Byju’s ups the ante against investors; India’s proposal on tackling cybercrime

Also in this letter:

■ Interview with Accel partner Arun Mathew

■ Fintechs await govt word on MDR subsidy

■ PhonePe launches Indus Appstore

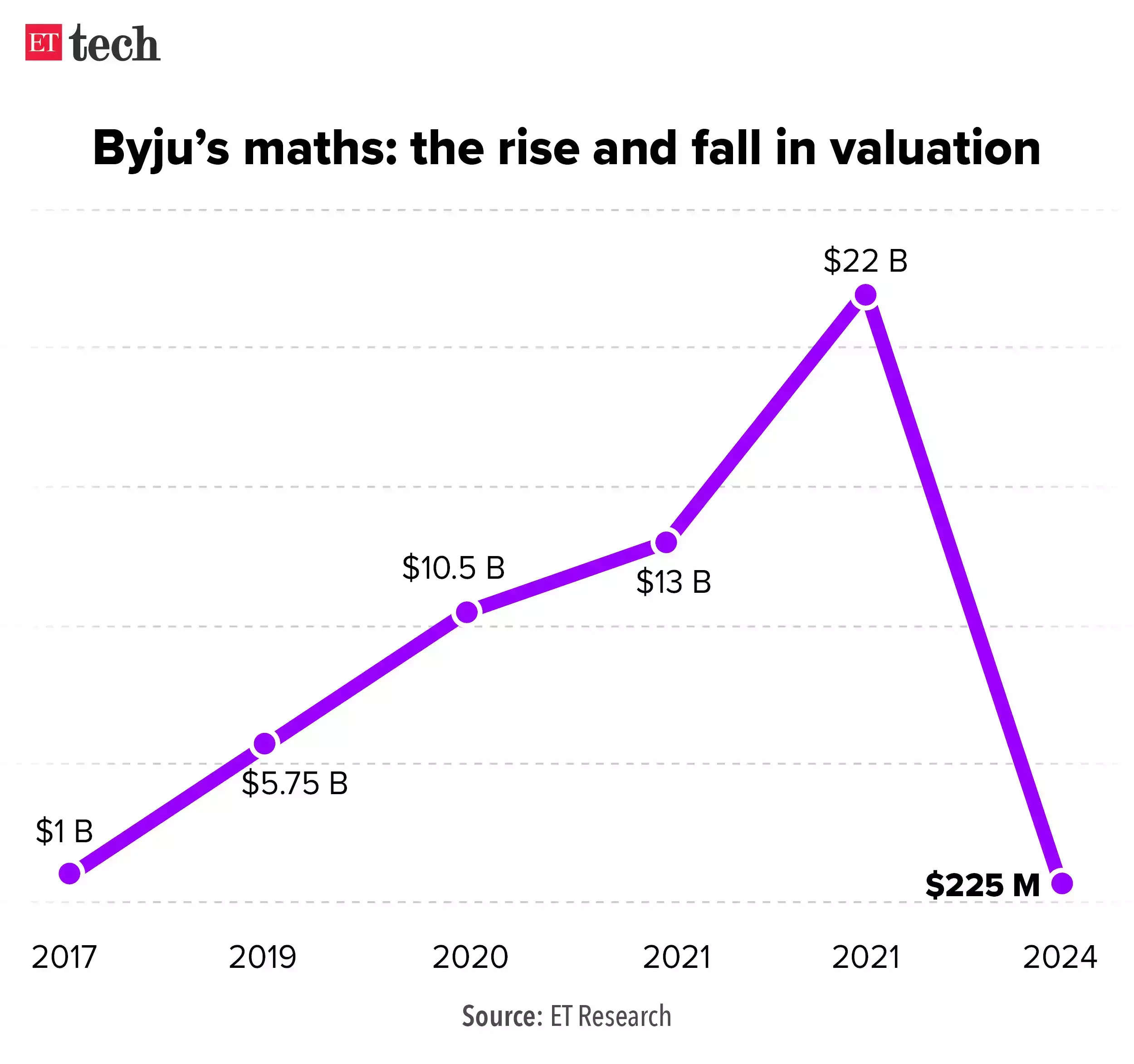

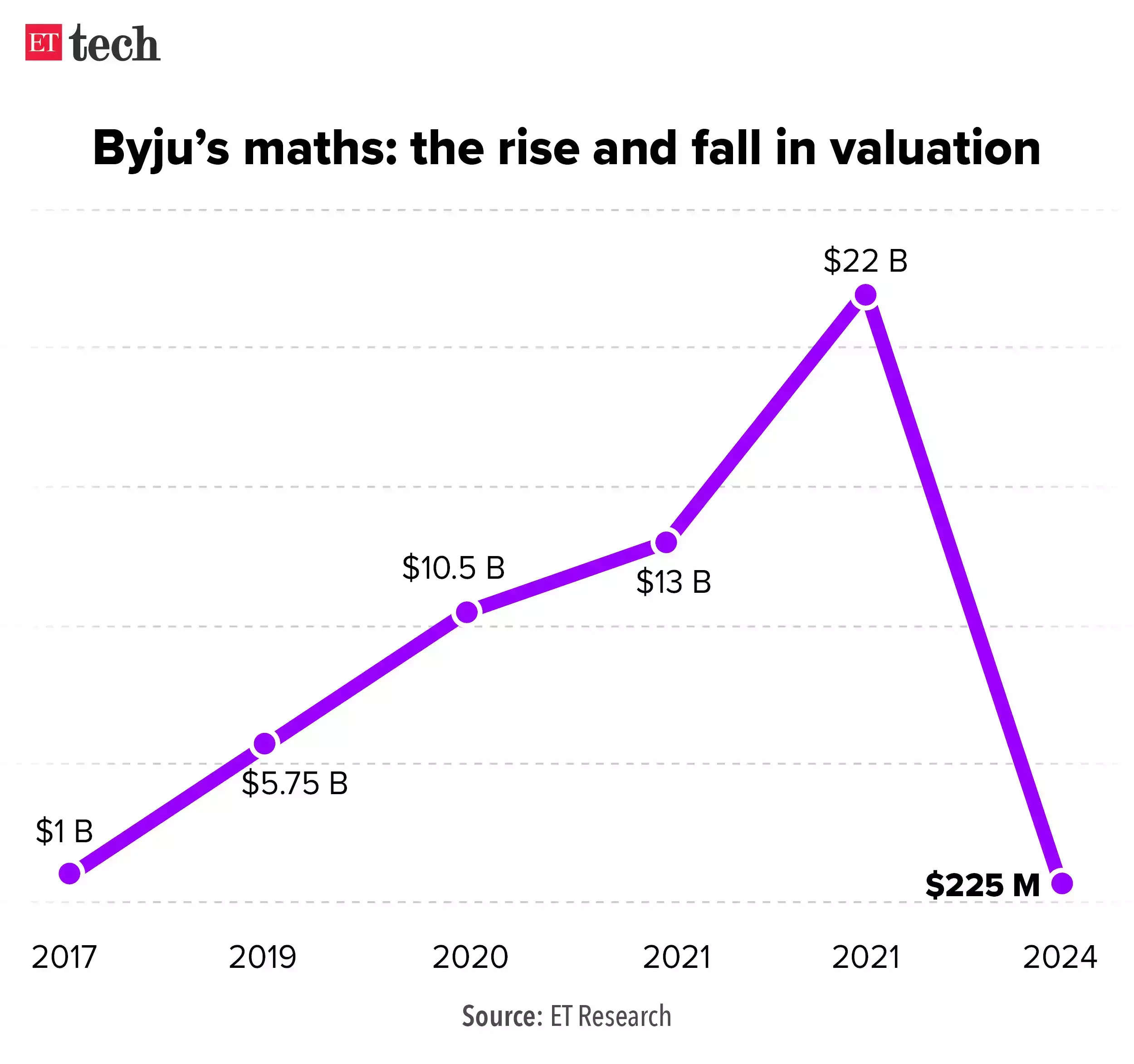

Byju’s secures stay on EGM resolutions from Karnataka HC

Byju’s parent Think & Learn has filed a petition in the Karnataka High Court against a group of investors alleging that they violated the shareholders’ agreement by calling for an extraordinary general meeting (EGM) seeking the removal of Byju Raveendran as CEO.

HC’s stance: In a statement Wednesday evening, Byju’s said the court has passed an order saying any resolutions proposed during the EGM by investors will be considered invalid until the final hearing and disposition of the petition.

The Karnataka HC said in its order that any decision taken by Byju’s shareholders in the EGM “shall not be given effect to, till the next date of hearing.”

Also read | When Byju’s made its presence felt, in absence

This comes ahead of a crucial EGM called by a group of investors to oust Raveendran, his wife, and his brother from the board of the firm.

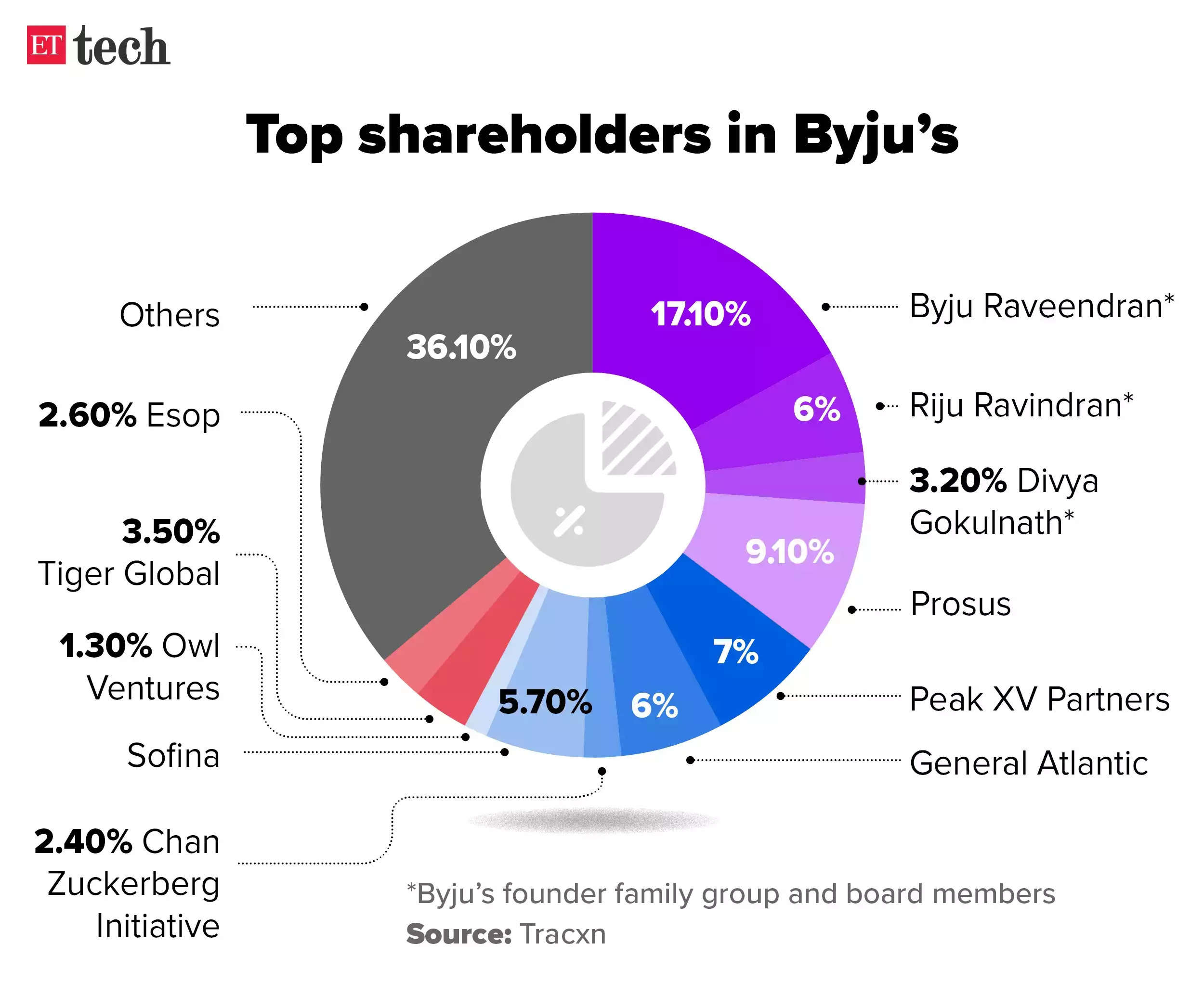

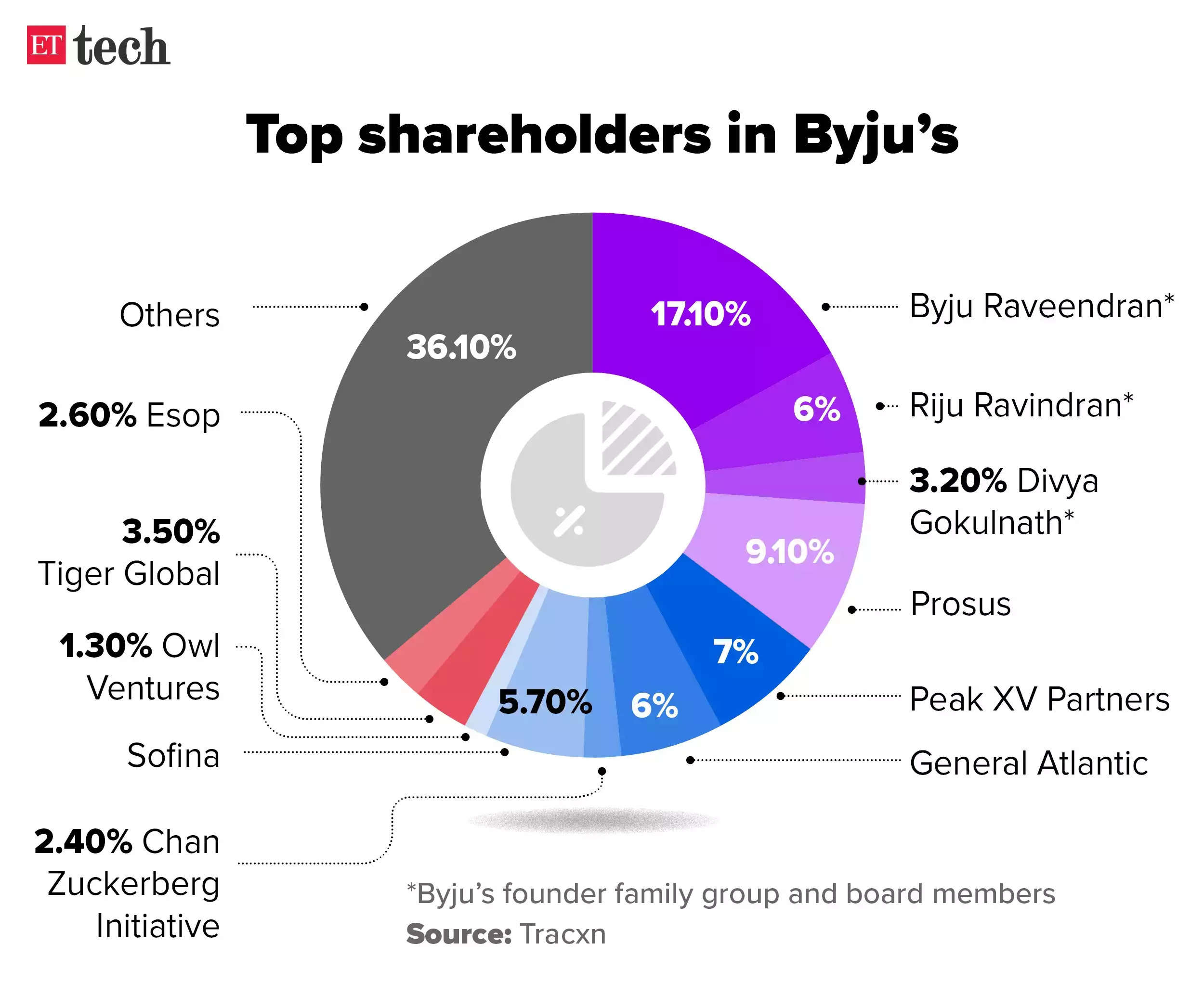

Who are the investors? The Bengaluru-based firm has filed the petition against investors, including Prosus, General Atlantic, Chan Zuckerberg Initiative, Owl Ventures, Peak XV Partners, SCI Investments, SCHF PV Mauritius, Sands Capital, Sofina, and T. Rowe Price Associates.

Read the full text of Byju Raveendran’s letter to shareholders on rights issue, board restructuring

Sources close to the investor group said the EGM will take place on February 23 as planned and a group of investors are planning to vote on the removal of Raveendran as CEO.

Byju’s vs investors faceoff: Earlier in the day, Byju’s said in a letter to shareholders that the $200 million rights issue has been fully subscribed, in a desperate relief to the financially beleaguered edtech startup.

Earlier this month, Byju’s had said the investor group — which demanded his exit and a change of board — has ‘no voting rights’ for the same. The teacher-turned-founder said a few vested interests are acting against the company at a time when it is facing a severe cash crunch.

Also read | Investors flag Byju’s failure to recover Rs 1,400 crore from reseller

India proposes 24×7 network to curb cybercrimes globally

India has proposed a global communication channel in the draft cybercrime treaty to combat phishing, the predominant global cybercrime.

Tell me more: In its proposal, India has said that phishing “stands out as the predominant cybercrime globally” and the current practices in dealing with it are “inadequate”. The 24×7 network could be used to promptly inform other nations about identified web links, uniform resource locators (URLs) and websites which send out phishing links.

The proposal is part of India’s submission to a draft treaty on the prevention of cybercrime, which is being deliberated upon by an ad-hoc committee of the United Nations.

Also read | EPFO, PMO data breach: Centre says aware of reports, Cert-In looking into details

“The requested state, upon verification, can take appropriate action in accordance with domestic law, contributing to building resilience against such abuses,” India has proposed.

Jargon buster: Phishing means using a malicious email or text prompt to trick users into giving up sensitive data, such as passwords and bank account numbers, by posing as a legitimate business or misrepresenting a person.

Expert view: “Such a proposal may, however, open Indian IT and cybercrime prevention and service-oriented companies to requests for data sharing from other countries, including states in the neighbouring region such as Pakistan and China,” Raman Jit Singh Chima, global cybersecurity lead at digital policy think-tank Access Now, said.

Interview: Accel partner Arun Mathew on AI push, IPO outlook and more

The push towards AI in general is forcing rationalisation in other parts of the business, Arun Mathew, a Silicon Valley-based partner at venture capital fund Accel, told us in an interview. Mathew said he is bullish about the SaaS ecosystem, highlighting the engineering talent now available to join these companies along with the cost advantages of building global firms from here.

Here are some edited excerpts:

On Accel’s portfolio amid slowdown: Macro-wise we are still in an uncertain place. The most significant impact has been the reduction in customer expansion.

On IPO market: We have many companies in our portfolio that are approaching public scale and are preparing to go public. We always push our companies to be in a position to be ready, whenever they want.

On SaaS space in India: The India SaaS story is in its infancy. The cost advantage that you have is amazing. So, for companies that just require a lot of engineering horsepower, it’s a really good place to build talent.

On Indian portfolio firms: Flipkart and Freshworks have been a success, investing at the seed and series A and along the way as well. We have a number of companies like BrowserStack, Amagi, Urban Company and Swiggy, which we partnered with at the very early stages. The distinction for Accel is that we take the approach of being first very seriously.

Troubled fintech firms await govt word on MDR subsidy allocation

The central government is yet to allocate the funds meant for promoting digital payments in the country and the fintech industry is looking to raise the issue in the next meeting with the finance minister on Monday.

Subsidy delay: The government typically allocates the funds which are meant to compensate banks for the losses they incur due to the zero MDR regime on Unified Payments Interface and RuPay debit cards, after a cabinet meeting in December or January. It is already the third week of February and the decision is still pending, industry insiders said.

Also read | Programmable, offline CBDC to drive next fintech wave, says NPCI MD

High expectations: Industry sources told ET that looking at the growth of the digital payments industry in the last year and the trends over the last two years, the expectation is towards an allocation of around Rs 4,000 to Rs 4,500 crore. This payment is crucial for payment aggregators who onboard bulk of the merchants for digital payments on behalf of banks.

Quote, unquote: “The fintech industry is really suffering due to increased compliance costs and rising infrastructure costs for processing a huge number of UPI transactions with zero revenue. The budgetary outlay by the finance ministry for digital payments has not reached any of the payments aggregators or banks since April 2023,” said Vishwas Patel, chairman, Payments Council of India.

Other Top Stories By Our Reporters

Sameer Nigam, cofounder and CEO, PhonePe

PhonePe launches made-in-India Indus Appstore: Walmart-owned payments company PhonePe Wednesday launched its mobile app marketplace Indus Appstore for users, in an attempt to rival Google Play Store and Apple App Store.

Cisco plans a ride on India’s digitisation wagon: Cityscape-transforming data centres and an enviable technology spine being built to undergird the rapid expansion of India’s digital economy present robust growth opportunities for Cisco Systems, which specialises in both networking and security solutions.

BluSmart signs deal with Tata Power; moves to solar power for all EV charging needs: BluSmart, an all-electric ride-hailing startup, said on Wednesday it will power its fleet of electric cabs with solar energy supplied by Tata Power, marking a key step towards sustainable transportation in India.

Global Picks We Are Reading

■ The Skilled Workers Training AI to Take Their Jobs (Wired)

■ Apple rivals lobby EU over App Store dominance (FT)

■ Musk’s SpaceX Forges Tighter Links With U.S. Spy and Military Agencies (WSJ)

Also in this letter:

■ Interview with Accel partner Arun Mathew

■ Fintechs await govt word on MDR subsidy

■ PhonePe launches Indus Appstore

Byju’s secures stay on EGM resolutions from Karnataka HC

Byju’s parent Think & Learn has filed a petition in the Karnataka High Court against a group of investors alleging that they violated the shareholders’ agreement by calling for an extraordinary general meeting (EGM) seeking the removal of Byju Raveendran as CEO.

HC’s stance: In a statement Wednesday evening, Byju’s said the court has passed an order saying any resolutions proposed during the EGM by investors will be considered invalid until the final hearing and disposition of the petition.

The Karnataka HC said in its order that any decision taken by Byju’s shareholders in the EGM “shall not be given effect to, till the next date of hearing.”

Also read | When Byju’s made its presence felt, in absence

This comes ahead of a crucial EGM called by a group of investors to oust Raveendran, his wife, and his brother from the board of the firm.

Who are the investors? The Bengaluru-based firm has filed the petition against investors, including Prosus, General Atlantic, Chan Zuckerberg Initiative, Owl Ventures, Peak XV Partners, SCI Investments, SCHF PV Mauritius, Sands Capital, Sofina, and T. Rowe Price Associates.

Read the full text of Byju Raveendran’s letter to shareholders on rights issue, board restructuring

Sources close to the investor group said the EGM will take place on February 23 as planned and a group of investors are planning to vote on the removal of Raveendran as CEO.

Byju’s vs investors faceoff: Earlier in the day, Byju’s said in a letter to shareholders that the $200 million rights issue has been fully subscribed, in a desperate relief to the financially beleaguered edtech startup.

Earlier this month, Byju’s had said the investor group — which demanded his exit and a change of board — has ‘no voting rights’ for the same. The teacher-turned-founder said a few vested interests are acting against the company at a time when it is facing a severe cash crunch.

Also read | Investors flag Byju’s failure to recover Rs 1,400 crore from reseller

India proposes 24×7 network to curb cybercrimes globally

India has proposed a global communication channel in the draft cybercrime treaty to combat phishing, the predominant global cybercrime.

Tell me more: In its proposal, India has said that phishing “stands out as the predominant cybercrime globally” and the current practices in dealing with it are “inadequate”. The 24×7 network could be used to promptly inform other nations about identified web links, uniform resource locators (URLs) and websites which send out phishing links.

The proposal is part of India’s submission to a draft treaty on the prevention of cybercrime, which is being deliberated upon by an ad-hoc committee of the United Nations.

Also read | EPFO, PMO data breach: Centre says aware of reports, Cert-In looking into details

“The requested state, upon verification, can take appropriate action in accordance with domestic law, contributing to building resilience against such abuses,” India has proposed.

Jargon buster: Phishing means using a malicious email or text prompt to trick users into giving up sensitive data, such as passwords and bank account numbers, by posing as a legitimate business or misrepresenting a person.

Expert view: “Such a proposal may, however, open Indian IT and cybercrime prevention and service-oriented companies to requests for data sharing from other countries, including states in the neighbouring region such as Pakistan and China,” Raman Jit Singh Chima, global cybersecurity lead at digital policy think-tank Access Now, said.

Interview: Accel partner Arun Mathew on AI push, IPO outlook and more

The push towards AI in general is forcing rationalisation in other parts of the business, Arun Mathew, a Silicon Valley-based partner at venture capital fund Accel, told us in an interview. Mathew said he is bullish about the SaaS ecosystem, highlighting the engineering talent now available to join these companies along with the cost advantages of building global firms from here.

Here are some edited excerpts:

On Accel’s portfolio amid slowdown: Macro-wise we are still in an uncertain place. The most significant impact has been the reduction in customer expansion.

On IPO market: We have many companies in our portfolio that are approaching public scale and are preparing to go public. We always push our companies to be in a position to be ready, whenever they want.

On SaaS space in India: The India SaaS story is in its infancy. The cost advantage that you have is amazing. So, for companies that just require a lot of engineering horsepower, it’s a really good place to build talent.

On Indian portfolio firms: Flipkart and Freshworks have been a success, investing at the seed and series A and along the way as well. We have a number of companies like BrowserStack, Amagi, Urban Company and Swiggy, which we partnered with at the very early stages. The distinction for Accel is that we take the approach of being first very seriously.

Troubled fintech firms await govt word on MDR subsidy allocation

The central government is yet to allocate the funds meant for promoting digital payments in the country and the fintech industry is looking to raise the issue in the next meeting with the finance minister on Monday.

Subsidy delay: The government typically allocates the funds which are meant to compensate banks for the losses they incur due to the zero MDR regime on Unified Payments Interface and RuPay debit cards, after a cabinet meeting in December or January. It is already the third week of February and the decision is still pending, industry insiders said.

Also read | Programmable, offline CBDC to drive next fintech wave, says NPCI MD

High expectations: Industry sources told ET that looking at the growth of the digital payments industry in the last year and the trends over the last two years, the expectation is towards an allocation of around Rs 4,000 to Rs 4,500 crore. This payment is crucial for payment aggregators who onboard bulk of the merchants for digital payments on behalf of banks.

Quote, unquote: “The fintech industry is really suffering due to increased compliance costs and rising infrastructure costs for processing a huge number of UPI transactions with zero revenue. The budgetary outlay by the finance ministry for digital payments has not reached any of the payments aggregators or banks since April 2023,” said Vishwas Patel, chairman, Payments Council of India.

Other Top Stories By Our Reporters

Sameer Nigam, cofounder and CEO, PhonePe

PhonePe launches made-in-India Indus Appstore: Walmart-owned payments company PhonePe Wednesday launched its mobile app marketplace Indus Appstore for users, in an attempt to rival Google Play Store and Apple App Store.

Cisco plans a ride on India’s digitisation wagon: Cityscape-transforming data centres and an enviable technology spine being built to undergird the rapid expansion of India’s digital economy present robust growth opportunities for Cisco Systems, which specialises in both networking and security solutions.

BluSmart signs deal with Tata Power; moves to solar power for all EV charging needs: BluSmart, an all-electric ride-hailing startup, said on Wednesday it will power its fleet of electric cabs with solar energy supplied by Tata Power, marking a key step towards sustainable transportation in India.

Global Picks We Are Reading

■ The Skilled Workers Training AI to Take Their Jobs (Wired)

■ Apple rivals lobby EU over App Store dominance (FT)

■ Musk’s SpaceX Forges Tighter Links With U.S. Spy and Military Agencies (WSJ)