Bollinger B4 EV gets IRS approval for up to $40k in tax credits

Two years after pivoting its business strategy toward the development of commercial EVs, Bollinger Motors has earned IRS approval for federal tax credits under the Inflation Reduction Act, offering fleet customers potential tax credits up to 40,000 per vehicle.

Bollinger Motors is an American EV startup celebrating ten years of operations that began with two passenger EV models – the B1 SUV and a pickup version called the B2, which reached the production-intent design phase in late 2020.

Following struggles in funding and reaching scaled production that plagues many startups, Bollinger announced it was shelving B1 and B2 development in January 2022 to focus on the commercial EV segment, quickly shifting over to Class 3 walk-in vans and beyond.

Six months later, Mullen, a fellow EV startup and commercial EV developer in its own right, announced it had taken a majority stake in Bollinger Motors, vowing to bring the B1 and B2 vehicles to market while keeping the fleet vehicle development going.

By July of 2023, Bollinger had validation builds of its B4 Chassis Cab ahead of 2024 deliveries, while Mullen began receiving IRS approval for federal EV tax credits for its own commercial vehicles like its Class 3 trucks and Class 1 vans.

Today, Bollinger has followed suit and received its own IRS certification.

Bollinger B4 qualifies for commercial EV federal tax credit

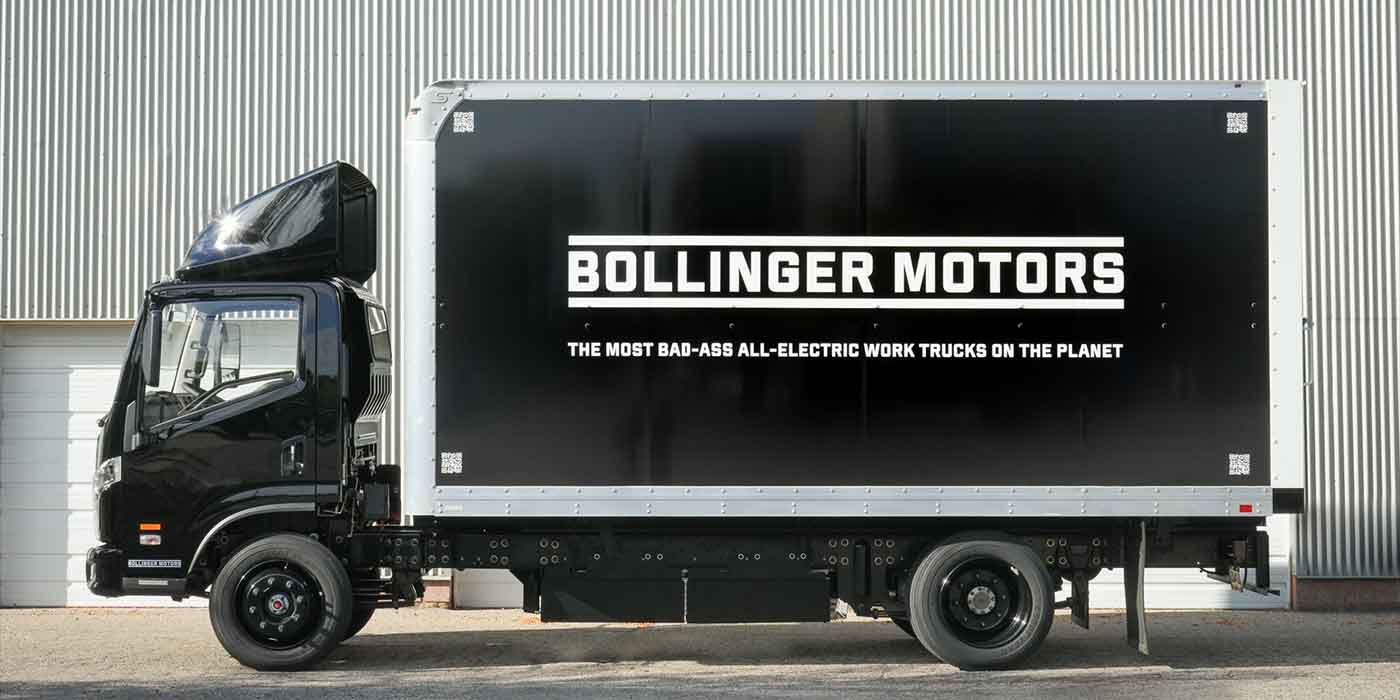

Per Bollinger Motors, customers of the modular B4 Chassis Cab can now officially obtain EV tax credits as it is approved as a qualified commercial clean vehicle under the terms outlined in 2022’s Inflation Reduction Act.

Under section 45W of the Internal Revenue Code (IRC), business and tax-exempt organizations can qualify for the clean vehicle tax credit of up to $40,000 per vehicle when they buy an approved EV such as the Bollinger B4. The credit applies to the lesser of these two purchase terms:

- 15% of the purchaser’s basis in the vehicle (30% if the vehicle is not powered by gas or diesel)

- The incremental cost of the vehicle versus a comparable vehicle with a gas or diesel engine

Bollinger states that as an all-electric commercial vehicle with a gross vehicle weight rating of 15,000 pounds, it is expected to qualify for the full $40,000 tax credit. Company founder and CEO Robert Bollinger spoke:

Bollinger Motors is poised for growth and we’re ready to help electrify America’s fleets. These tax credits are an important incentive for our customers to replace their gas and diesel trucks and lower their total cost of ownership.

Bollinger expects B4 EV deliveries to make their way to initial customers in the second half of 2024.

FTC: We use income earning auto affiliate links. More.

Two years after pivoting its business strategy toward the development of commercial EVs, Bollinger Motors has earned IRS approval for federal tax credits under the Inflation Reduction Act, offering fleet customers potential tax credits up to 40,000 per vehicle.

Bollinger Motors is an American EV startup celebrating ten years of operations that began with two passenger EV models – the B1 SUV and a pickup version called the B2, which reached the production-intent design phase in late 2020.

Following struggles in funding and reaching scaled production that plagues many startups, Bollinger announced it was shelving B1 and B2 development in January 2022 to focus on the commercial EV segment, quickly shifting over to Class 3 walk-in vans and beyond.

Six months later, Mullen, a fellow EV startup and commercial EV developer in its own right, announced it had taken a majority stake in Bollinger Motors, vowing to bring the B1 and B2 vehicles to market while keeping the fleet vehicle development going.

By July of 2023, Bollinger had validation builds of its B4 Chassis Cab ahead of 2024 deliveries, while Mullen began receiving IRS approval for federal EV tax credits for its own commercial vehicles like its Class 3 trucks and Class 1 vans.

Today, Bollinger has followed suit and received its own IRS certification.

Bollinger B4 qualifies for commercial EV federal tax credit

Per Bollinger Motors, customers of the modular B4 Chassis Cab can now officially obtain EV tax credits as it is approved as a qualified commercial clean vehicle under the terms outlined in 2022’s Inflation Reduction Act.

Under section 45W of the Internal Revenue Code (IRC), business and tax-exempt organizations can qualify for the clean vehicle tax credit of up to $40,000 per vehicle when they buy an approved EV such as the Bollinger B4. The credit applies to the lesser of these two purchase terms:

- 15% of the purchaser’s basis in the vehicle (30% if the vehicle is not powered by gas or diesel)

- The incremental cost of the vehicle versus a comparable vehicle with a gas or diesel engine

Bollinger states that as an all-electric commercial vehicle with a gross vehicle weight rating of 15,000 pounds, it is expected to qualify for the full $40,000 tax credit. Company founder and CEO Robert Bollinger spoke:

Bollinger Motors is poised for growth and we’re ready to help electrify America’s fleets. These tax credits are an important incentive for our customers to replace their gas and diesel trucks and lower their total cost of ownership.

Bollinger expects B4 EV deliveries to make their way to initial customers in the second half of 2024.

FTC: We use income earning auto affiliate links. More.