GPU Demand Has Been Slowly But Steadily Declining in Q1 of 2022

In a new report by Jon Peddie Research, it appears the GPU market is in a slow but steady recovery from the incessant supply and demand issues that have plagued the industry over the past two years. According to the report, GPU shipments in the first quarter of 2022 saw a 6.2% decrease compared to Q4 of 2021, with a total of 96 million units shipped in Q1. This includes both integrated and discrete graphics from all the major players: Intel, AMD, and Nvidia.

When broken down by each company, AMD saw the slightest decline of just 1.5%, while Nvidia saw a modest 3.2% increase. Intel’s market decline showed the most significant drop at negative 8.7% when compared to last quarter. On the flip side, consumer graphics cards from add-in board partners (AIBs) have seen an increase in shipments by 1.4% from last year. So it appears that these shipment reductions are mostly a result of OEMs machines and especially laptops.

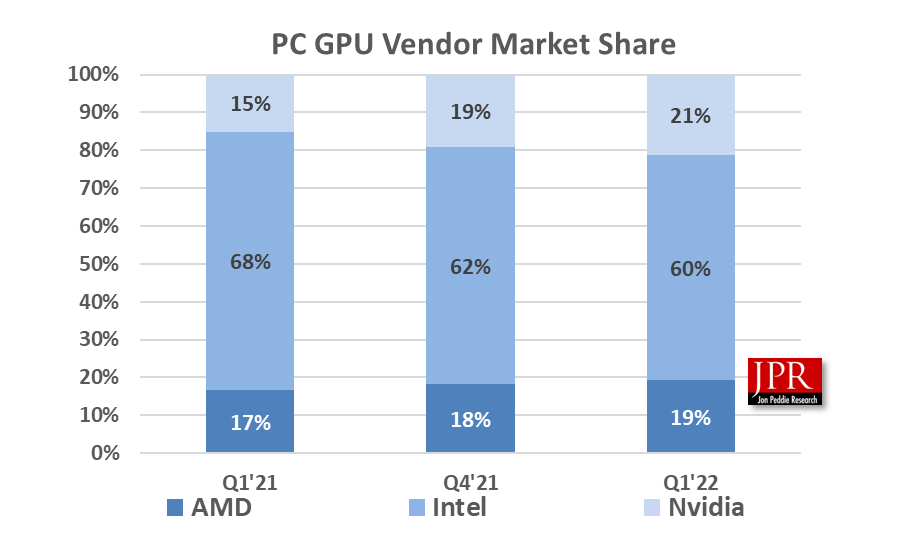

GPU market share over the past year has seen quite a change as well, with Nvidia and AMD eating some of Intel’s market share from Q1 of 2021 to Q1 of 2022 and Nvidia taking a lead over AMD.

In Q1 of 2021, Intel saw a large 68% GPU market share, thanks to the massive volume of integrated graphics chips it ships in both desktops and laptops. AMD came in second place with a 17% market share — again thanks mostly to integrated graphics solutions, though it did ship some discrete GPUs as well. Nvidia meanwhile had just 15% of the market share, but that consists entirely of dedicated solutions as the company lacks any integrated graphics options.

Fast forward to Q1 of 2022 and the GPU market share landscape has changed quite a bit. Intel lost 8% of its market share and now sits at 60%, and Nvidia has jumped into second place with a 21% market share, with AMD improving slightly to 19%. This is impressive considering all of Nvidia’s graphics shipments comes exclusively from discrete GPUs.

| Q1 2021 | Q4 2021 | Q1 2022 | |

| AMD | 19% | 18% | 17% |

| Intel | N/A | 5% | 4% |

| Nvidia | 81% | 78% | 78% |

Interestingly, discrete GPU shipments from AMD, Nvidia, and now Intel has changed over the past year thanks to Intel’s entrance into the discrete GPU space. Q1 of 2021 of course saw no Intel market share, with Nvidia leading by 81% and AMD 19%. That changed in Q4 of 2021 where Intel grabbed a respectable 5% market share, and AMD dropped a point to 18% while Nvidia led the pack at 78%.

Q1 of 2022 showed no major change in market share, with AMD and Intel swapping 1% of market share between themselves. AMD currently sits at 17%, Intel at 4%, and Nvidia stays the same at 78%. What’s particularly surprising is that all of Intel’s dedicated GPU shipments come courtesy of its DG1 graphics solution, which isn’t a particularly potent graphics solution. We suspect the vast majority of Intel’s 4–5% discrete GPU market share is thanks to major laptop OEMs opting for Intel GPUs, probably at lower prices than AMD and Nvidia offered.

CPU shipments showed and even more drastic change over the past year with a 10.8% reduction in shipments quarter to quarter, and a full 26.2% reduction year over year. That’s good news for CPU buyers, as it means there should be plenty of options at or below MSRP due to the lack of demand.

Overall, this data seems to confirm that GPU demand has been steadily decreasing, which is great considering the explosive year we had last year, where GPU supply could not keep up with demand. With the drop off in mining profitability, combined with the impending launches of Nvidia’s Ada architecture and AMD’s RDNA 3, we expect supply will continue to improve. That could lead to GPUs selling at or below MSRP by the end of the year. However, we suspect demand for the next generation GPUs will once again eclipse supply, at least in the short term, once those parts launch.

We also don’t expect the downward trend in GPU sales to last forever. JPR expects the compound annual growth of GPUs to increase to 6.3% over the next five years. 2021 was also an exceptional year for CPU and GPU sales, so the drop in sales the following year isn’t particularly surprising. Long term, there’s still strong market demand for discrete GPUs in both notebooks and desktops, plus increasing shipments for data center and deep learning purposes.

In a new report by Jon Peddie Research, it appears the GPU market is in a slow but steady recovery from the incessant supply and demand issues that have plagued the industry over the past two years. According to the report, GPU shipments in the first quarter of 2022 saw a 6.2% decrease compared to Q4 of 2021, with a total of 96 million units shipped in Q1. This includes both integrated and discrete graphics from all the major players: Intel, AMD, and Nvidia.

When broken down by each company, AMD saw the slightest decline of just 1.5%, while Nvidia saw a modest 3.2% increase. Intel’s market decline showed the most significant drop at negative 8.7% when compared to last quarter. On the flip side, consumer graphics cards from add-in board partners (AIBs) have seen an increase in shipments by 1.4% from last year. So it appears that these shipment reductions are mostly a result of OEMs machines and especially laptops.

GPU market share over the past year has seen quite a change as well, with Nvidia and AMD eating some of Intel’s market share from Q1 of 2021 to Q1 of 2022 and Nvidia taking a lead over AMD.

In Q1 of 2021, Intel saw a large 68% GPU market share, thanks to the massive volume of integrated graphics chips it ships in both desktops and laptops. AMD came in second place with a 17% market share — again thanks mostly to integrated graphics solutions, though it did ship some discrete GPUs as well. Nvidia meanwhile had just 15% of the market share, but that consists entirely of dedicated solutions as the company lacks any integrated graphics options.

Fast forward to Q1 of 2022 and the GPU market share landscape has changed quite a bit. Intel lost 8% of its market share and now sits at 60%, and Nvidia has jumped into second place with a 21% market share, with AMD improving slightly to 19%. This is impressive considering all of Nvidia’s graphics shipments comes exclusively from discrete GPUs.

| Q1 2021 | Q4 2021 | Q1 2022 | |

| AMD | 19% | 18% | 17% |

| Intel | N/A | 5% | 4% |

| Nvidia | 81% | 78% | 78% |

Interestingly, discrete GPU shipments from AMD, Nvidia, and now Intel has changed over the past year thanks to Intel’s entrance into the discrete GPU space. Q1 of 2021 of course saw no Intel market share, with Nvidia leading by 81% and AMD 19%. That changed in Q4 of 2021 where Intel grabbed a respectable 5% market share, and AMD dropped a point to 18% while Nvidia led the pack at 78%.

Q1 of 2022 showed no major change in market share, with AMD and Intel swapping 1% of market share between themselves. AMD currently sits at 17%, Intel at 4%, and Nvidia stays the same at 78%. What’s particularly surprising is that all of Intel’s dedicated GPU shipments come courtesy of its DG1 graphics solution, which isn’t a particularly potent graphics solution. We suspect the vast majority of Intel’s 4–5% discrete GPU market share is thanks to major laptop OEMs opting for Intel GPUs, probably at lower prices than AMD and Nvidia offered.

CPU shipments showed and even more drastic change over the past year with a 10.8% reduction in shipments quarter to quarter, and a full 26.2% reduction year over year. That’s good news for CPU buyers, as it means there should be plenty of options at or below MSRP due to the lack of demand.

Overall, this data seems to confirm that GPU demand has been steadily decreasing, which is great considering the explosive year we had last year, where GPU supply could not keep up with demand. With the drop off in mining profitability, combined with the impending launches of Nvidia’s Ada architecture and AMD’s RDNA 3, we expect supply will continue to improve. That could lead to GPUs selling at or below MSRP by the end of the year. However, we suspect demand for the next generation GPUs will once again eclipse supply, at least in the short term, once those parts launch.

We also don’t expect the downward trend in GPU sales to last forever. JPR expects the compound annual growth of GPUs to increase to 6.3% over the next five years. 2021 was also an exceptional year for CPU and GPU sales, so the drop in sales the following year isn’t particularly surprising. Long term, there’s still strong market demand for discrete GPUs in both notebooks and desktops, plus increasing shipments for data center and deep learning purposes.