Board exits at Paytm bank; Mamaearth’s Q3 profit up 265%

Also in this letter:

■ Licious lays off 80 employees

■ ETtech Deals Digest

■ Startup employees look for exits

Two independent directors quit Paytm Payments Bank board

Paytm Payments Bank independent directors Shinjini Kumar (left) and Manju Agarwal

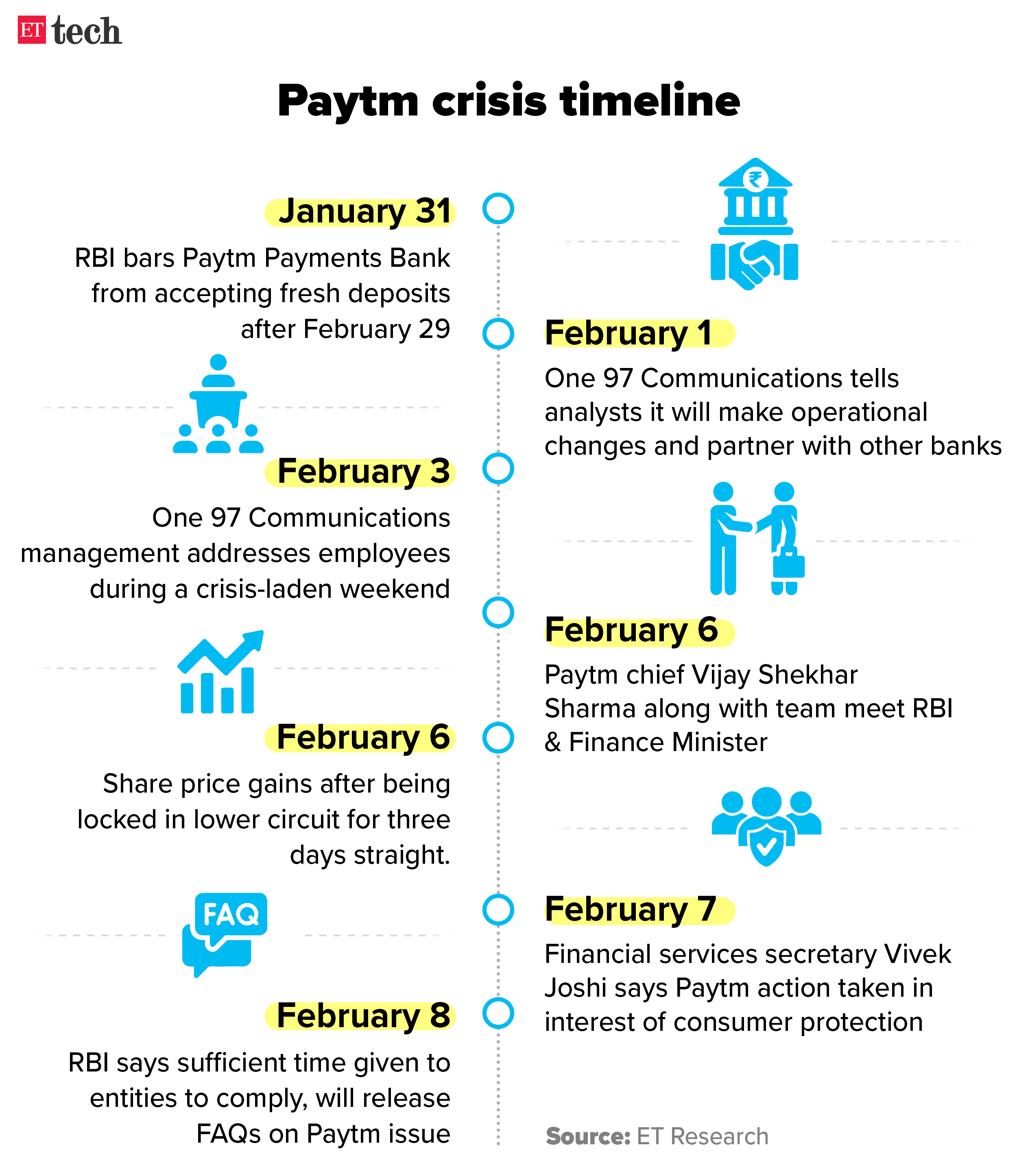

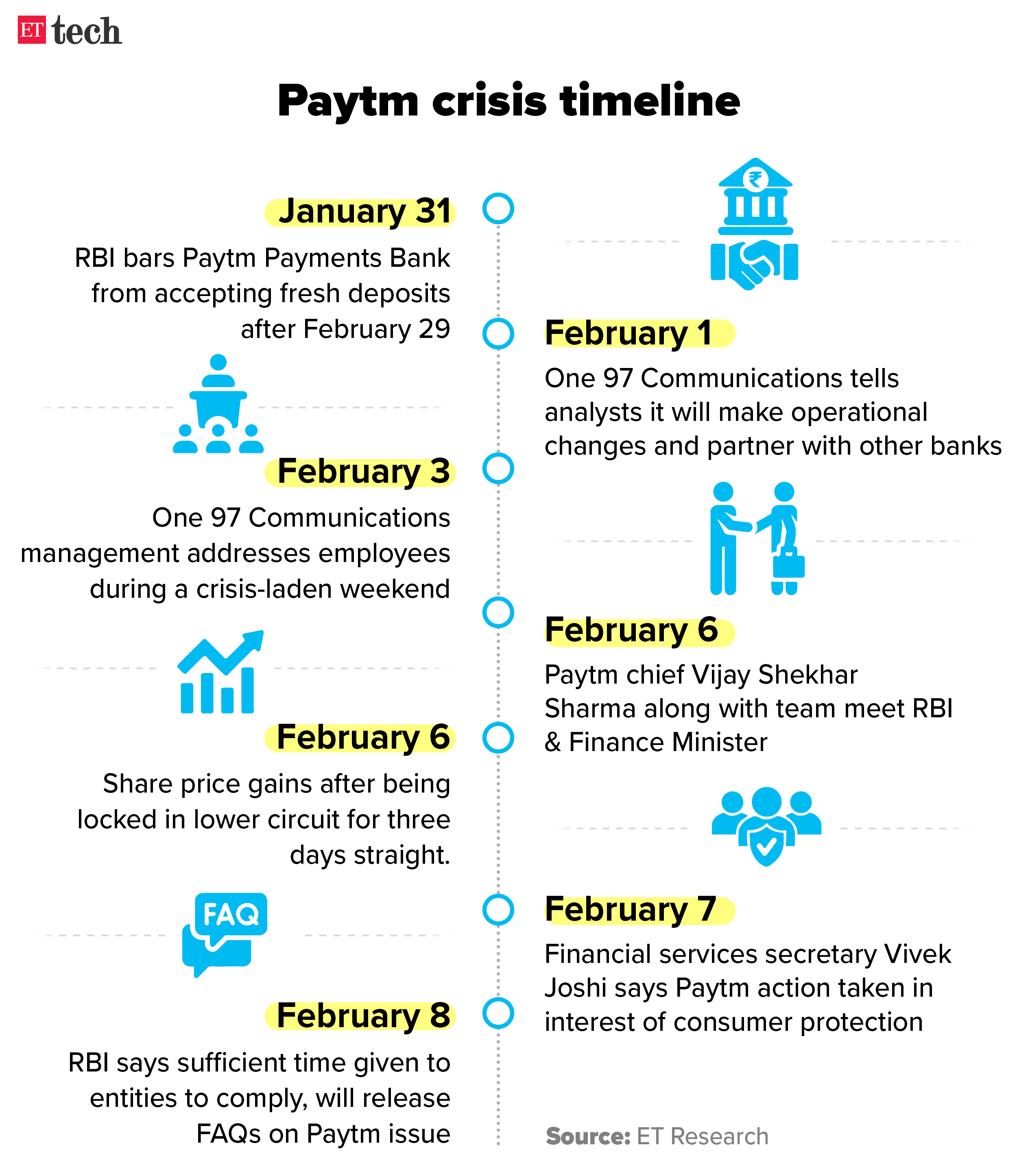

Two independent directors have quit the board of Paytm Payments Bank (PPBL) even as it tries to assuage concerns about the continuity of its operations beyond February.

Who left? Shinjini Kumar, a former Bank of America and PricewaterhouseCoopers (PwC) executive, resigned from the payments bank’s board in December, we have learnt. Manju Agarwal, former deputy managing director at State Bank of India, has also quit.

While Kumar’s resignation was accepted and a replacement was being finalised, she is said to have attended two board meetings as a special invitee to meet RBI rules.

Present board: Post the two exits, PPBL’s board consists of three independent directors – veteran banker Arvind Kumar Jain, former Accenture managing director Pankaj Vaish, and former Department for Promotion of Industry and Internal Trade (DPIIT) secretary Ramesh Abhishek.

From One 97 Communications, group head of regulatory affairs, Dr Srinivas Yanamandra, and chief operating officer and president, Bhavesh Gupta are on the board. The other board members are Paytm founder Vijay Shekhar Sharma and PPBL managing director and chief executive officer Surinder Chawla.

SoftBank Vision Fund nearly exits Paytm: Meanwhile, SoftBank Group sold a majority of its stake in Paytm before the RBI order caused the shares to dive. The Japanese tech investor saw uncertainty growing in India’s regulatory environment, as well as over Paytm Payments Bank’s licence, SoftBank Vision Fund CFO Navneet Govil told Bloomberg.

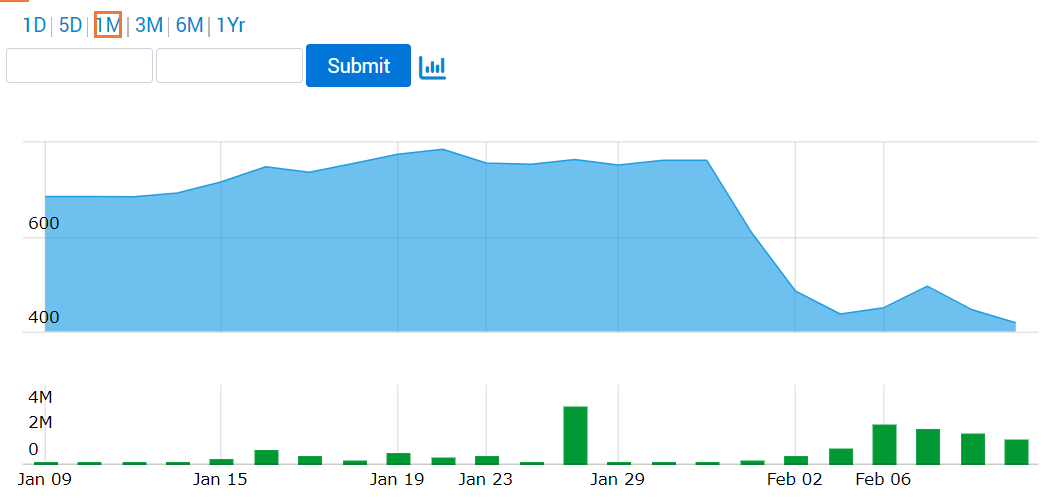

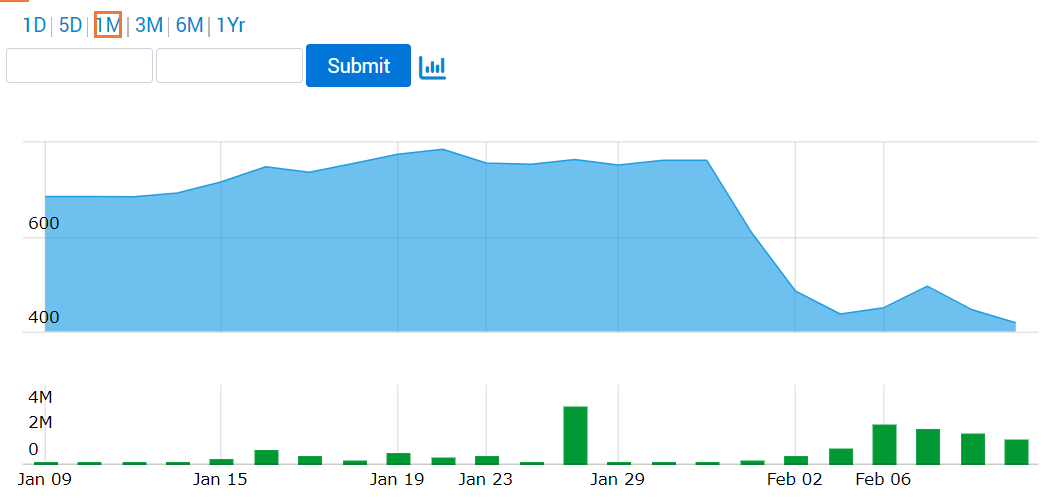

Shares tumble: One 97 Communications saw its share price fall as much as 9% to the day’s low at Rs 408 on the BSE on Friday. It closed the session at Rs 419.85, down 6%.

Source: BSE

Read our detailed coverage on the Paytm crisis:

Mamaearth Q3 profit jumps 265% YoY to Rs 26 crore

Mamaearth founders Varun Alagh (left) and Ghazal Alagh

Omnichannel retailer Honasa Consumer, which owns and operates Mamaearth, on Friday reported a 265% growth in its consolidated net profit to Rs 26 crore for the quarter ended December. Honasa Consumer shares closed 3.54% lower at Rs 432.75 on the BSE.

Key numbers:

- Revenue from operations rose 28% year-on-year (YoY) to Rs 488 crore.

- Consolidated Ebitda jumped 192% YoY in Q3 to Rs 34.5 crore; margins improved 397 basis points YoY to 7.1%.

- Mamaearth grew its household penetration of facewash by 280 bps, and of shampoo by 110 bps in 2 years.

- Younger brands continue to grow, with The Derma Co achieving Ebitda profitability. About 122 new products were launched in CY23.

Also read | Mamaearth parent Honasa’s IPO at a crossroads

Quote, unquote: “We are seeing the consumer sentiment even in the urban markets to be slightly weaker than we expected it to be. It started with weaker festive sales for ecommerce platforms, where traffic was less than expected,” Mamaearth cofounder and CEO Varun Alagh told ET.

“During all of this, the rural pain was already there, and what we’ve seen is that it has led to incumbents discounting far more and that is slightly painful to manage. Overall, our objective is to continue to grow faster than the market and gain share,” he added.

Details: The company continued to strengthen and expand omnichannel distribution with over 1.7 lakh retail touchpoints, an increase of 37% YoY.

Also read | Nykaa net profit doubles in Q3, operating revenue up 22% to Rs 1,789 crore

Licious lays off 80 employees as part of ‘operational reset’

Licious founders Vivek Gupta (left) and Abhay Hanjura

Omnichannel meat retailer Licious has laid off 80 employees, representing 3% of its total employee base. The layoffs were part of an “operational reset to sharpen growth focus,” the firm said. The company has 650 corporate employees and 2,350 other staff running the production and supply chain.

Details: The impacted employees are being offered two months salary as compensation, along with the variable payment for FY24. Licious, the only unicorn in the sector, has seen a gradual slowdown over the past year and a half.

Recent numbers: The company had reported a 9% growth in revenue for FY23 to Rs 748 crore, against a reported revenue projection of Rs 1,500 crore.

Other plans: The meat and seafood company has been working to expand its range of ready-to-eat products. It also came out with its own plant-based meat brand, UnCrave, as it tried to tackle the seasonal nature of the business.

Also read | ETtech in-depth: Lacking bite and funding, online meat ecosystem returns to the drawing board

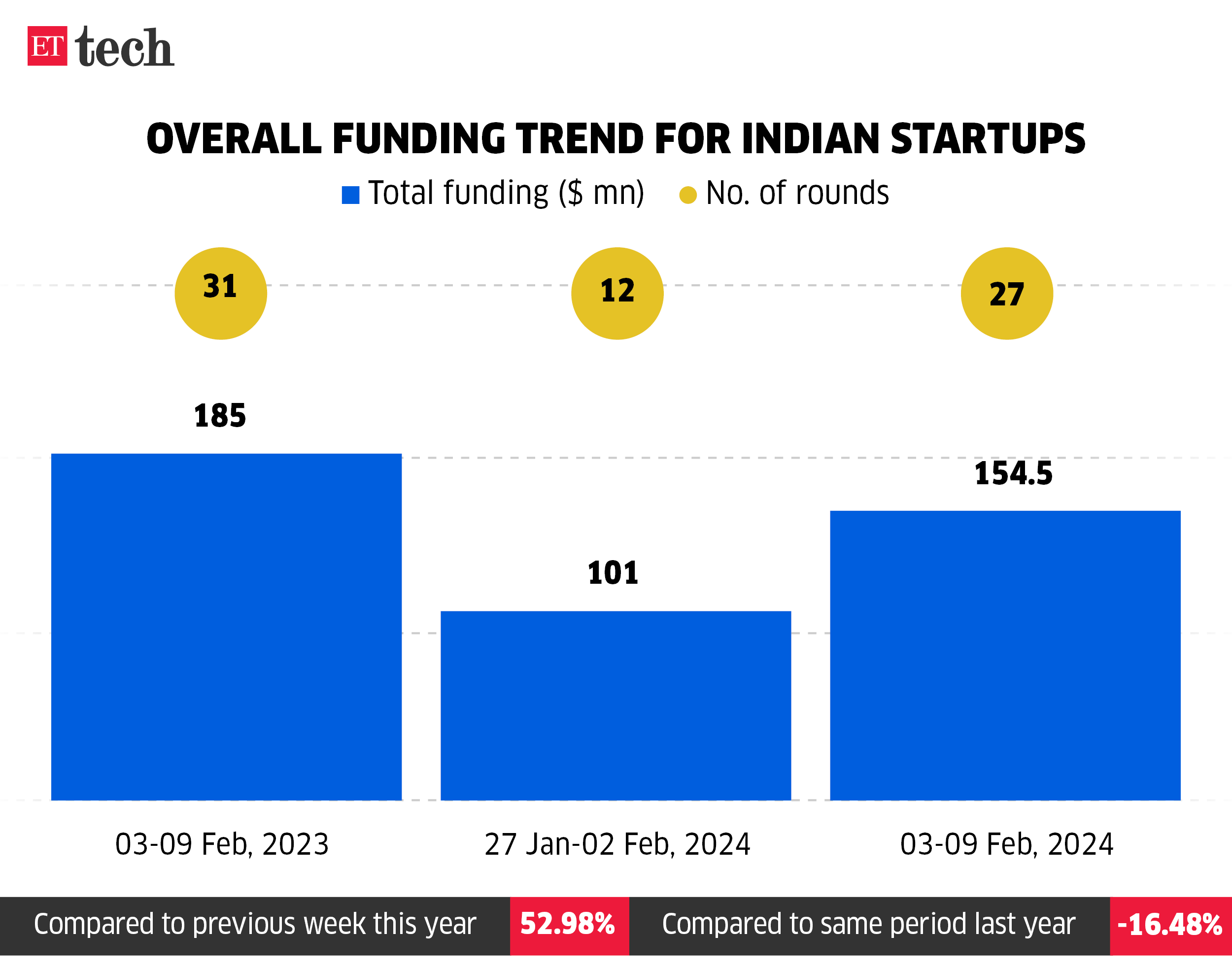

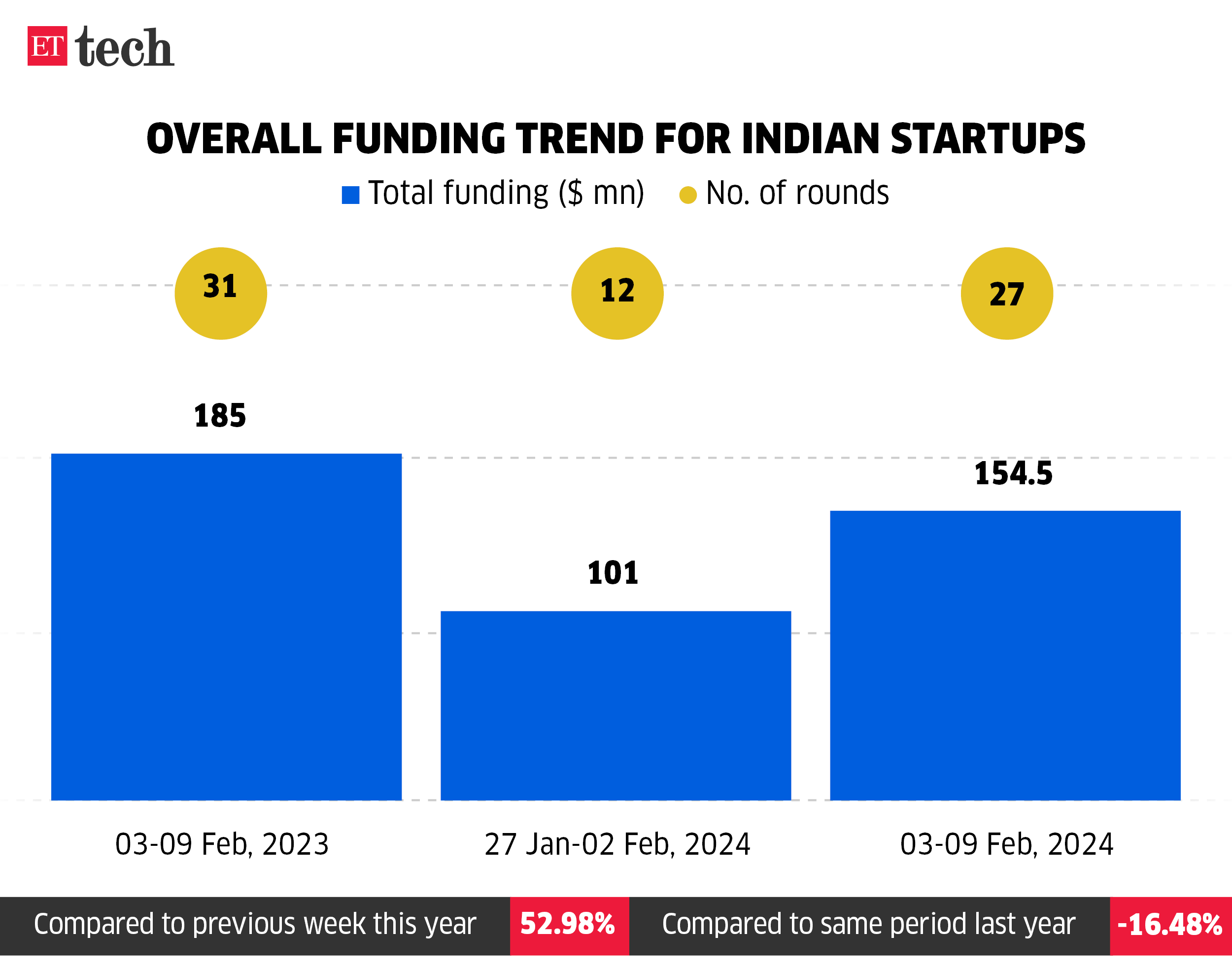

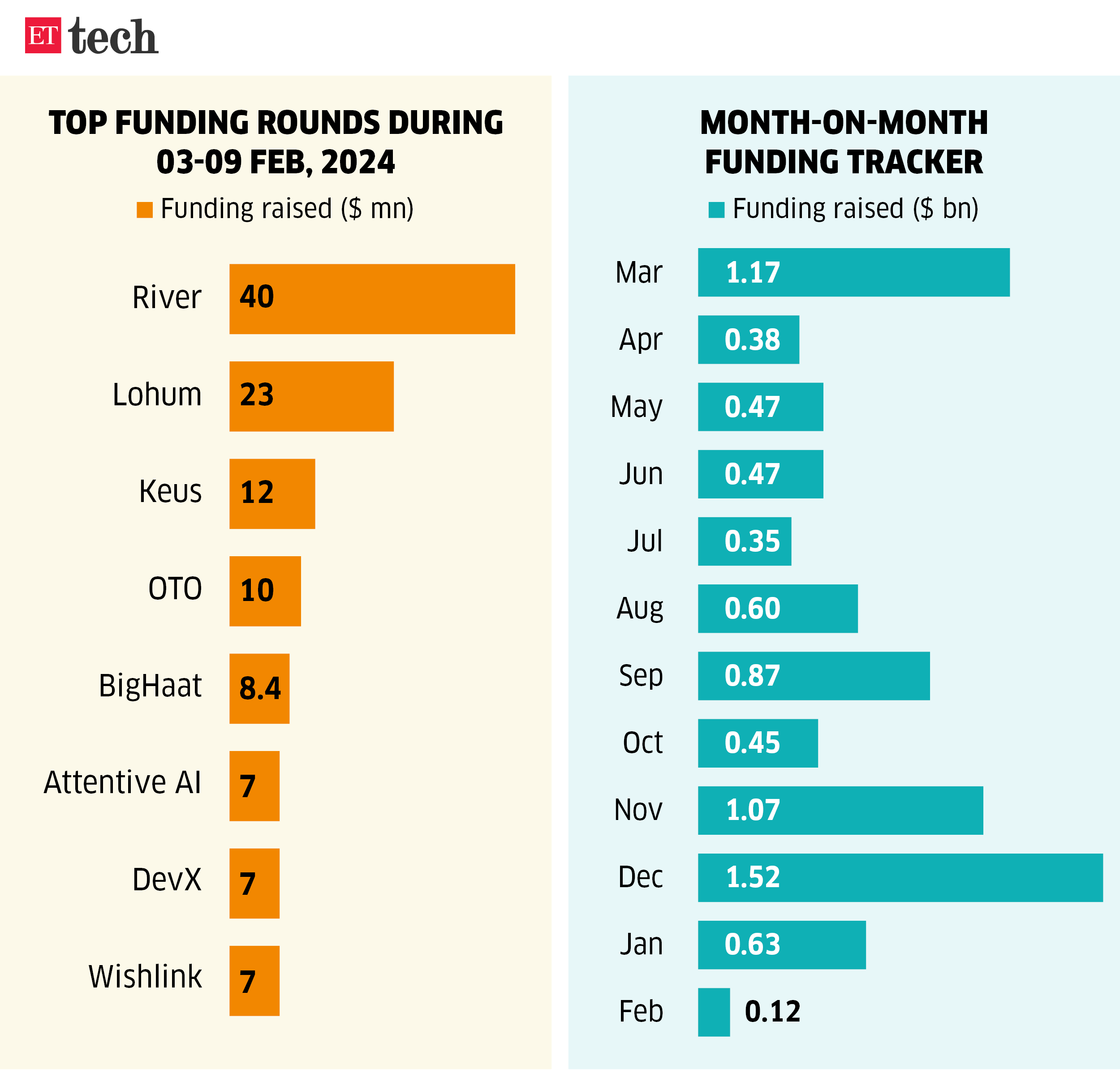

ETtech Deals Digest: startup funding drops 17% to $155 million this week

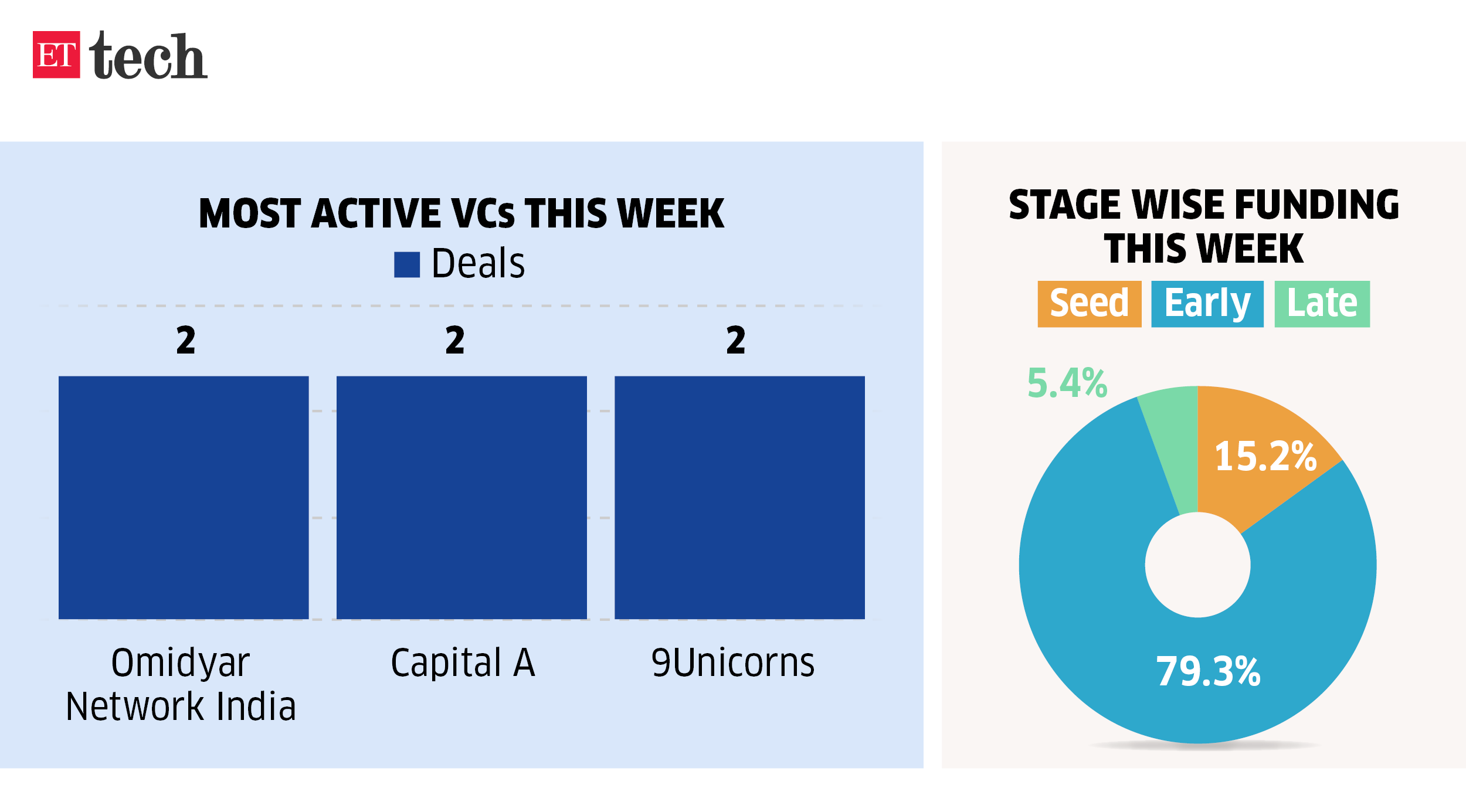

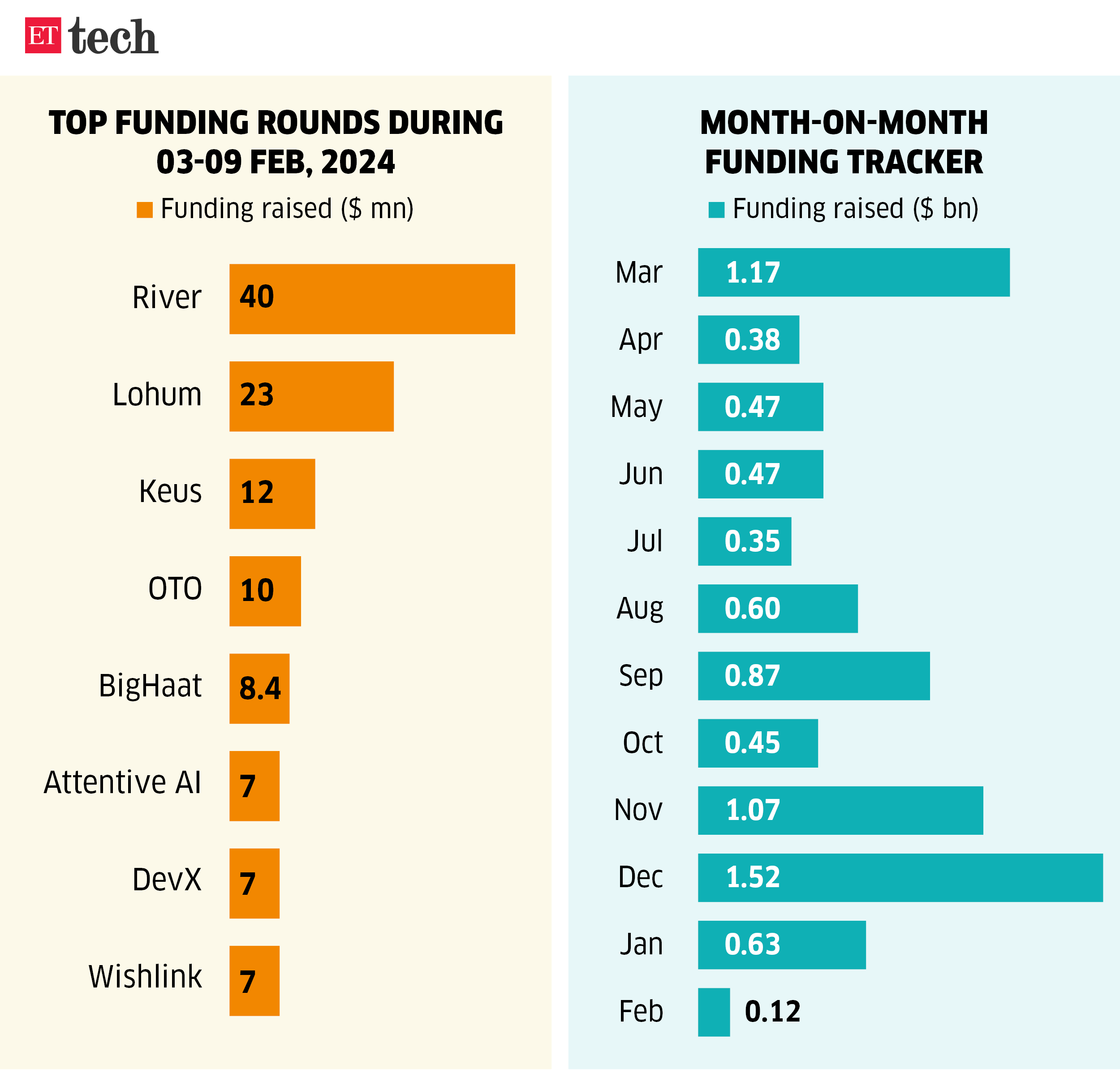

Startup funding in the first week of February 2024 was down about 17% from the same period a year ago, totalling $154.5 million across 27 deals.

Companies, across seed, early and late-stages, had raised about $185 million from 31 rounds in the period from February 3 to February 9, 2023, as per data from Tracxn.

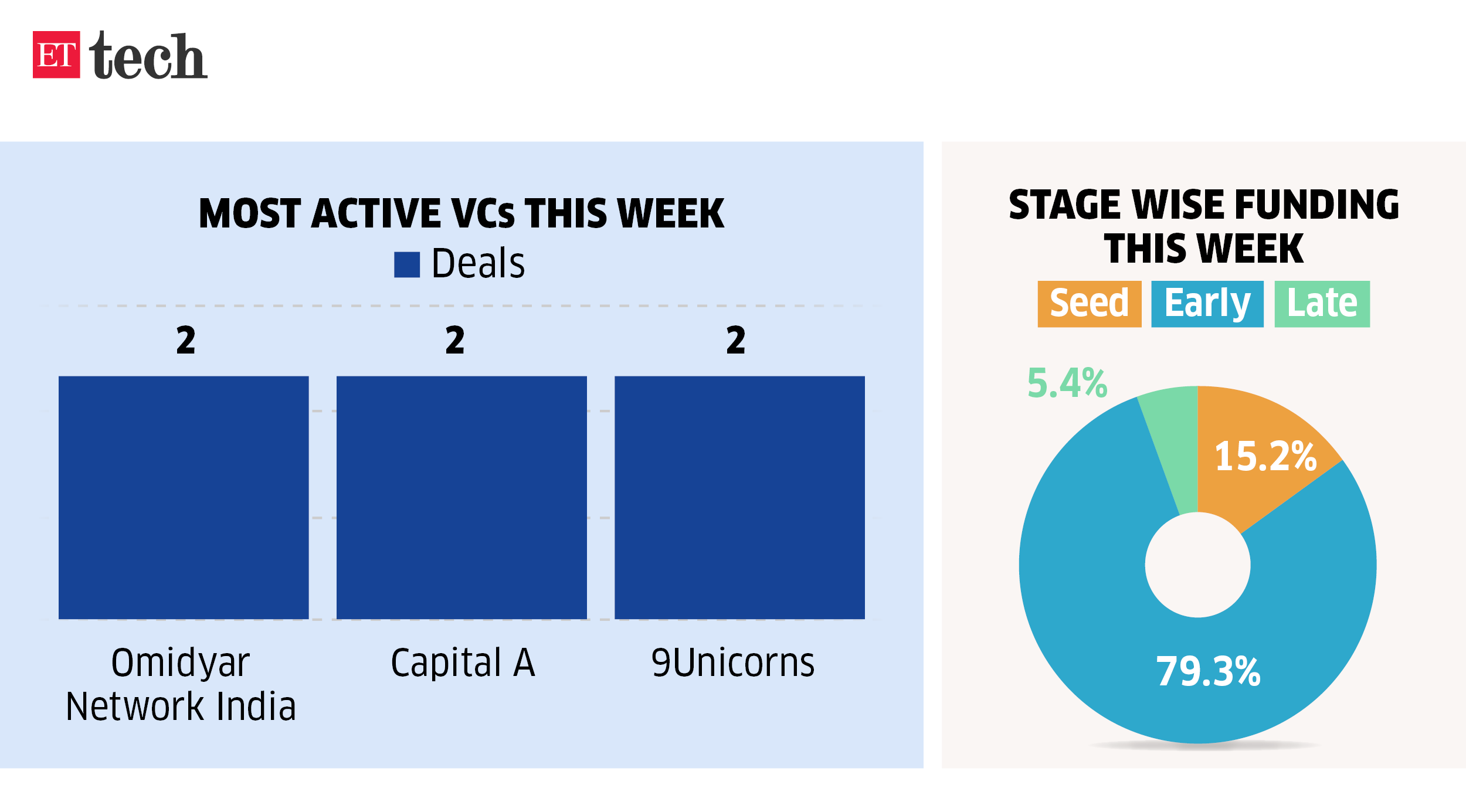

The most significant amount of capital raised this week was in the early stage, at about $122.6 million, accounting for about 79% of the overall deal value. Seed-stage funding came next at $23.5 million, commanding 15%.

Startup employees look for exits amid crises at unicorns

Amid the crises playing out at Byju’s and Paytm – the erstwhile poster boys of India’s edtech and fintech sector – the attractiveness of the already troubled startup sector has eroded further.

Way out: Recruiters say that talent from other sectors, especially at senior levels, is reluctant to join startups. Many who joined startups from traditional sectors at eye-popping hikes at the peak of the funding boom are now eager to exit, even with pay cuts of 20-30%.

MNCs and Indian conglomerates are being preferred to startups, even if the pay is lower, as they are considered more stable, said recruiters.

Reputations at stake: “Troubles at some of these decacorns mean bad news for the startup sector as a whole. It is definitely becoming more difficult to close mandates for CXO roles at startups,” said Anshuman Das, CEO, Longhouse Consulting. People do not want to put their reputations at risk, and that is now becoming the case when working at such companies, he said.

Image takes a beating: “This is the fourth downcycle we are seeing since 2012, but never has it lasted this long. Things look bleak even for the next 2-3 quarters,” said Anuj Roy, managing partner of Fidius Advisory.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Erick Massey in New Delhi.

Also in this letter:

■ Licious lays off 80 employees

■ ETtech Deals Digest

■ Startup employees look for exits

Two independent directors quit Paytm Payments Bank board

Paytm Payments Bank independent directors Shinjini Kumar (left) and Manju Agarwal

Two independent directors have quit the board of Paytm Payments Bank (PPBL) even as it tries to assuage concerns about the continuity of its operations beyond February.

Who left? Shinjini Kumar, a former Bank of America and PricewaterhouseCoopers (PwC) executive, resigned from the payments bank’s board in December, we have learnt. Manju Agarwal, former deputy managing director at State Bank of India, has also quit.

While Kumar’s resignation was accepted and a replacement was being finalised, she is said to have attended two board meetings as a special invitee to meet RBI rules.

Present board: Post the two exits, PPBL’s board consists of three independent directors – veteran banker Arvind Kumar Jain, former Accenture managing director Pankaj Vaish, and former Department for Promotion of Industry and Internal Trade (DPIIT) secretary Ramesh Abhishek.

From One 97 Communications, group head of regulatory affairs, Dr Srinivas Yanamandra, and chief operating officer and president, Bhavesh Gupta are on the board. The other board members are Paytm founder Vijay Shekhar Sharma and PPBL managing director and chief executive officer Surinder Chawla.

SoftBank Vision Fund nearly exits Paytm: Meanwhile, SoftBank Group sold a majority of its stake in Paytm before the RBI order caused the shares to dive. The Japanese tech investor saw uncertainty growing in India’s regulatory environment, as well as over Paytm Payments Bank’s licence, SoftBank Vision Fund CFO Navneet Govil told Bloomberg.

Shares tumble: One 97 Communications saw its share price fall as much as 9% to the day’s low at Rs 408 on the BSE on Friday. It closed the session at Rs 419.85, down 6%.

Source: BSE

Read our detailed coverage on the Paytm crisis:

Mamaearth Q3 profit jumps 265% YoY to Rs 26 crore

Mamaearth founders Varun Alagh (left) and Ghazal Alagh

Omnichannel retailer Honasa Consumer, which owns and operates Mamaearth, on Friday reported a 265% growth in its consolidated net profit to Rs 26 crore for the quarter ended December. Honasa Consumer shares closed 3.54% lower at Rs 432.75 on the BSE.

Key numbers:

- Revenue from operations rose 28% year-on-year (YoY) to Rs 488 crore.

- Consolidated Ebitda jumped 192% YoY in Q3 to Rs 34.5 crore; margins improved 397 basis points YoY to 7.1%.

- Mamaearth grew its household penetration of facewash by 280 bps, and of shampoo by 110 bps in 2 years.

- Younger brands continue to grow, with The Derma Co achieving Ebitda profitability. About 122 new products were launched in CY23.

Also read | Mamaearth parent Honasa’s IPO at a crossroads

Quote, unquote: “We are seeing the consumer sentiment even in the urban markets to be slightly weaker than we expected it to be. It started with weaker festive sales for ecommerce platforms, where traffic was less than expected,” Mamaearth cofounder and CEO Varun Alagh told ET.

“During all of this, the rural pain was already there, and what we’ve seen is that it has led to incumbents discounting far more and that is slightly painful to manage. Overall, our objective is to continue to grow faster than the market and gain share,” he added.

Details: The company continued to strengthen and expand omnichannel distribution with over 1.7 lakh retail touchpoints, an increase of 37% YoY.

Also read | Nykaa net profit doubles in Q3, operating revenue up 22% to Rs 1,789 crore

Licious lays off 80 employees as part of ‘operational reset’

Licious founders Vivek Gupta (left) and Abhay Hanjura

Omnichannel meat retailer Licious has laid off 80 employees, representing 3% of its total employee base. The layoffs were part of an “operational reset to sharpen growth focus,” the firm said. The company has 650 corporate employees and 2,350 other staff running the production and supply chain.

Details: The impacted employees are being offered two months salary as compensation, along with the variable payment for FY24. Licious, the only unicorn in the sector, has seen a gradual slowdown over the past year and a half.

Recent numbers: The company had reported a 9% growth in revenue for FY23 to Rs 748 crore, against a reported revenue projection of Rs 1,500 crore.

Other plans: The meat and seafood company has been working to expand its range of ready-to-eat products. It also came out with its own plant-based meat brand, UnCrave, as it tried to tackle the seasonal nature of the business.

Also read | ETtech in-depth: Lacking bite and funding, online meat ecosystem returns to the drawing board

ETtech Deals Digest: startup funding drops 17% to $155 million this week

Startup funding in the first week of February 2024 was down about 17% from the same period a year ago, totalling $154.5 million across 27 deals.

Companies, across seed, early and late-stages, had raised about $185 million from 31 rounds in the period from February 3 to February 9, 2023, as per data from Tracxn.

The most significant amount of capital raised this week was in the early stage, at about $122.6 million, accounting for about 79% of the overall deal value. Seed-stage funding came next at $23.5 million, commanding 15%.

Startup employees look for exits amid crises at unicorns

Amid the crises playing out at Byju’s and Paytm – the erstwhile poster boys of India’s edtech and fintech sector – the attractiveness of the already troubled startup sector has eroded further.

Way out: Recruiters say that talent from other sectors, especially at senior levels, is reluctant to join startups. Many who joined startups from traditional sectors at eye-popping hikes at the peak of the funding boom are now eager to exit, even with pay cuts of 20-30%.

MNCs and Indian conglomerates are being preferred to startups, even if the pay is lower, as they are considered more stable, said recruiters.

Reputations at stake: “Troubles at some of these decacorns mean bad news for the startup sector as a whole. It is definitely becoming more difficult to close mandates for CXO roles at startups,” said Anshuman Das, CEO, Longhouse Consulting. People do not want to put their reputations at risk, and that is now becoming the case when working at such companies, he said.

Image takes a beating: “This is the fourth downcycle we are seeing since 2012, but never has it lasted this long. Things look bleak even for the next 2-3 quarters,” said Anuj Roy, managing partner of Fidius Advisory.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Erick Massey in New Delhi.