E-bike maker SONDORS enters receivership, company up for sale

After a series of financial setbacks followed by an Electrek exposé revealing the failed Metacycle electric motorcycle project, e-bike maker SONDORS has appeared to enter receivership. The search is now on for a buyer who can scoop up the company and its assets.

Electrek has reviewed documents sent out by Rock Creek Financial Advisors (RCFA) indicating that an RFCA representative has been appointed as receiver of SONDORS, Inc, and that the company is being offered for sale along with its assets.

RCFA describes itself on its website as specializing in “advising and operating companies through state regulated Assignment for the Benefit of Creditors (ABCs), which are a faster, cheaper, and less publicized insolvency proceeding that allows a company to shed its liabilities in a cost effective manner, sell the assets of the company and wind-down the company by the Rock Creek professionals.”

A receivership differs from a bankruptcy. While a traditional bankruptcy proceeding is usually a lengthy process designed to protect the company and shield it from creditors, a receivership is usually set up by a struggling company’s creditors themselves and is a quicker process intended to protect those creditors – often by selling the company and its assets in an attempt to save their investment.

As explained in an RCFA document regarding SONDORS, Inc and reviewed by Electrek, “Rock Creek is working to sell the Assets. We will consider all offers of interest. Term sheets will be due no later than Friday, January 19, before 11:59 pm ET, but we will accept indications of interest prior to that time.”

RCFA also provided a lengthy presentation deck prepared by SONDORS, Inc that pitches the value of the company and its diverse product line. Among the claims in the presentation are that SONDORS, Inc has sold over 63,000 electric bikes and has over 10,000 cash deposits for its Metacycle electric motorcycle that total over $19.9M.

The presentation also includes several unreleased products as demonstrations of potential upcoming projects, including an electric dirt bike, a larger electric motorcycle, and an electric ATV quad.

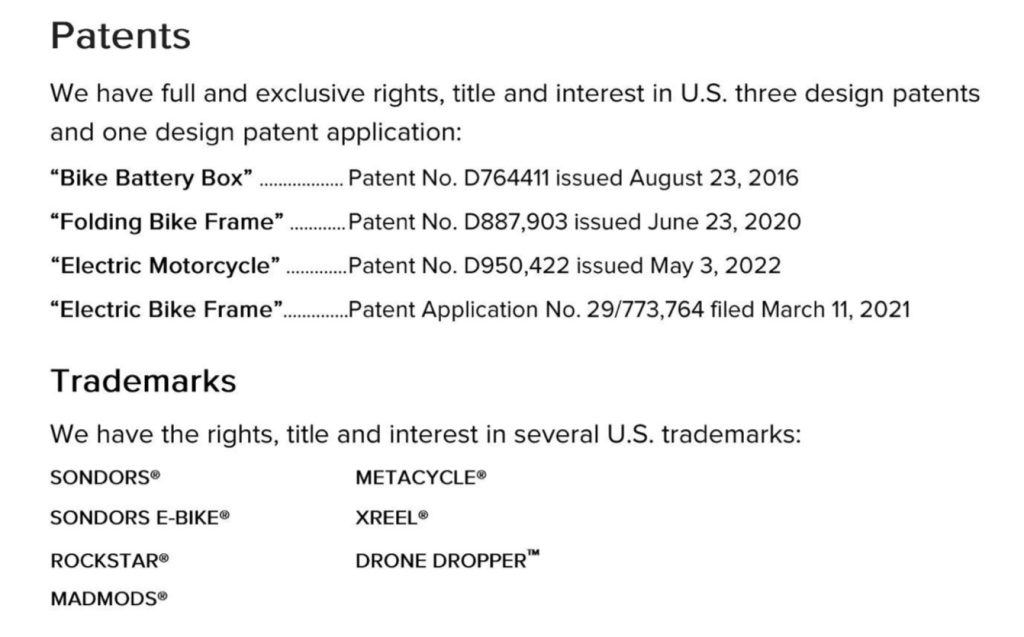

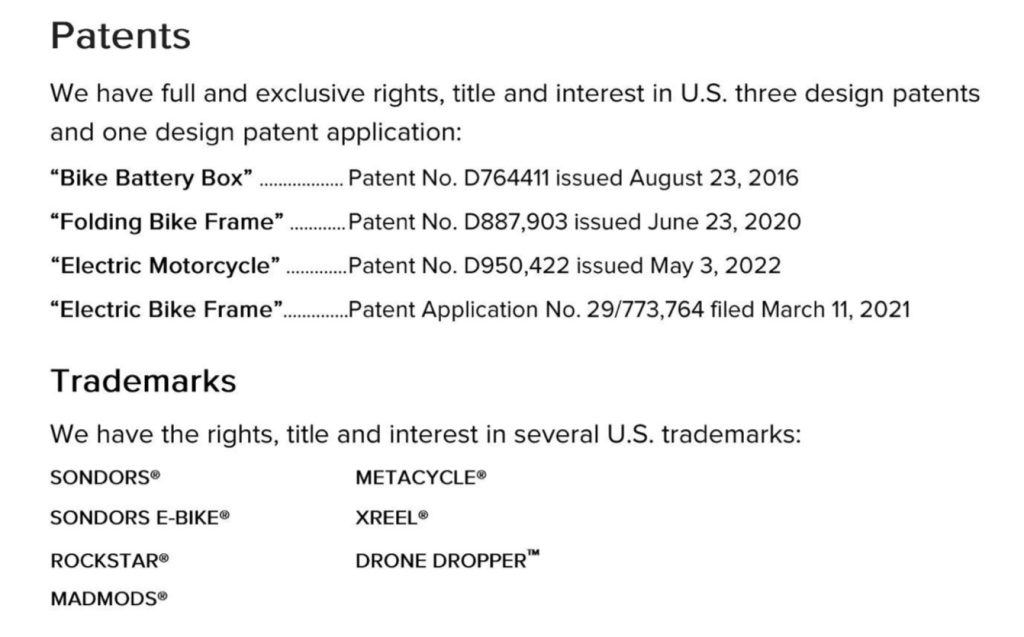

The company detailed its patents and trademarks in the pitch, which would likely be included in any sale of the company’s assets.

However, much of the presentation is out of date. It is listed as being prepared nearly a year ago in January 2023. Members of the leadership team detailed in the presentation have left or changed in that time, and the company largely ceased delivering its flagship Metacycle electric motorcycle at some point in 2023.

It is unclear if there are any prospective buyers for SONDORS, Inc, but RCFA appears to be leaving the door open through January 19, 2024, offering less than a month to find a buyer for the company.

FTC: We use income earning auto affiliate links. More.

After a series of financial setbacks followed by an Electrek exposé revealing the failed Metacycle electric motorcycle project, e-bike maker SONDORS has appeared to enter receivership. The search is now on for a buyer who can scoop up the company and its assets.

Electrek has reviewed documents sent out by Rock Creek Financial Advisors (RCFA) indicating that an RFCA representative has been appointed as receiver of SONDORS, Inc, and that the company is being offered for sale along with its assets.

RCFA describes itself on its website as specializing in “advising and operating companies through state regulated Assignment for the Benefit of Creditors (ABCs), which are a faster, cheaper, and less publicized insolvency proceeding that allows a company to shed its liabilities in a cost effective manner, sell the assets of the company and wind-down the company by the Rock Creek professionals.”

A receivership differs from a bankruptcy. While a traditional bankruptcy proceeding is usually a lengthy process designed to protect the company and shield it from creditors, a receivership is usually set up by a struggling company’s creditors themselves and is a quicker process intended to protect those creditors – often by selling the company and its assets in an attempt to save their investment.

As explained in an RCFA document regarding SONDORS, Inc and reviewed by Electrek, “Rock Creek is working to sell the Assets. We will consider all offers of interest. Term sheets will be due no later than Friday, January 19, before 11:59 pm ET, but we will accept indications of interest prior to that time.”

RCFA also provided a lengthy presentation deck prepared by SONDORS, Inc that pitches the value of the company and its diverse product line. Among the claims in the presentation are that SONDORS, Inc has sold over 63,000 electric bikes and has over 10,000 cash deposits for its Metacycle electric motorcycle that total over $19.9M.

The presentation also includes several unreleased products as demonstrations of potential upcoming projects, including an electric dirt bike, a larger electric motorcycle, and an electric ATV quad.

The company detailed its patents and trademarks in the pitch, which would likely be included in any sale of the company’s assets.

However, much of the presentation is out of date. It is listed as being prepared nearly a year ago in January 2023. Members of the leadership team detailed in the presentation have left or changed in that time, and the company largely ceased delivering its flagship Metacycle electric motorcycle at some point in 2023.

It is unclear if there are any prospective buyers for SONDORS, Inc, but RCFA appears to be leaving the door open through January 19, 2024, offering less than a month to find a buyer for the company.

FTC: We use income earning auto affiliate links. More.