Federation of Automobile Dealers Associations (FADA) Released Vehicle Retail Data for July’22

The Federation of Automobile Dealers Associations (FADA) today released

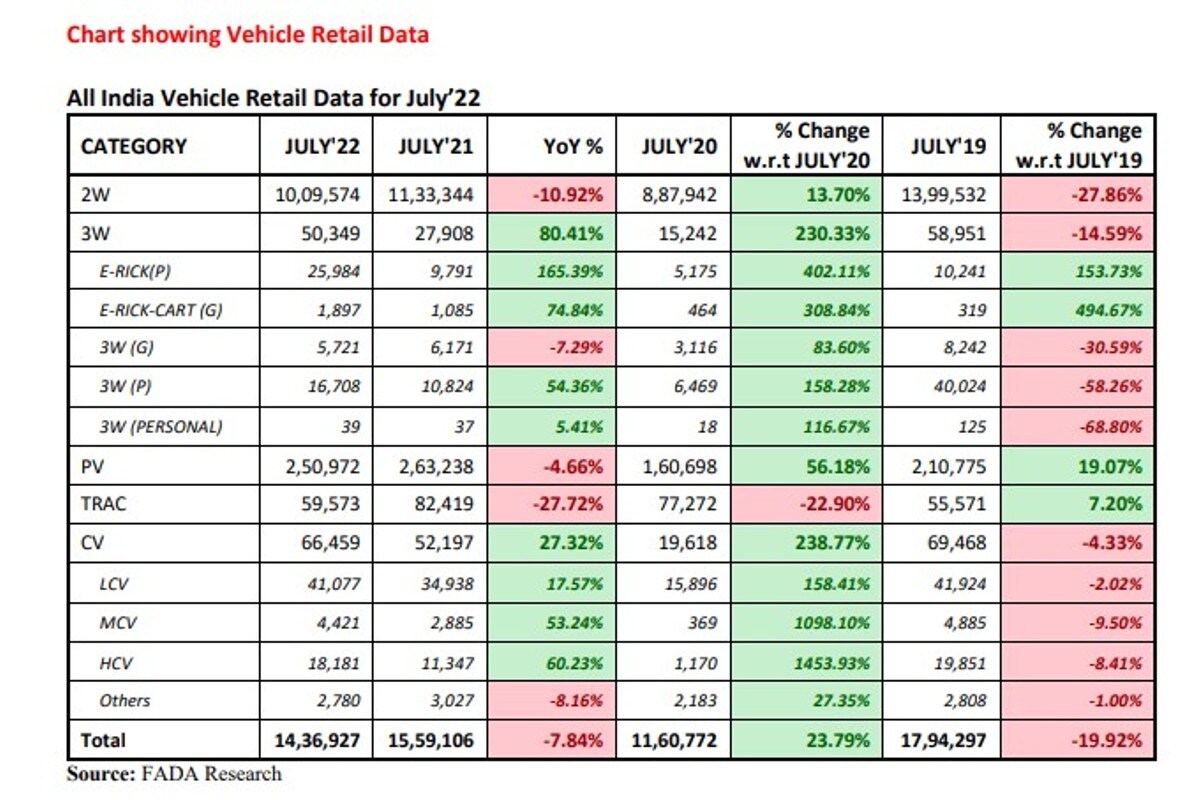

Vehicle Retail Data for July’22. The association for the first time has released a 3W sub-segment along with its regular 2W, 3W, PV, and CV Data.

Commenting on how July’22 performed, FADA President, Mr. Vinkesh Gulati said, Our quest for a deeper insight into Auto Retail figures, FADA for the first time has released 3W sub-segment retail figures. After the breakup of the CV segment, the 3W sub-segmentation will help all the stakeholders understand the 3W market in much detail.

Auto Retail for the month of July’22 fell by -8%. July is generally considered a lean month before the festival season hits in August. When compared with July’19, a pre-covid month, total vehicle retails fell by -20%. PV and Trac continued to outperform by growing 19% and 7%. All the other categories were in red with 2W, 3W, and CV falling by -28%, -15%, and -4% respectively.

The 2W retail run witnessed poor demand as Rural India continues to underperform. This coupled with high inflation, erratic monsoon, and high cost of ownership continue to keep the bottom of the pyramid customers at bay.

The 3W space continued to see demand recovery even though full recovery to pre-covid levels is still some time away. Digging deeper, it is clearly evident that e-rickshaws are the biggest mover in the segment. Demand recovery in the 3W passenger category also shows that covid is now behind us as passenger movement has once again started gaining traction.

Also Read: Tata Tiago NRG XT Launched at Rs 6.42 Lakhs

CV retail figures continue to witness good demand as Government’s infrastructure push is helping customers in concluding their purchases. Apart from this, the Bus segment also witnessed the beginning of demand recovery as educational institutions and offices are once again back to normal mode. The PV segment is witnessing a dream run as retail sales are already higher than in 2019.

Even though there is a blip in July numbers, the industry is continuously introducing new models, especially in the compact SUV segment. Along with this, a better supply in the coming months will help in bringing down customer anxiety due to the large waiting period.

After Russia- Ukraine war, the world is once again facing the threat of the Taiwan- China war. Due to this, the threat of semi-conductor shortage is once again looming as chip-maker TSMC raises a red flag that if war hits, Taiwanese chip manufacturers would be rendered ‘non- operable’.

India’s services sector PMI (Purchasing Manager’s Index) fell to a 4-month low in July to 55.5 showing that growth momentum lost steam as a result of weaker sales growth and inflationary pressure in the previous month. Overall, FADA remains cautiously optimistic due to the above factors as it enters the festival season.

Read all the Latest News and Breaking News here

The Federation of Automobile Dealers Associations (FADA) today released

Vehicle Retail Data for July’22. The association for the first time has released a 3W sub-segment along with its regular 2W, 3W, PV, and CV Data.

Commenting on how July’22 performed, FADA President, Mr. Vinkesh Gulati said, Our quest for a deeper insight into Auto Retail figures, FADA for the first time has released 3W sub-segment retail figures. After the breakup of the CV segment, the 3W sub-segmentation will help all the stakeholders understand the 3W market in much detail.

Auto Retail for the month of July’22 fell by -8%. July is generally considered a lean month before the festival season hits in August. When compared with July’19, a pre-covid month, total vehicle retails fell by -20%. PV and Trac continued to outperform by growing 19% and 7%. All the other categories were in red with 2W, 3W, and CV falling by -28%, -15%, and -4% respectively.

The 2W retail run witnessed poor demand as Rural India continues to underperform. This coupled with high inflation, erratic monsoon, and high cost of ownership continue to keep the bottom of the pyramid customers at bay.

The 3W space continued to see demand recovery even though full recovery to pre-covid levels is still some time away. Digging deeper, it is clearly evident that e-rickshaws are the biggest mover in the segment. Demand recovery in the 3W passenger category also shows that covid is now behind us as passenger movement has once again started gaining traction.

Also Read: Tata Tiago NRG XT Launched at Rs 6.42 Lakhs

CV retail figures continue to witness good demand as Government’s infrastructure push is helping customers in concluding their purchases. Apart from this, the Bus segment also witnessed the beginning of demand recovery as educational institutions and offices are once again back to normal mode. The PV segment is witnessing a dream run as retail sales are already higher than in 2019.

Even though there is a blip in July numbers, the industry is continuously introducing new models, especially in the compact SUV segment. Along with this, a better supply in the coming months will help in bringing down customer anxiety due to the large waiting period.

After Russia- Ukraine war, the world is once again facing the threat of the Taiwan- China war. Due to this, the threat of semi-conductor shortage is once again looming as chip-maker TSMC raises a red flag that if war hits, Taiwanese chip manufacturers would be rendered ‘non- operable’.

India’s services sector PMI (Purchasing Manager’s Index) fell to a 4-month low in July to 55.5 showing that growth momentum lost steam as a result of weaker sales growth and inflationary pressure in the previous month. Overall, FADA remains cautiously optimistic due to the above factors as it enters the festival season.

Read all the Latest News and Breaking News here