samsung’s India plans: “Our Noida factory can double our production. It is just that we need to go phase by phase. There are limited opportunities for us to further invest in the production space. The PLI (production-linked incentive scheme) has a lifespan, it has a limit to how many years you can apply for that.”

AI integration: “The Galaxy S24 with AI will be ground-breaking… with AI, the smartphone will become even smarter. So, in playing or productivity or creativity, I think for the Indian consumer, this will be a game changer.”

Samsung’s new AI phones: The Korean electronics major recently launched its latest generation of flagship smartphones under the Galaxy S24 lineup embedded with on-device AI capabilities.

The S24 models can live translate phone calls to multiple languages, write captions for social posts, compile notes from voice recordings and more, using Galaxy AI and powered by Qualcomm’s latest flagship chipset

Apple pips Samsung: The new launch comes at a crucial time for Samsung, which has lost market share amid a broader slump in smartphone sales.

Apple ended Samsung’s 12-year run as the largest seller of smartphones in the world, commanding a 20% share of the market in 2023, according to data from International Data Corp. Samsung ended the year with a 19.4% share, followed by China’s Xiaomi, Oppo and Transsion, data showed.

Also read | Samsung won’t get incentive for smartphone production in FY22

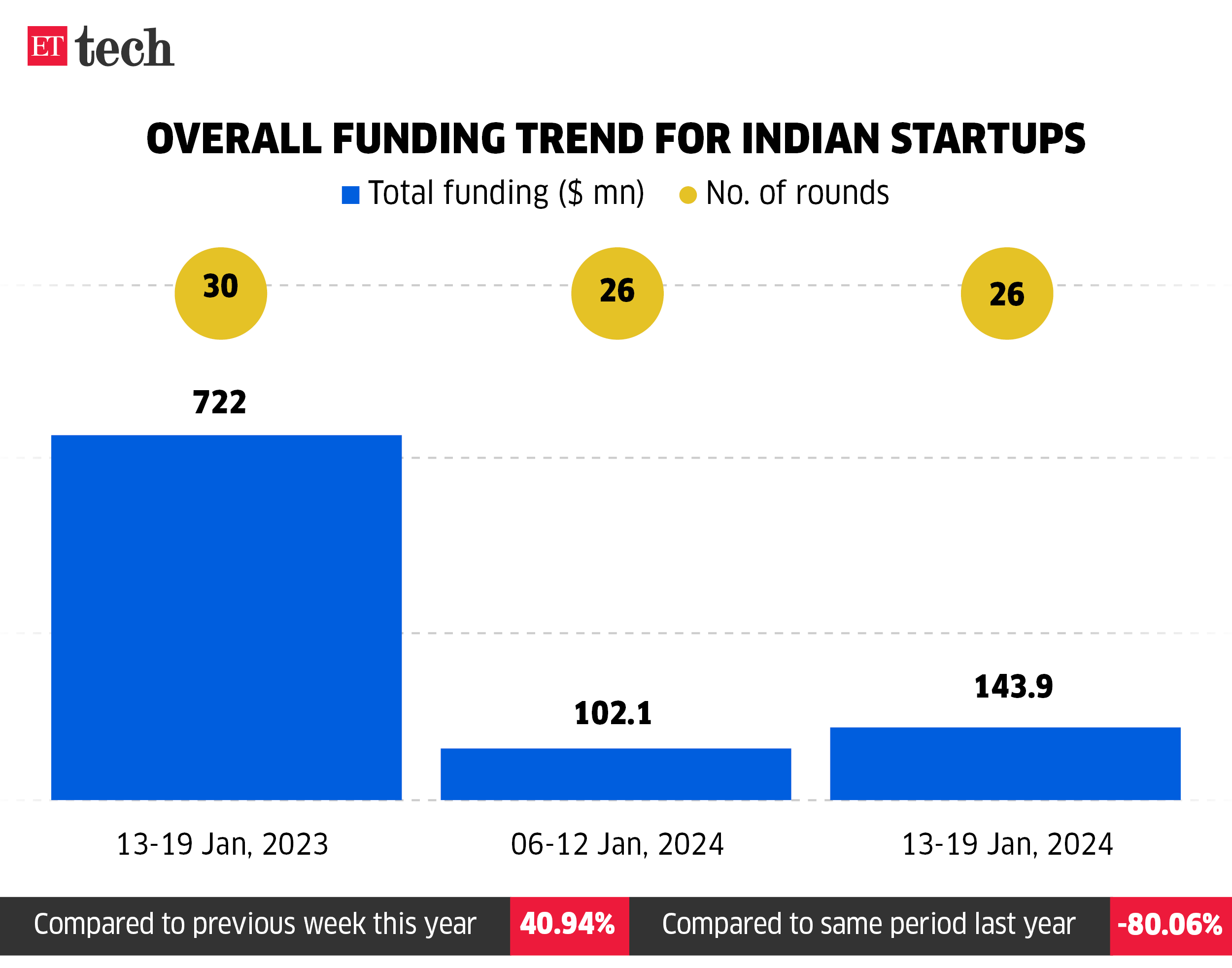

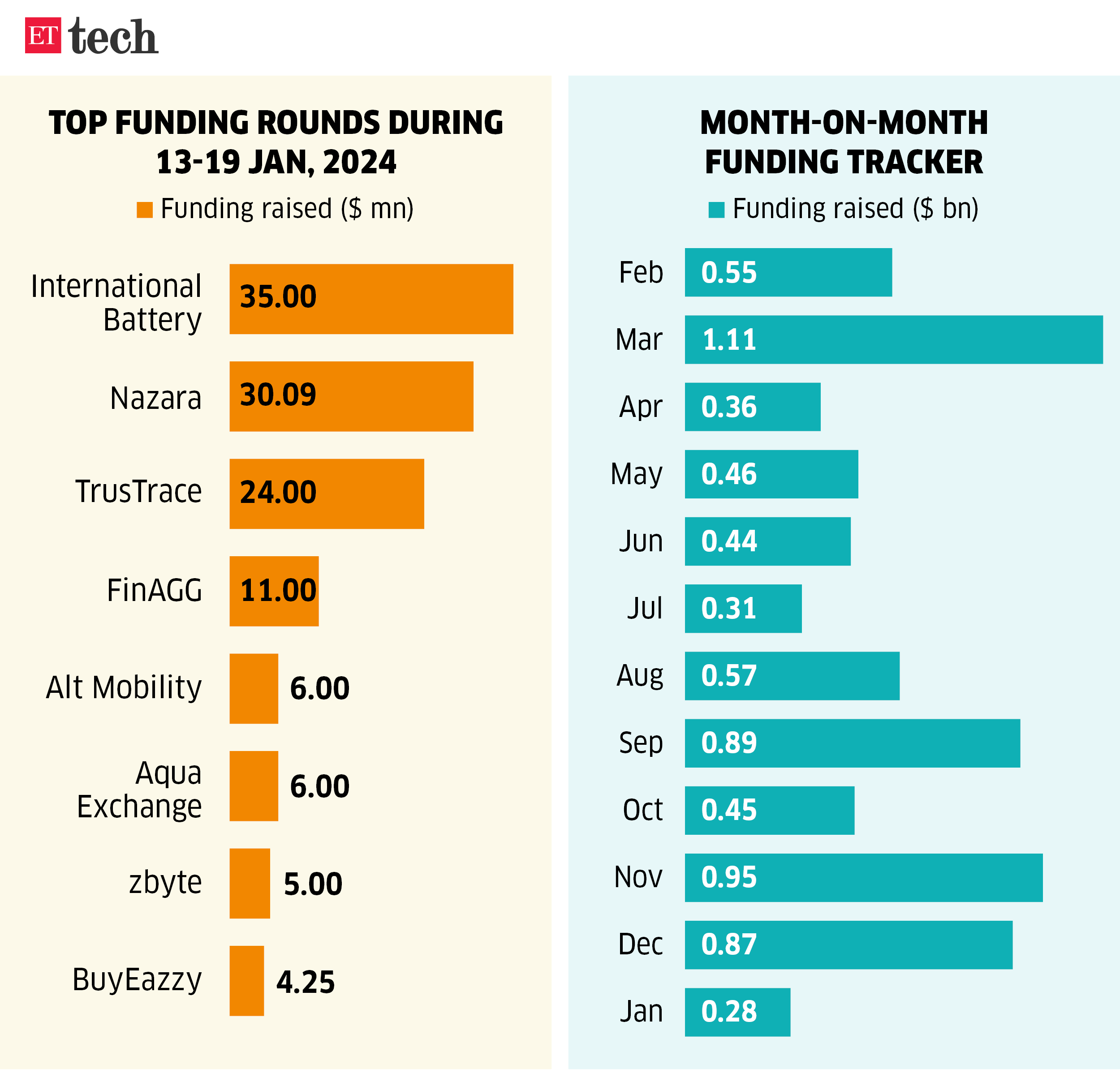

ETtech Deals Digest

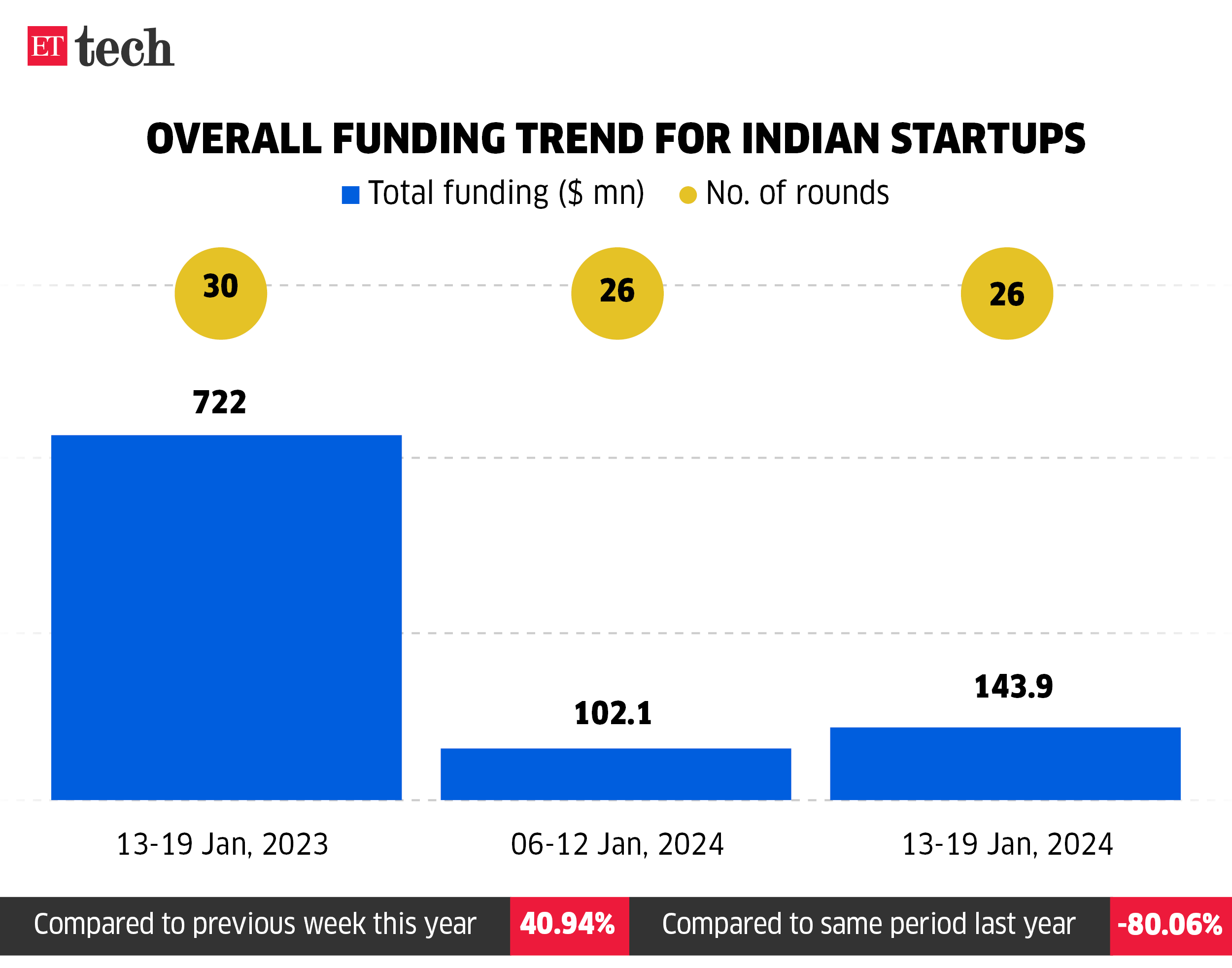

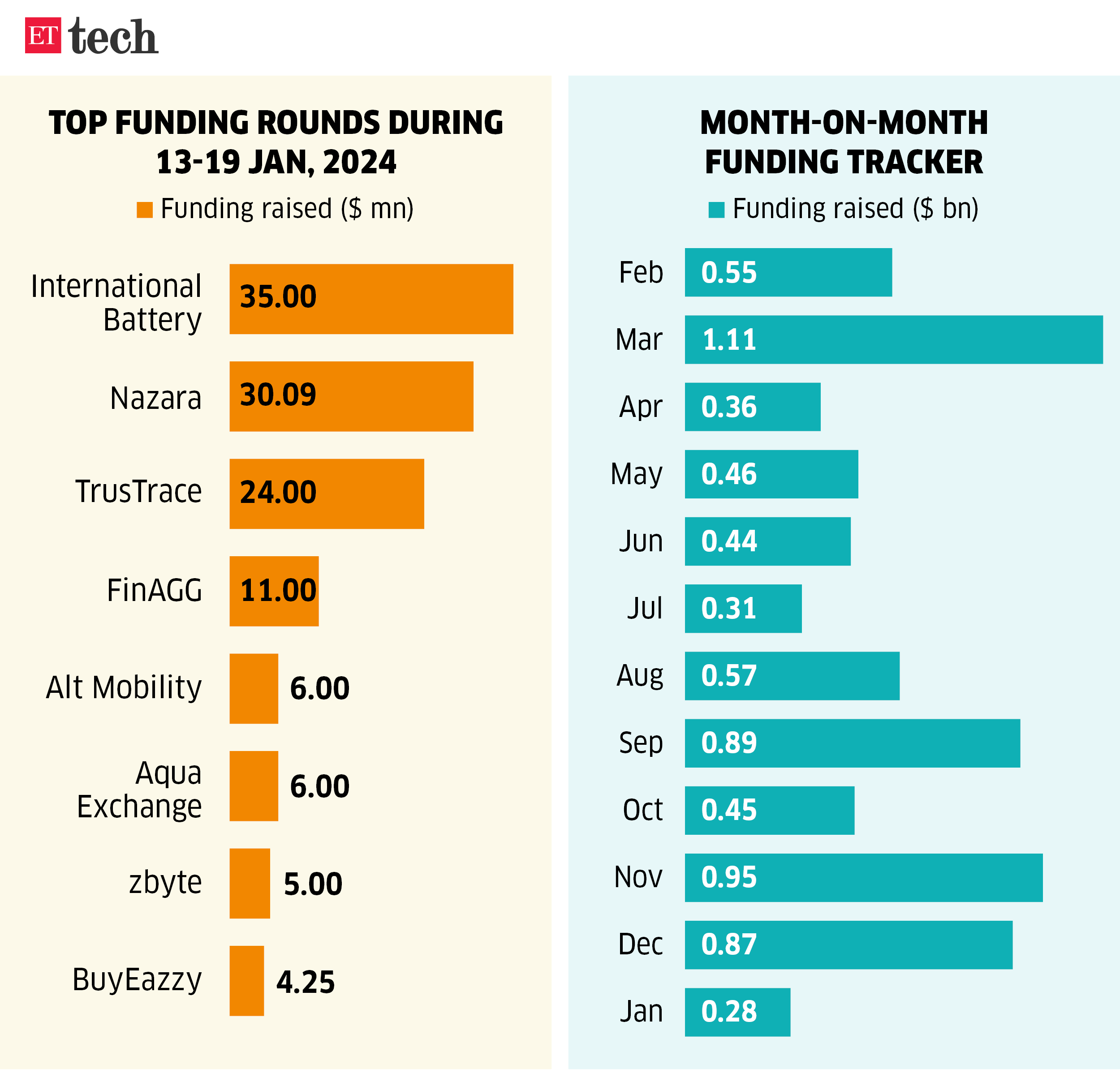

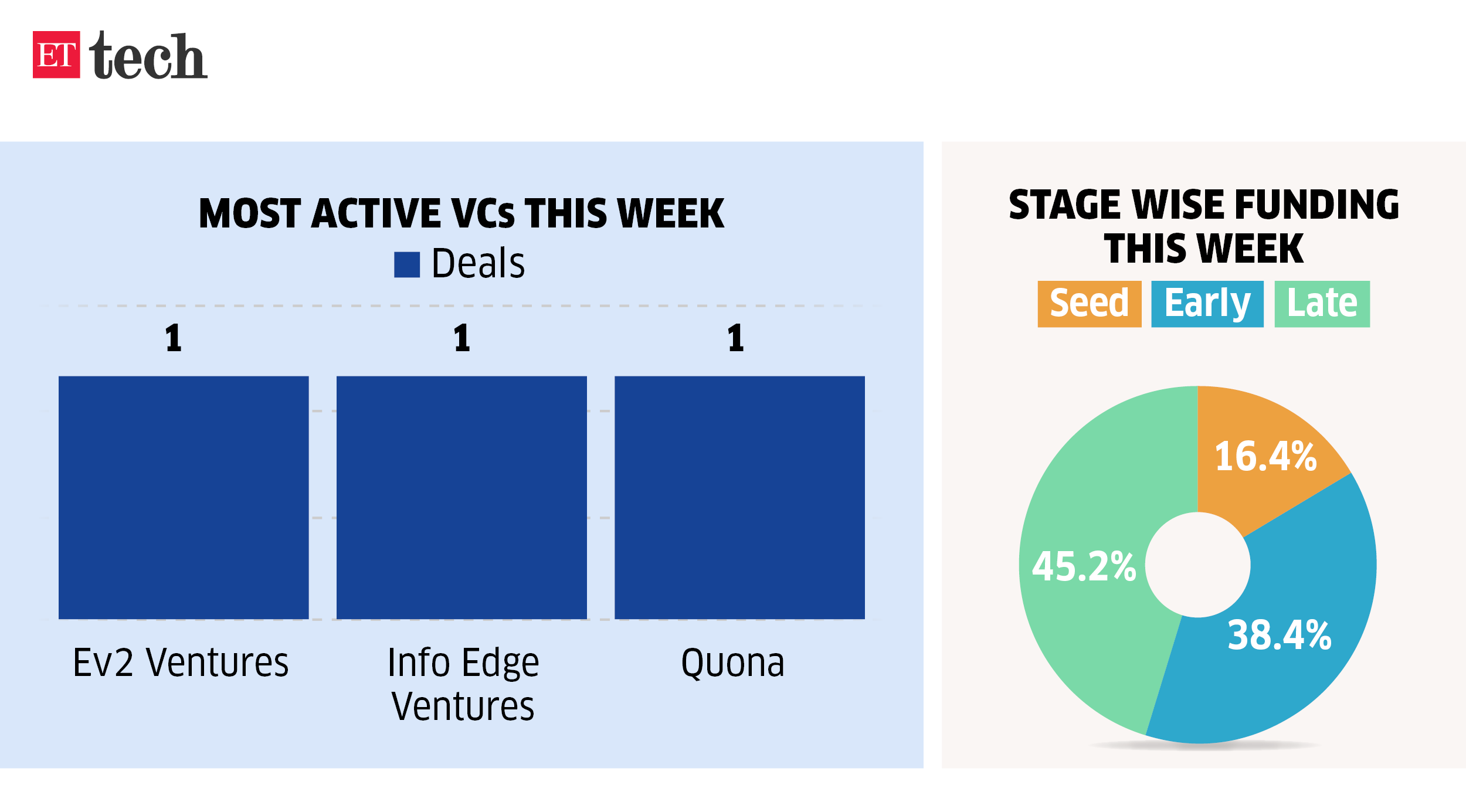

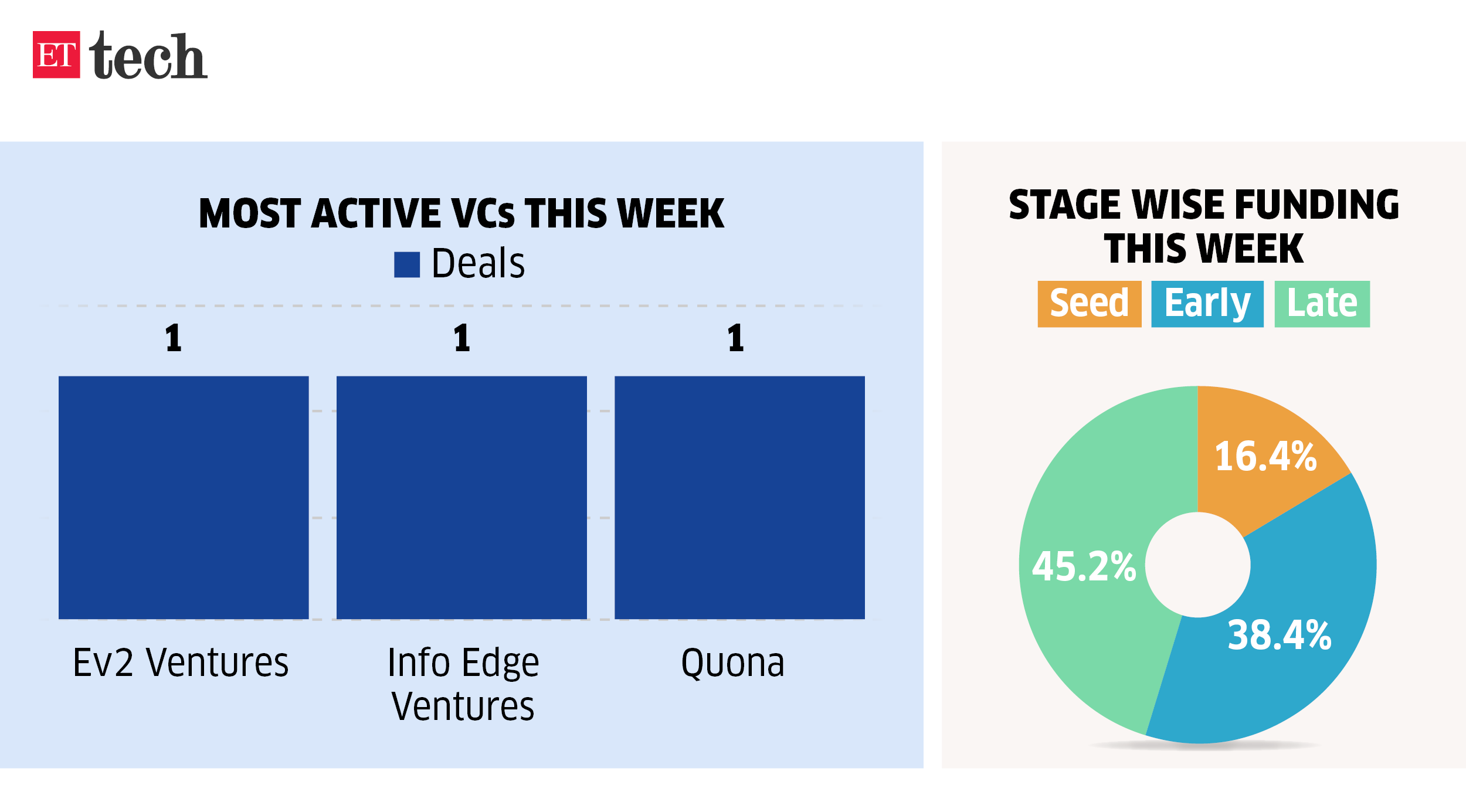

Investments in Indian startups dropped about 80% on year this week, totalling $144 million across 26 different deals.

Companies, across seed, early and late stages, had raised about $722 million in 30 rounds in the period from January 13 to 19 last year, as per data from Tracxn.

The most significant amount of capital raised this week was in the late stage, at about $65 million, accounting for 45.2% of the overall deal value. This was followed by $55.3 million in early-stage funding, making up 38.4%.

Nazara Technologies’s Rs 250-crore fundraise from Nikhil Kamath, ICICI Prudential and International Battery Company’s $35-million funding led by RTP Global were the two most prominent funding rounds from this week.

Davos 2024: Tech chiefs enthused by AI’s potential, world leaders urge caution

OpenAI CEO Sam Altman

The annual World Economic Forum (WEF) meeting in Davos couldn’t get enough of the buzzword of last year – artificial intelligence (AI). As the annual meet wraps up today, here’s a look at who said what.

OpenAI debut: At his first WEF meet, OpenAI chief executive Sam Altman said an energy breakthrough is necessary for the future of AI, which will consume vastly more power than people have expected.

Addressing his ouster by the board in November, Altman said the episode taught the company not to let “not-urgent problems” linger.

Tech bosses upbeat: Microsoft CEO Satya Nadella said AI has the potential to boost the laggard global economy. Nadella said he’s “very optimistic about AI being that general purpose technology that drives economic growth.”

Julie Sweet, CEO of consulting firm Accenture, said “there isn’t an area, there isn’t an industry that’s not going to be impacted” by AI.

IBM CEO Arvind Krishna said AI could be a boon for jobs like coding, customer service, and even invoicing for greater efficiency.

World leaders sound caution: Chinese Premier Li Qiang called AI “a double-edged sword.” “Human beings must control the machines instead of having the machines control us,” he said.

European Commission president Ursula von der Leyen said AI is “a very significant opportunity, if used responsibly.”

“AI is now undoubtedly the most important potential contribution for global development,” UN Secretary-General António Guterres said.

Today’s ETtech Top 5 newsletter was curated Megha Mishra in Mumbai.

Also in this letter:

■ Interview with Samsung’s Southwest Asia president and CEO

■ ETtech Deals Digest

■ Davos 2024: Tech chiefs hype AI’s potential

Paytm Q3 results: Loss narrows 43% to Rs 220 crore

Paytm founder Vijay Shekhar Sharma

Digital payments major Paytm on Friday said it has narrowed losses to Rs 222 crore for the quarter ended December, from Rs 392 crore a year ago and Rs 290 crore in the preceding quarter.

Key numbers:

- Revenue from operations in Q3 jumped 38% to Rs 2,850 crore.

- GMV rose 47% on year to Rs 5.1 lakh crore.

- Ebitda (before ESOP) improved during the quarter to Rs 219 crore, with a margin of 8%.

- Revenue from the payment services business rose 45% on year to Rs 1,730 crore.

MF bets increase: We reported on January 13 that mutual funds upped their holdings in Paytm, in the December quarter even as one of its biggest investors, Japan’s SoftBank, pared stake. The filings showed that MFs held 4.99% in Paytm for the three months ended December, from 2.79% in the previous quarter.

Focus on profitability: The Noida-based firm has been trying to turn profitable and enter newer segments, and has built a large loan book. It is also laying off 1,000 employees over a few months to cut costs.

Paytm said on January 10 that it would invest Rs 100 crore in Gujarat International Finance Tec-City (GIFT City). It will also set up a development centre to build cross-border solutions which will house engineers to build a suite of financial products and services.

Meanwhile, SoftBank has reduced its stake in the company by 1.66% sequentially to 6.46% as of December-end. Long-standing investor Ant Group (formerly Ant Financial) held a 9.89% stake.

Dream11 FY23 revenue grows 66% to Rs 6,384 crore

Harsh Jain, CEO and cofounder, Dream Sports

Fantasy sports platform Dream11 reported a 66% year-on-year jump in operating revenue to Rs 6,384 crore for the year ended March 31, 2023, regulatory filings from Tofler showed.

Key numbers:

- Net profit for the year increased to Rs 188 crore, compared to Rs 142 crore in FY22.

- Advertising and promotional expenses stood at Rs 2,964 crore, up 37% on year.

- Employee costs also increased over two-fold in the year to Rs 1,154 crore.

GST dues a concern: The company’s auditor, SR Batliboi & Co, noted that notices issued to Dream11 by goods and services tax (GST) authorities seeking more than Rs 28,000 crore in the past tax dues “may cast significant doubt on the group’s ability to continue as a going concern.” The company is currently in the process of contesting the government’s tax demand.

Also read | Dream Sports eyes diversification via investments, M&As to cope with tax blow

Catch up quick: We had reported in September that the Directorate General of GST Intelligence (DGGI) had issued notices worth Rs 55,000 crore to Dream11, Games 24×7 and Head Digital Works.

Also read | SC seeks response from taxman on ₹1L cr notices to e-gaming firms

Following the implementation of the new GST regime in October 2023, Dream11 revised its profit target for FY24 downward by 80%.

In comparison: Bengaluru-based bootstrapped online gaming firm Gameskraft reported a 25% spike in revenue from operations to Rs 2,662 crore in FY23. Gameskraft’s net profit rose 14.2% on year to Rs 1,062 crore.

Similarly, Mobile Premier League saw its net loss narrow significantly to $37.04 million in FY23, from $194.47 million in the previous year. MPL’s revenue grew 63% year-on-year amid a decline in expenses.

Also read | ETtech in-depth: Rario collapse, tax woes bring curtains down on Dream Sports’ venture arm

With AI, smartphones will become even smarter: Samsung boss

JB Park, president and CEO, Southwest Asia

Samsung’s plateauing mobile phone exports are tied to soft demand in global markets amid geopolitical uncertainties, JB Park, president and CEO, Southwest Asia, Samsung, told us in an interview. Park added that the second half of 2024 could see a revival as the issues settle.

On the Indian market: “India is the most strategic market for Samsung. Smartphone or consumer electronics penetration is still not 100%. So, that is going to be the number one priority—how do we reach out to consumers who still do not have a refrigerator or TV or washing machine?”

Samsung’s India plans: “Our Noida factory can double our production. It is just that we need to go phase by phase. There are limited opportunities for us to further invest in the production space. The PLI (production-linked incentive scheme) has a lifespan, it has a limit to how many years you can apply for that.”

AI integration: “The Galaxy S24 with AI will be ground-breaking… with AI, the smartphone will become even smarter. So, in playing or productivity or creativity, I think for the Indian consumer, this will be a game changer.”

Samsung’s new AI phones: The Korean electronics major recently launched its latest generation of flagship smartphones under the Galaxy S24 lineup embedded with on-device AI capabilities.

The S24 models can live translate phone calls to multiple languages, write captions for social posts, compile notes from voice recordings and more, using Galaxy AI and powered by Qualcomm’s latest flagship chipset

Apple pips Samsung: The new launch comes at a crucial time for Samsung, which has lost market share amid a broader slump in smartphone sales.

Apple ended Samsung’s 12-year run as the largest seller of smartphones in the world, commanding a 20% share of the market in 2023, according to data from International Data Corp. Samsung ended the year with a 19.4% share, followed by China’s Xiaomi, Oppo and Transsion, data showed.

Also read | Samsung won’t get incentive for smartphone production in FY22

ETtech Deals Digest

Investments in Indian startups dropped about 80% on year this week, totalling $144 million across 26 different deals.

Companies, across seed, early and late stages, had raised about $722 million in 30 rounds in the period from January 13 to 19 last year, as per data from Tracxn.

The most significant amount of capital raised this week was in the late stage, at about $65 million, accounting for 45.2% of the overall deal value. This was followed by $55.3 million in early-stage funding, making up 38.4%.

Nazara Technologies’s Rs 250-crore fundraise from Nikhil Kamath, ICICI Prudential and International Battery Company’s $35-million funding led by RTP Global were the two most prominent funding rounds from this week.

Davos 2024: Tech chiefs enthused by AI’s potential, world leaders urge caution

OpenAI CEO Sam Altman

The annual World Economic Forum (WEF) meeting in Davos couldn’t get enough of the buzzword of last year – artificial intelligence (AI). As the annual meet wraps up today, here’s a look at who said what.

OpenAI debut: At his first WEF meet, OpenAI chief executive Sam Altman said an energy breakthrough is necessary for the future of AI, which will consume vastly more power than people have expected.

Addressing his ouster by the board in November, Altman said the episode taught the company not to let “not-urgent problems” linger.

Tech bosses upbeat: Microsoft CEO Satya Nadella said AI has the potential to boost the laggard global economy. Nadella said he’s “very optimistic about AI being that general purpose technology that drives economic growth.”

Julie Sweet, CEO of consulting firm Accenture, said “there isn’t an area, there isn’t an industry that’s not going to be impacted” by AI.

IBM CEO Arvind Krishna said AI could be a boon for jobs like coding, customer service, and even invoicing for greater efficiency.

World leaders sound caution: Chinese Premier Li Qiang called AI “a double-edged sword.” “Human beings must control the machines instead of having the machines control us,” he said.

European Commission president Ursula von der Leyen said AI is “a very significant opportunity, if used responsibly.”

“AI is now undoubtedly the most important potential contribution for global development,” UN Secretary-General António Guterres said.

Today’s ETtech Top 5 newsletter was curated Megha Mishra in Mumbai.