Groundbreaking for Tata chip plants next week; NPCI’s meeting on UPI market

Also in the letter:

■ Temporary relief for Indian apps

■ NPCI meeting on UPI market share

■ Nasscom calls for dynamic cab fares

Groundbreaking for three chip plants likely next week

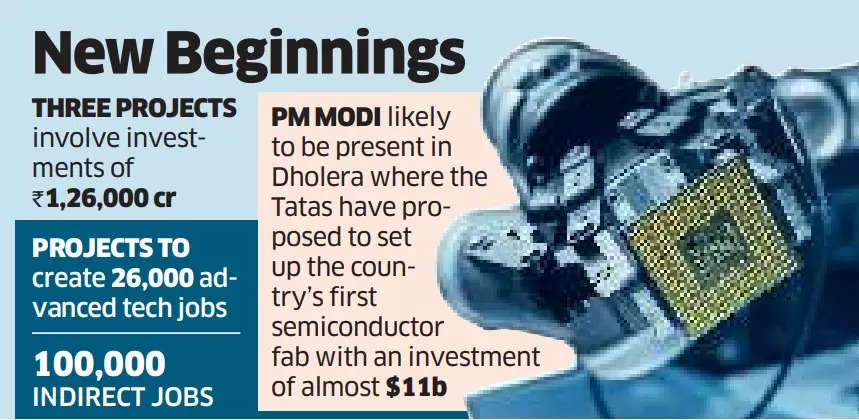

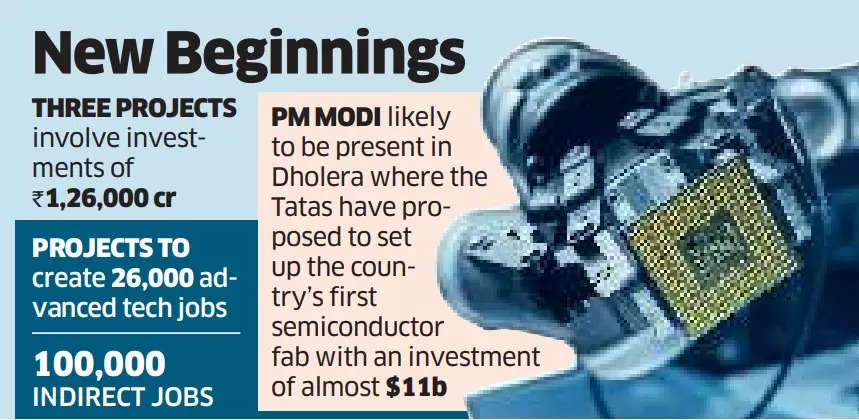

Less than two weeks after the Union Cabinet greenlit the proposals, groundbreaking ceremonies for three semiconductor projects entailing investments of $15.14 billion, including two from the Tata Group, are likely to be held next week.

Driving the news: Chief ministers, union ministers, key government officials and top executives from the companies are likely to attend the groundbreaking events, officials told ET.

Union minister Ashwini Vaishnaw told ET last week that all clearances and land allocation for the semiconductor plants were being fast-tracked. “The land bank has already been identified and demarcated (at all three places). The (land) allocation should happen in a few days. The permits are all lined up,” Vaishnaw said.

Details: The projects include:

- Tata Group’s $11-billion semiconductor fab facility at Dholera

- Tata Group’s Rs 27,000-crore chip assembly, testing, marking and packaging facility at Morigaon in Assam

- Murugappa Group’s CG Power’s chip assembly facility at Sanand in Gujarat at a cost of Rs 7,600 crore

Construction of the plants is likely to begin in 60-70 days.

Tell me more: Most of the permits for the construction of the Assam factory, and some for residential units to house workers and executives, are in place. Other routine approvals will come through after the groundbreaking ceremony, one official said.

Investment boost: The minister said that the four semiconductor plants — the fourth being a facility proposed by US-based Micron, also at Sanand — will galvanise investment into the country, catapulting it into one of the top five semiconductor nations in the next five years. These projects are expected to create 26,000 advanced technology jobs and 100,000 indirect jobs.

NPCI eyes evenly sliced UPI pie in huddle with payment companies

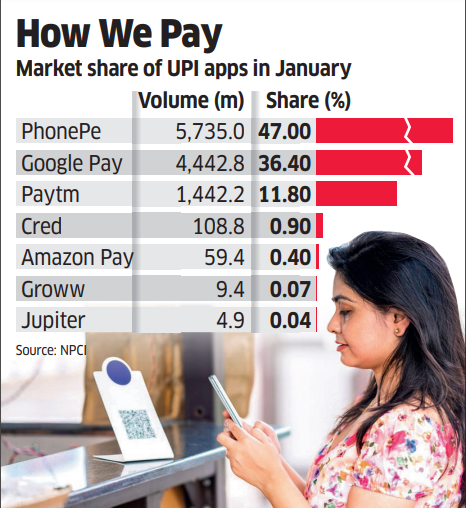

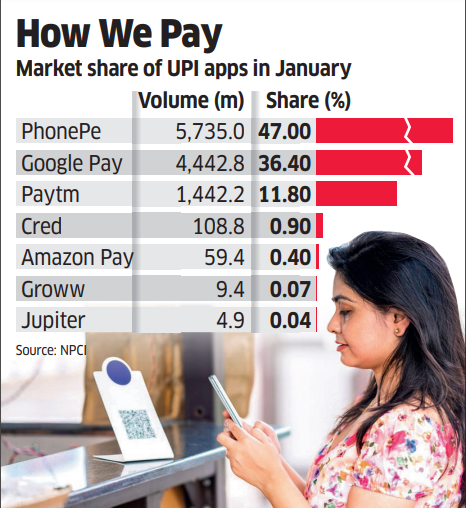

In a meeting between the payments industry and the National Payments Corporation of India (NPCI), which runs UPI, discussions yielded several ideas to level the playing field. These included creating specialised incentive programs for smaller UPI players and implementing a reservation system among third-party apps to benefit emerging players.

Driving the news: “NPCI mainly wanted to understand how they can enable smaller apps to grow on UPI and help distribute the load from the top three players to others in the market,” a senior industry executive told ET on the condition of anonymity.

The meeting also discussed how large UPI players backed by financial resources and technical expertise, make it difficult for smaller players to compete. Their advantage extends to features, where smaller players struggle to innovate and match the pace of larger players, the executive added.

What’s the matter? Another executive said that there is a “definite concentration risk building up on UPI” which has alarmed the central bank and NPCI. He added that “the market is at a position from where it is going to be very difficult to change that”. The NPCI attempted to understand why several app providers, established in their own fields, like Groww, Cred, Amazon Pay, and WhatsApp, haven’t gained significant market share.

What’s next: “Nothing concrete” came out of the meeting, one executive cited earlier said, but suggestions and points were exchanged. The payments body has also agreed to organise more such meetings with banks and smaller fintechs to discuss the issue of concentration risk on UPI.

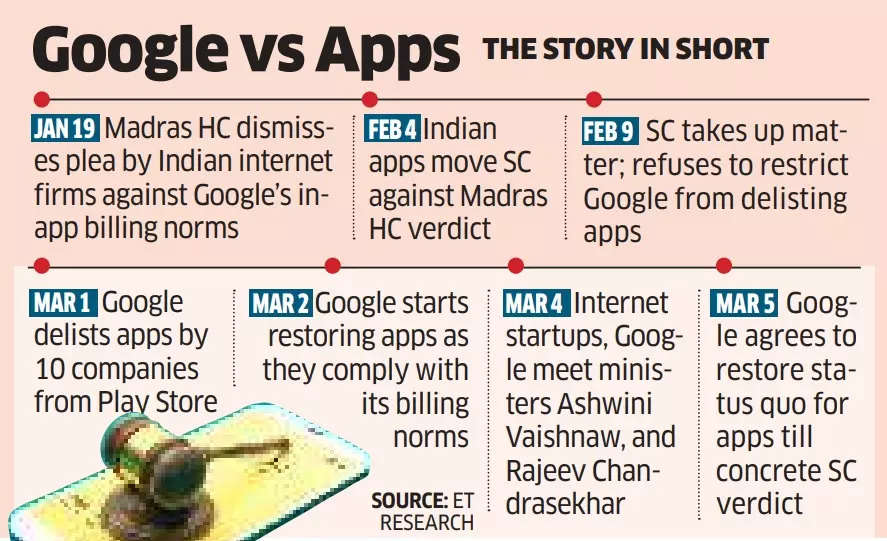

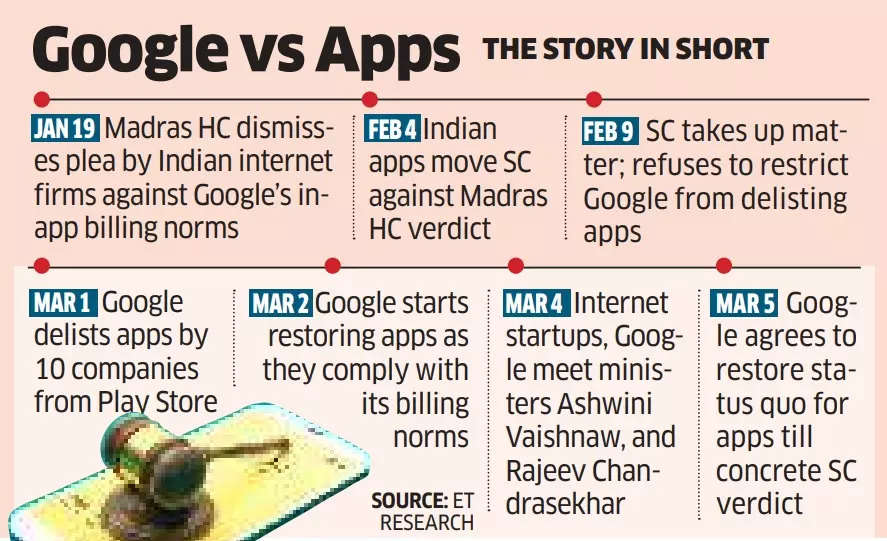

Google extends services fee payments timeline; allows in-app purchase

In a temporary reprieve for the ten Indian internet companies opposing Google’s billing norms, the Android maker has restored the status quo for the apps of these firms, allowing them an extended timeline for paying service fee for in-app transactions. The move came after Google’s Monday meeting with union IT minister Ashwini Vaishnaw and representatives of local firms.

Tell me more: The timeline extension will last at least until there is a concrete verdict from the Supreme Court, people aware of the matter told us. The apex court will hear the matter, in which developers have appealed against Google’s policies, on March 19.

Quote, unquote: “Google maintains its right to implement and enforce its business model, as established in various courts. We will invoice our full applicable services fees in the interim and are extending payment timelines for these companies. We look forward to a collaborative effort to find solutions that respect the needs of all parties,” the US tech major said in a statement.

Also read | ETtech Explainer: Why are Indian startups up in arms against Google Billing?

Government intervention: ET had reported on Monday that in addition to a short-term fix of getting the apps restored to the status quo on Play Store, the government is also working on a longer-term framework to ensure that unilateral actions from bigger tech companies do not affect Indian startups.

Counter view: Matrimony.com’s founder and CEO Murugavel Janakiraman said that Google’s fee of 11-26% on in-app payments is “highly burdensome” for digital firms. “We look forward to working with Google on ensuring app developers have the freedom of choice in picking payment gateways…This is required for the long-term sustenance of apps, and for our thriving startup ecosystem,” he said.

Also read | Indian internet companies dial up fight against Google

Other Top Stories By Our Reporters

Indian SaaS products to corner 8% global market share by 2028: report | As Indian software startups continue to target international markets, the global market share of SaaS products from India is expected to reach 8% by 2028, a latest report from advisory firm 1Lattice and venture investor Sorin Investments led by veteran dealmaker Sanjay Nayar said.

IT companies eye specialised talent in small drives to future-proof biz: Top-tier IT companies are looking to induct specialists in new technologies through small-scale recruitment drives in a bid to future-proof business. Tata Consultancy Services and Infosys are rolling out programmes to hire junior and mid-level talent with a focus on specific technology skills.

Nasscom urges Karnataka govt to review uniform taxi fare rules: The National Association of Software and Service Companies (Nasscom) has urged the Karnataka government to review the uniform fare structure for taxis that it had notified in early February, raising concern over aspects such as taxi aggregators not being allowed surge pricing.

Not in a hurry to add new categories; will focus on grocery: BigBasket CEO Hari Menon | Tata Digital-owned online supermarket BigBasket said it is not in a rush to broaden its product portfolio and will continue to focus primarily on grocery even as quick commerce rivals such as Zomato-owned Blinkit and Mumbai-based Zepto are rapidly diversifying into newer categories.

GenAI startup Ema secures $25 million: Enterprise-grade generative AI startup, Ema has raised $25 million in funding led by Accel, Section 32 and Prosus Ventures.

Indonesian startup Wagely raises $23 million: Indonesian fintech startup Wagely has raised $23 million, in a mix of equity and debt, as a part of its latest funding round.

Exly raises $6.2 million in latest funding round: Business tools provider for creator economy, Exly has raised $6.2 million in a fresh round of funding led by Chiratae Ventures.

Global Picks We Are Reading

■ Over 600 Google workers urge the company to cut ties with Israeli tech conference (Wired)

■ AI talent is in demand as other tech job listings decline (WSJ)

■ The robots are coming. And that’s a good thing (MIT Technology Review)

Also in the letter:

■ Temporary relief for Indian apps

■ NPCI meeting on UPI market share

■ Nasscom calls for dynamic cab fares

Groundbreaking for three chip plants likely next week

Less than two weeks after the Union Cabinet greenlit the proposals, groundbreaking ceremonies for three semiconductor projects entailing investments of $15.14 billion, including two from the Tata Group, are likely to be held next week.

Driving the news: Chief ministers, union ministers, key government officials and top executives from the companies are likely to attend the groundbreaking events, officials told ET.

Union minister Ashwini Vaishnaw told ET last week that all clearances and land allocation for the semiconductor plants were being fast-tracked. “The land bank has already been identified and demarcated (at all three places). The (land) allocation should happen in a few days. The permits are all lined up,” Vaishnaw said.

Details: The projects include:

- Tata Group’s $11-billion semiconductor fab facility at Dholera

- Tata Group’s Rs 27,000-crore chip assembly, testing, marking and packaging facility at Morigaon in Assam

- Murugappa Group’s CG Power’s chip assembly facility at Sanand in Gujarat at a cost of Rs 7,600 crore

Construction of the plants is likely to begin in 60-70 days.

Tell me more: Most of the permits for the construction of the Assam factory, and some for residential units to house workers and executives, are in place. Other routine approvals will come through after the groundbreaking ceremony, one official said.

Investment boost: The minister said that the four semiconductor plants — the fourth being a facility proposed by US-based Micron, also at Sanand — will galvanise investment into the country, catapulting it into one of the top five semiconductor nations in the next five years. These projects are expected to create 26,000 advanced technology jobs and 100,000 indirect jobs.

NPCI eyes evenly sliced UPI pie in huddle with payment companies

In a meeting between the payments industry and the National Payments Corporation of India (NPCI), which runs UPI, discussions yielded several ideas to level the playing field. These included creating specialised incentive programs for smaller UPI players and implementing a reservation system among third-party apps to benefit emerging players.

Driving the news: “NPCI mainly wanted to understand how they can enable smaller apps to grow on UPI and help distribute the load from the top three players to others in the market,” a senior industry executive told ET on the condition of anonymity.

The meeting also discussed how large UPI players backed by financial resources and technical expertise, make it difficult for smaller players to compete. Their advantage extends to features, where smaller players struggle to innovate and match the pace of larger players, the executive added.

What’s the matter? Another executive said that there is a “definite concentration risk building up on UPI” which has alarmed the central bank and NPCI. He added that “the market is at a position from where it is going to be very difficult to change that”. The NPCI attempted to understand why several app providers, established in their own fields, like Groww, Cred, Amazon Pay, and WhatsApp, haven’t gained significant market share.

What’s next: “Nothing concrete” came out of the meeting, one executive cited earlier said, but suggestions and points were exchanged. The payments body has also agreed to organise more such meetings with banks and smaller fintechs to discuss the issue of concentration risk on UPI.

Google extends services fee payments timeline; allows in-app purchase

In a temporary reprieve for the ten Indian internet companies opposing Google’s billing norms, the Android maker has restored the status quo for the apps of these firms, allowing them an extended timeline for paying service fee for in-app transactions. The move came after Google’s Monday meeting with union IT minister Ashwini Vaishnaw and representatives of local firms.

Tell me more: The timeline extension will last at least until there is a concrete verdict from the Supreme Court, people aware of the matter told us. The apex court will hear the matter, in which developers have appealed against Google’s policies, on March 19.

Quote, unquote: “Google maintains its right to implement and enforce its business model, as established in various courts. We will invoice our full applicable services fees in the interim and are extending payment timelines for these companies. We look forward to a collaborative effort to find solutions that respect the needs of all parties,” the US tech major said in a statement.

Also read | ETtech Explainer: Why are Indian startups up in arms against Google Billing?

Government intervention: ET had reported on Monday that in addition to a short-term fix of getting the apps restored to the status quo on Play Store, the government is also working on a longer-term framework to ensure that unilateral actions from bigger tech companies do not affect Indian startups.

Counter view: Matrimony.com’s founder and CEO Murugavel Janakiraman said that Google’s fee of 11-26% on in-app payments is “highly burdensome” for digital firms. “We look forward to working with Google on ensuring app developers have the freedom of choice in picking payment gateways…This is required for the long-term sustenance of apps, and for our thriving startup ecosystem,” he said.

Also read | Indian internet companies dial up fight against Google

Other Top Stories By Our Reporters

Indian SaaS products to corner 8% global market share by 2028: report | As Indian software startups continue to target international markets, the global market share of SaaS products from India is expected to reach 8% by 2028, a latest report from advisory firm 1Lattice and venture investor Sorin Investments led by veteran dealmaker Sanjay Nayar said.

IT companies eye specialised talent in small drives to future-proof biz: Top-tier IT companies are looking to induct specialists in new technologies through small-scale recruitment drives in a bid to future-proof business. Tata Consultancy Services and Infosys are rolling out programmes to hire junior and mid-level talent with a focus on specific technology skills.

Nasscom urges Karnataka govt to review uniform taxi fare rules: The National Association of Software and Service Companies (Nasscom) has urged the Karnataka government to review the uniform fare structure for taxis that it had notified in early February, raising concern over aspects such as taxi aggregators not being allowed surge pricing.

Not in a hurry to add new categories; will focus on grocery: BigBasket CEO Hari Menon | Tata Digital-owned online supermarket BigBasket said it is not in a rush to broaden its product portfolio and will continue to focus primarily on grocery even as quick commerce rivals such as Zomato-owned Blinkit and Mumbai-based Zepto are rapidly diversifying into newer categories.

GenAI startup Ema secures $25 million: Enterprise-grade generative AI startup, Ema has raised $25 million in funding led by Accel, Section 32 and Prosus Ventures.

Indonesian startup Wagely raises $23 million: Indonesian fintech startup Wagely has raised $23 million, in a mix of equity and debt, as a part of its latest funding round.

Exly raises $6.2 million in latest funding round: Business tools provider for creator economy, Exly has raised $6.2 million in a fresh round of funding led by Chiratae Ventures.

Global Picks We Are Reading

■ Over 600 Google workers urge the company to cut ties with Israeli tech conference (Wired)

■ AI talent is in demand as other tech job listings decline (WSJ)

■ The robots are coming. And that’s a good thing (MIT Technology Review)