Dutch fintech leader Finom nets €50M to boost digital banking for SMEs

Dutch fintech Finom has raised €50mn, which the startup will use to boost its digital banking services.

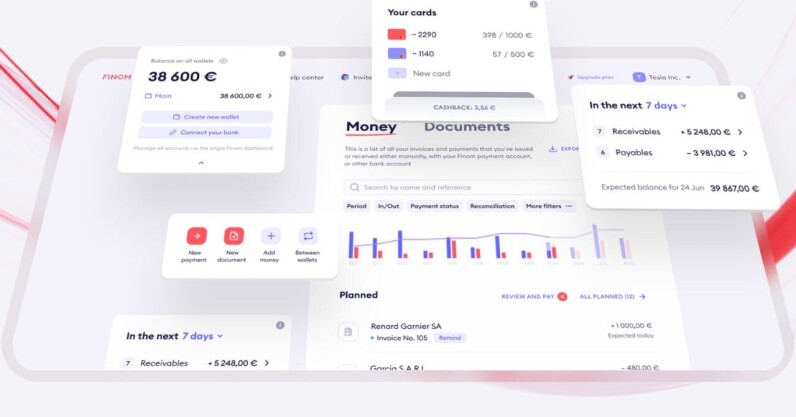

Founded in 2019, the Amsterdam-based business operates a pan-European neobank for SMEs and entrepreneurs. It integrates online banking, accounting, and financial management into a single platform.

Kos Stiskin, co-founder at Finom, said the company was built to simplify banking for small businesses.

“Finom was born as a cost-effective and user-friendly digital banking solution for entrepreneurs to foster business growth and development across Europe,” Stiskin wrote on LinkedIn.

TNW Conference 2024 – Group ticket offer

Save up to 40% with our Group offer and join Europe’s leading tech festival in June!

“We aimed to give them more time to focus and reach their full potential.”

In the preceding four years, Finom built a customer base of over 85,000 SMEs and individual entrepreneurs. As an authorised Electronic Money Institution (EMI), the startup can provide numerous financial services across the EU, but can’t lend money.

The Series B financing was co-led by new investor Northzone alongside General Catalyst, which first backed Finom in a 2020 seed funding round. Northzone described the startup as “the future of SME banking in Europe.”

“Finom has a truly best-in-class core banking product, which forms the backbone of their customers’ financial stack,” Northzone partner Sanjot Malhi said in a statement.

However, the true platform potential of Finom is seen through its payments and microservices software offering for SMEs, with clear demonstrated success across several major Western European economies.”

The fresh cash injection takes the startup’s total funding to over €100mn. Finom will use the new capital to enhance its core products, recruit new talent, and accelerate its expansion across Europe. By next year, the company plans to cover the entire Eurozone.

Dutch fintech Finom has raised €50mn, which the startup will use to boost its digital banking services.

Founded in 2019, the Amsterdam-based business operates a pan-European neobank for SMEs and entrepreneurs. It integrates online banking, accounting, and financial management into a single platform.

Kos Stiskin, co-founder at Finom, said the company was built to simplify banking for small businesses.

“Finom was born as a cost-effective and user-friendly digital banking solution for entrepreneurs to foster business growth and development across Europe,” Stiskin wrote on LinkedIn.

TNW Conference 2024 – Group ticket offer

Save up to 40% with our Group offer and join Europe’s leading tech festival in June!

“We aimed to give them more time to focus and reach their full potential.”

In the preceding four years, Finom built a customer base of over 85,000 SMEs and individual entrepreneurs. As an authorised Electronic Money Institution (EMI), the startup can provide numerous financial services across the EU, but can’t lend money.

The Series B financing was co-led by new investor Northzone alongside General Catalyst, which first backed Finom in a 2020 seed funding round. Northzone described the startup as “the future of SME banking in Europe.”

“Finom has a truly best-in-class core banking product, which forms the backbone of their customers’ financial stack,” Northzone partner Sanjot Malhi said in a statement.

However, the true platform potential of Finom is seen through its payments and microservices software offering for SMEs, with clear demonstrated success across several major Western European economies.”

The fresh cash injection takes the startup’s total funding to over €100mn. Finom will use the new capital to enhance its core products, recruit new talent, and accelerate its expansion across Europe. By next year, the company plans to cover the entire Eurozone.