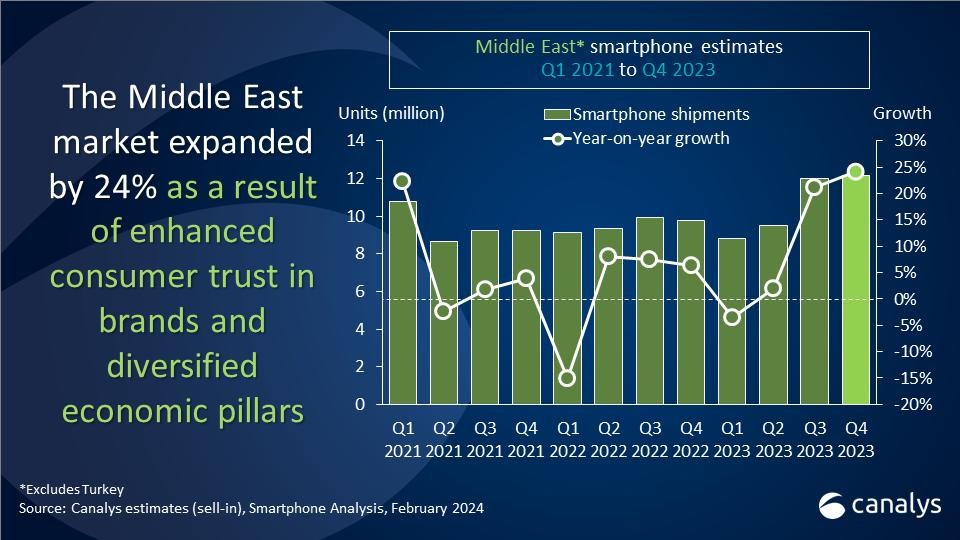

Canalys: the smartphone market in the Middle East grew 24% in Q4, 11% for the full year 2023

12.2 million smartphones were shipped in the Middle East (excluding Turkey) in the final quarter of 2023 – that is a 24% increase compared to the same period of the year before, according to research published by Canalys. 2023 as a whole brought an 11% increase in shipments compared to 2022 for a total of 42.5 million.

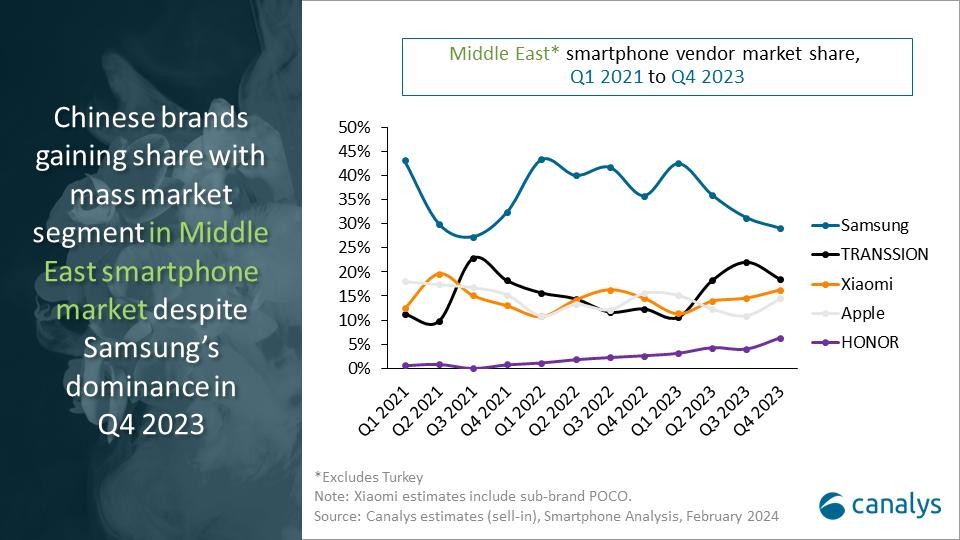

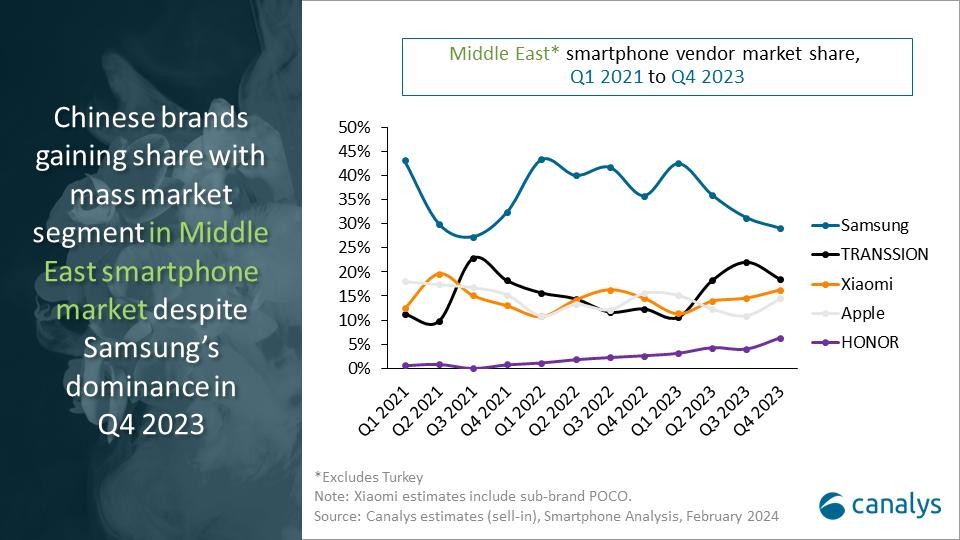

Samsung maintains its position as the #1 vendor, though it is no longer as dominant as it was in previous years. Transsion (Tecno, Infinix, iTel), Xiaomi (including Redmi and Poco) and Apple had very similar volumes in Q4 and we may see some reshuffling.

Canalys credits end-of-season sales events like the Dubai Shopping Festival, plus Black Friday and Yellow Friday from Amazon and Noon. The UAE showed a healthy 22% growth, which is actually on the smaller end of the scale.

Xiaomi has been expanding its presence in brick and mortar stores in the UAE. For example, Xiaomi phones are now offered in twelve Sharaf DG, up from four. Models like the Redmi 12C proved particularly popular.

Iraq saw a massive 86% surge in shipments as Transsion and Xiaomi ran marketing campaigns aimed at a younger audience. Honor’s Xa and Xb series, along with flagships like the Magic 5 Pro are bringing more and more attention to the new brand in Iraq and Saudi Arabia.

While Motorola didn’t make the Top 5, the company saw an impressive 49% growth in the region. Moto phones are available in several countries in the Middle East and Africa, but the company is looking to expand to over 10 new oens.

Looking forward, Canalys’ prognosis for 2024 is a positive one. The analysts also see the thriving tourism section as a driver for growth: “In the long-term, the imminent introduction of a unified GCC tourist visa, likely to occur in 2024 or 2025, is expected to boost visitors, potentially benefiting various sectors, particularly tourism-related services. A surge in tourism could create demand for the latest devices and technology,” said Canalys Senior Consultant Manish Pravinkumar.

12.2 million smartphones were shipped in the Middle East (excluding Turkey) in the final quarter of 2023 – that is a 24% increase compared to the same period of the year before, according to research published by Canalys. 2023 as a whole brought an 11% increase in shipments compared to 2022 for a total of 42.5 million.

Samsung maintains its position as the #1 vendor, though it is no longer as dominant as it was in previous years. Transsion (Tecno, Infinix, iTel), Xiaomi (including Redmi and Poco) and Apple had very similar volumes in Q4 and we may see some reshuffling.

Canalys credits end-of-season sales events like the Dubai Shopping Festival, plus Black Friday and Yellow Friday from Amazon and Noon. The UAE showed a healthy 22% growth, which is actually on the smaller end of the scale.

Xiaomi has been expanding its presence in brick and mortar stores in the UAE. For example, Xiaomi phones are now offered in twelve Sharaf DG, up from four. Models like the Redmi 12C proved particularly popular.

Iraq saw a massive 86% surge in shipments as Transsion and Xiaomi ran marketing campaigns aimed at a younger audience. Honor’s Xa and Xb series, along with flagships like the Magic 5 Pro are bringing more and more attention to the new brand in Iraq and Saudi Arabia.

While Motorola didn’t make the Top 5, the company saw an impressive 49% growth in the region. Moto phones are available in several countries in the Middle East and Africa, but the company is looking to expand to over 10 new oens.

Looking forward, Canalys’ prognosis for 2024 is a positive one. The analysts also see the thriving tourism section as a driver for growth: “In the long-term, the imminent introduction of a unified GCC tourist visa, likely to occur in 2024 or 2025, is expected to boost visitors, potentially benefiting various sectors, particularly tourism-related services. A surge in tourism could create demand for the latest devices and technology,” said Canalys Senior Consultant Manish Pravinkumar.