How to activate and use UPI for international payments

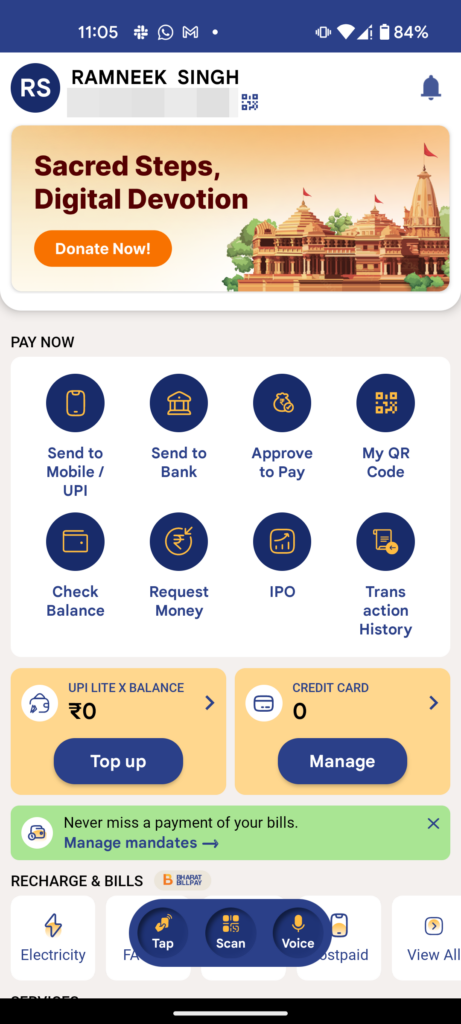

Now, you can use UPI (Unified Payments Interface) internationally as well, using BHIM and other third-party apps such as Google Pay, Paytm, and PhonePe. This grants you financial freedom to conduct transactions without the need to carry foreign currency or cards. Below is an easy step-by-step guide on how to activate UPI International and make payments online. So without further ado, let’s explore the process along with how UPI International works and how to use the feature.

Note: For this feature to work, both your and the foreign merchant’s bank must support UPI International. So far, only seven countries accept UPI payments.

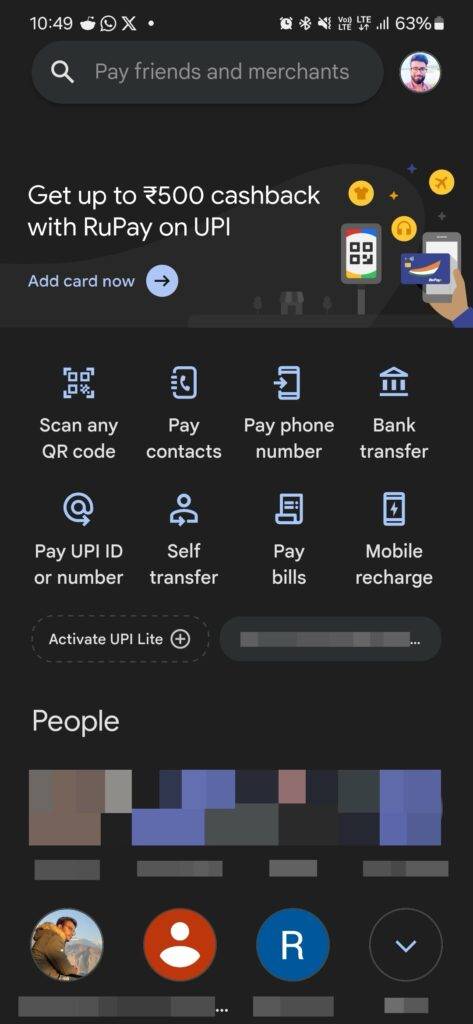

Activate UPI International on Google Pay

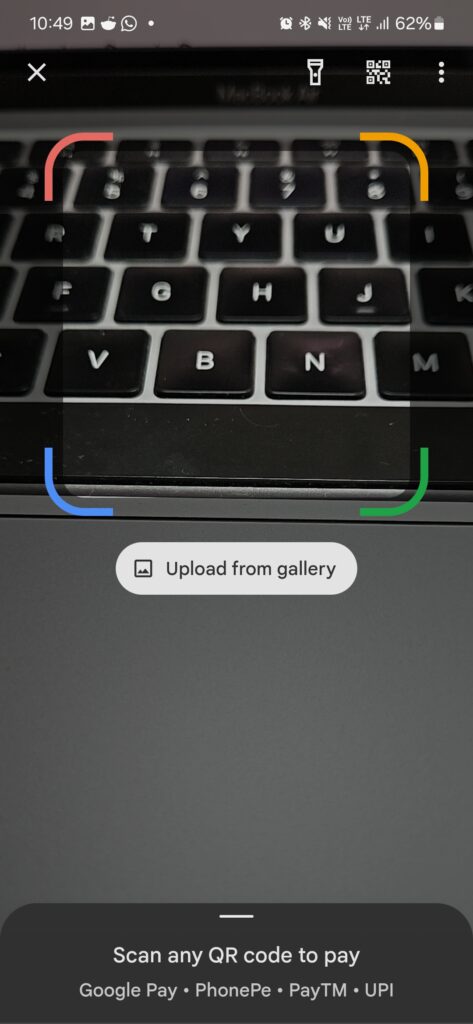

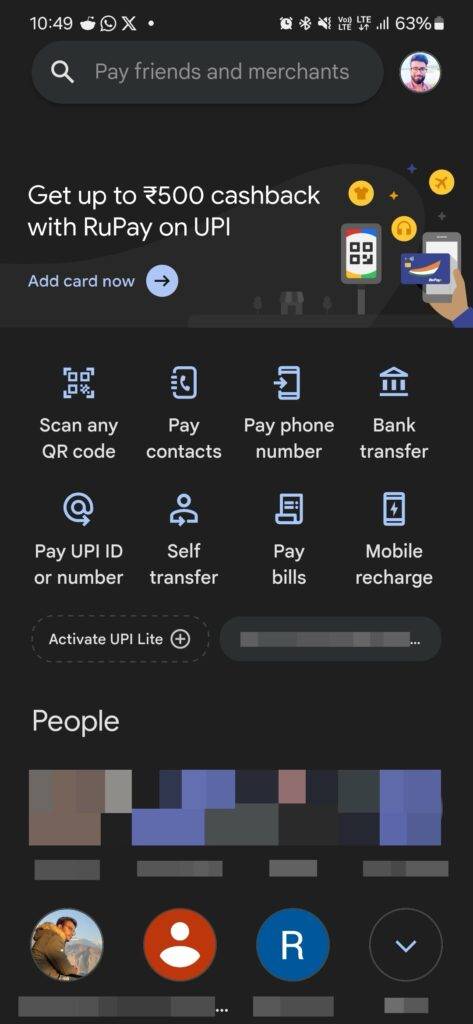

Step 1: Open the Google Pay app on your phone.

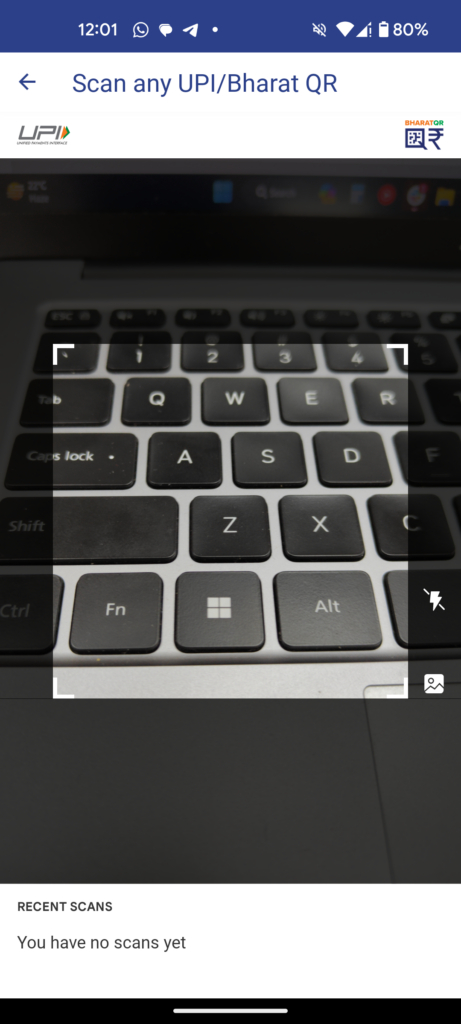

Step 2: Tap on the Scan QR code option.

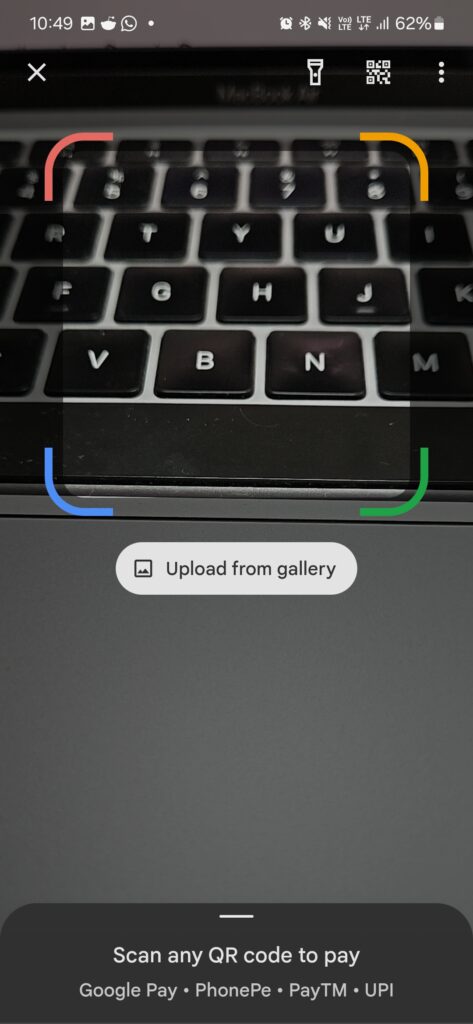

Step 3: Scan the foreign merchant’s QR code.

Step 4: Enter the amount to be paid in foreign currency. The Google Pay UI will show you the real-time conversion in INR and the incurred bank fees.

Step 5: You will have to tap on the Activate UPI International button at the bottom.

The amount will be deducted from your domestic bank in INR. The amount includes the aforementioned bank charges.

Also, note this activation lasts for 7 days and you will have to do the above process again to reactivate it.

Use UPI International on Google Pay

Step 1: Open Google Pay on your phone.

Step 2: Tap the Scan QR code option.

Step 3: Scan the foreign merchant’s QR code and enter the amount in the foreign currency denomination to make the payment.

Step 4: Choose the bank account from which you want to make the payment.

Step 5: Enter your UPI PIN to authenticate the transaction.

That’s it.

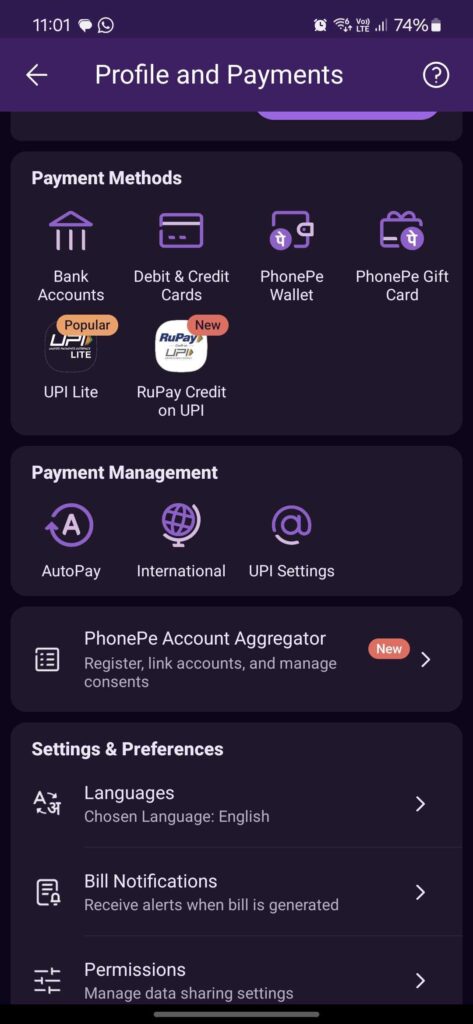

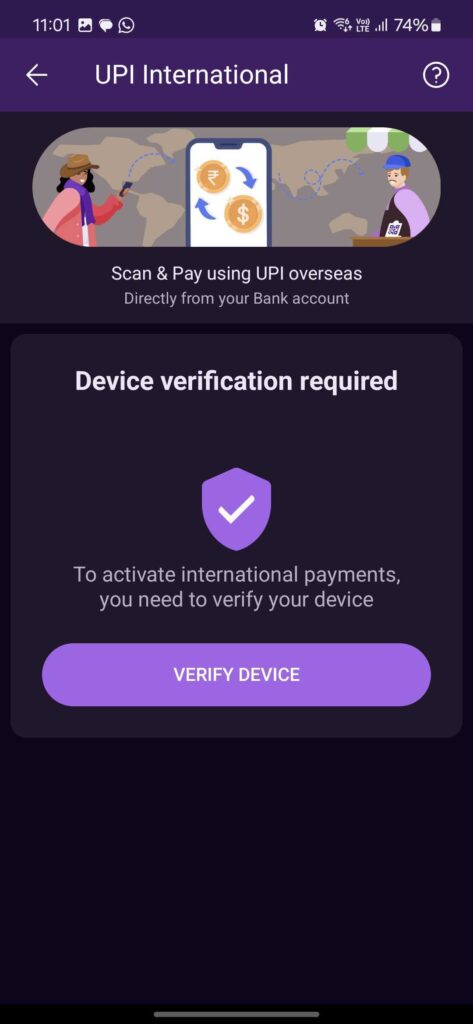

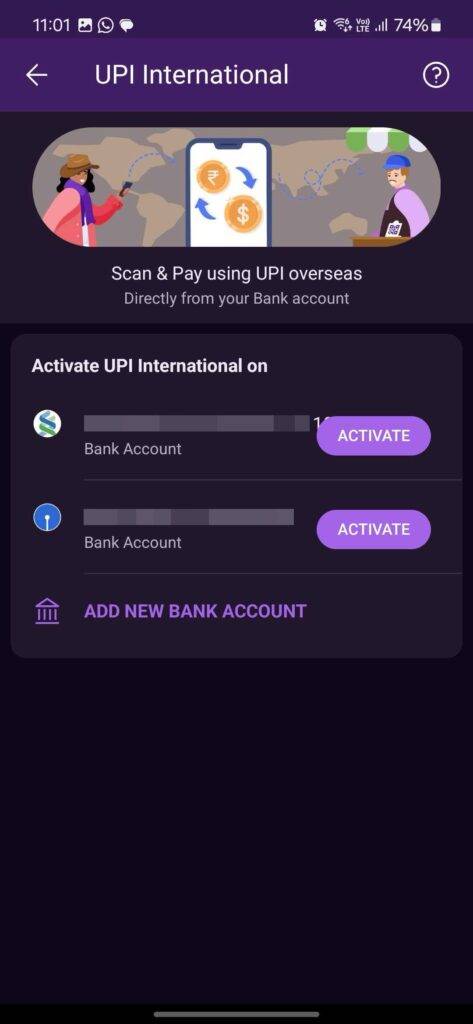

Activate UPI International on PhonePe

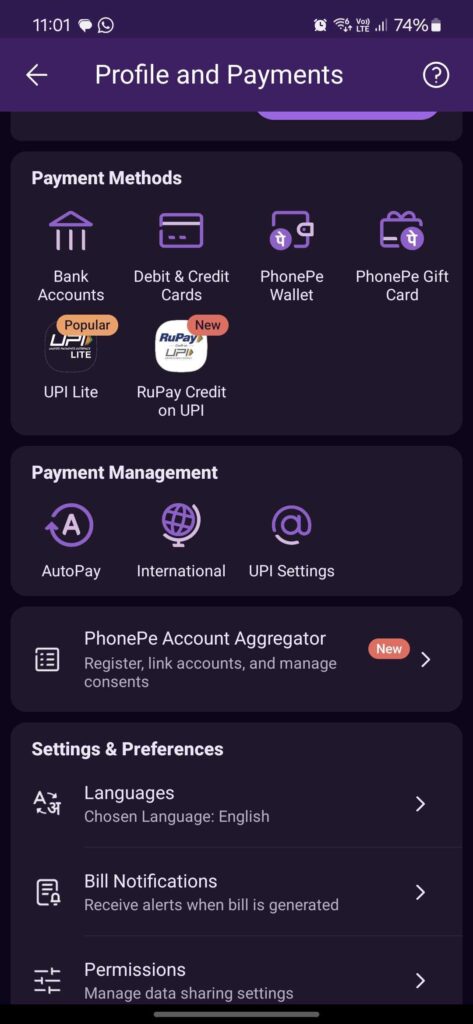

Step 1: Open PhonePe on your phone.

Step 2: Tap your profile picture icon on the Phonepe homescreen.

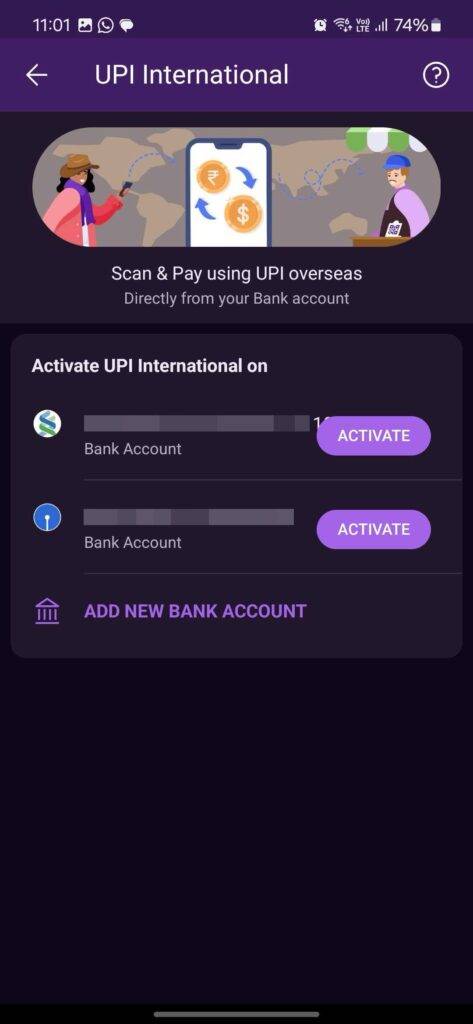

Step 3: Scroll to the Payment Settings section and select the UPI International option.

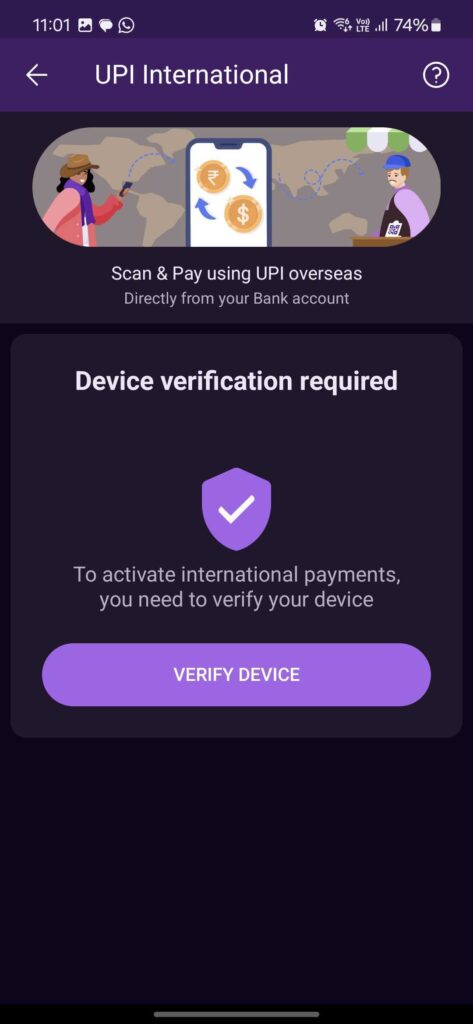

Step 4: Right next to the bank account from which you want to make the payment, you should see an Activate button.

Step 5: Enter your UPI PIN to authenticate it.

You can deactivate by going into PhonePe Payment Settings > UPI International. You’ll have to enter the UPI PIN to disable it.

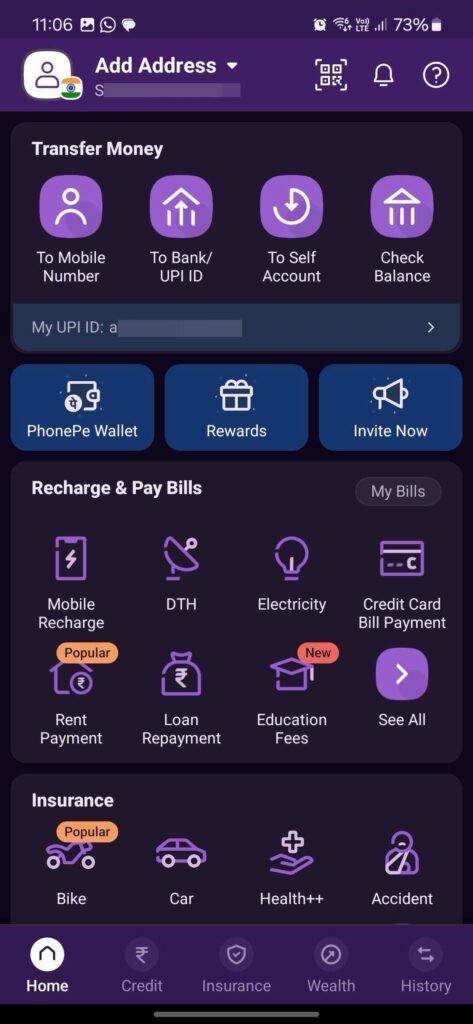

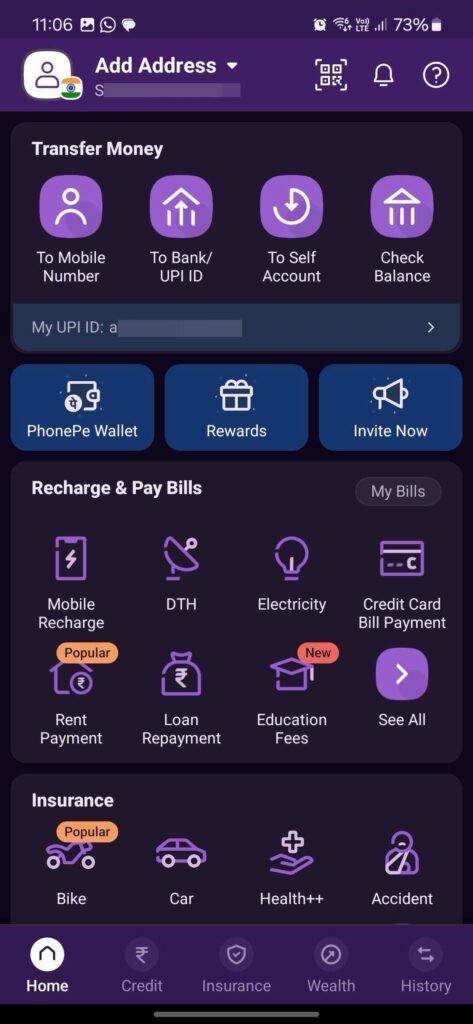

Use UPI International on PhonePe

Step 1: Open PhonePe.

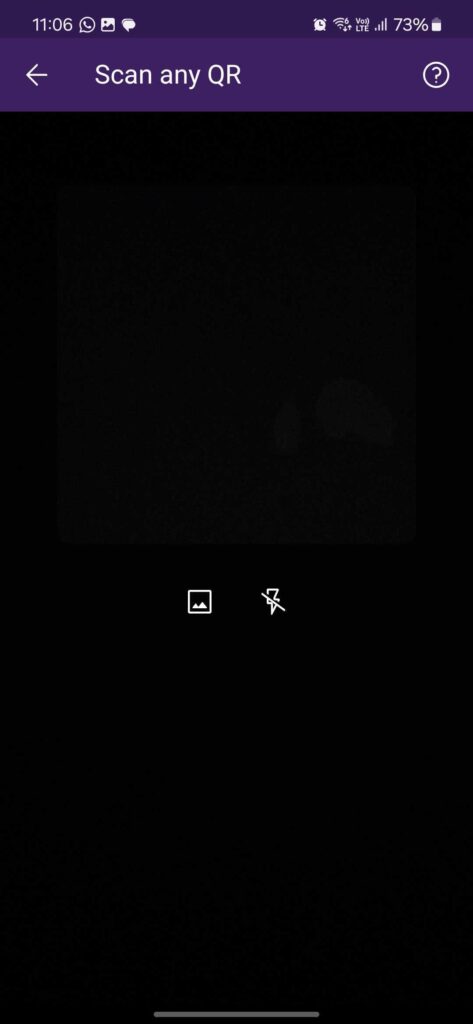

Step 2: Tap on the Scan QR Code option.

Step 3: Enter the payable amount in foreign currency. You will see the amount in both foreign currency and INR.

Step 4: Tap on the Pay button.

Step 5: Enter the UPI PIN and submit.

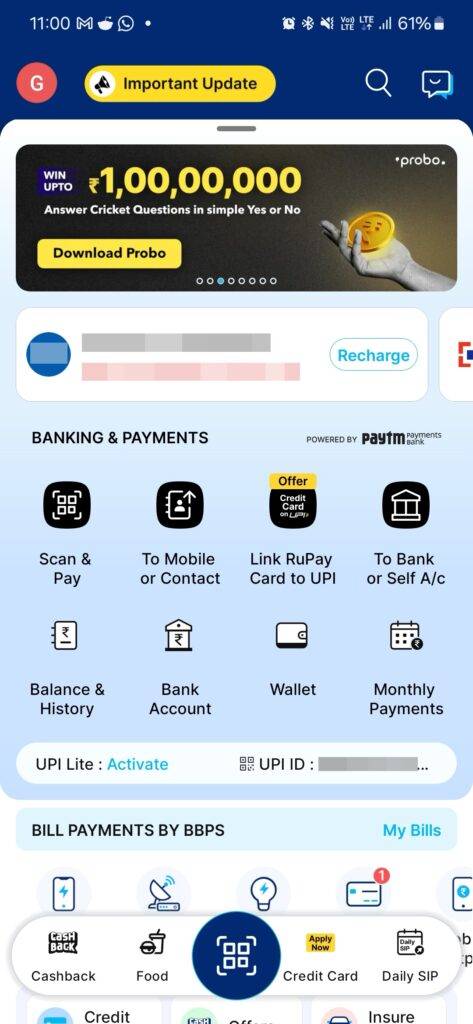

Activate UPI International on Paytm

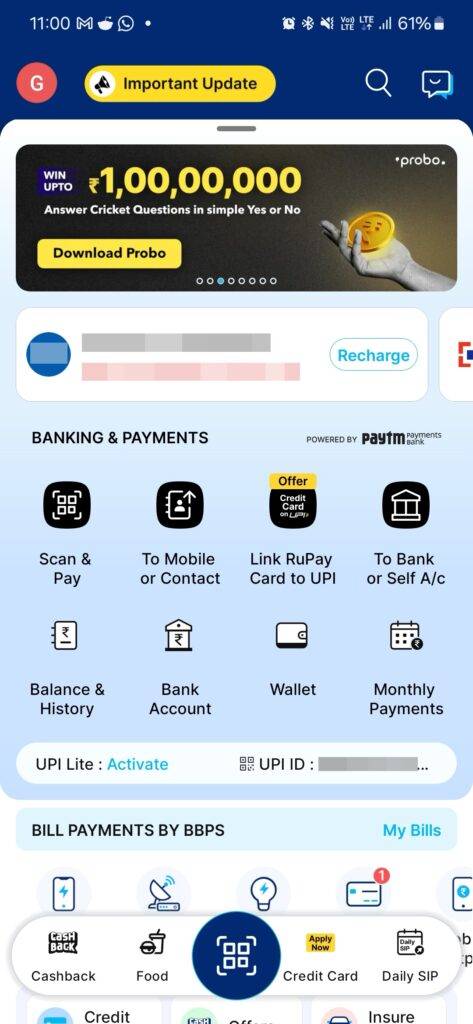

Step 1: Open Paytm on your phone.

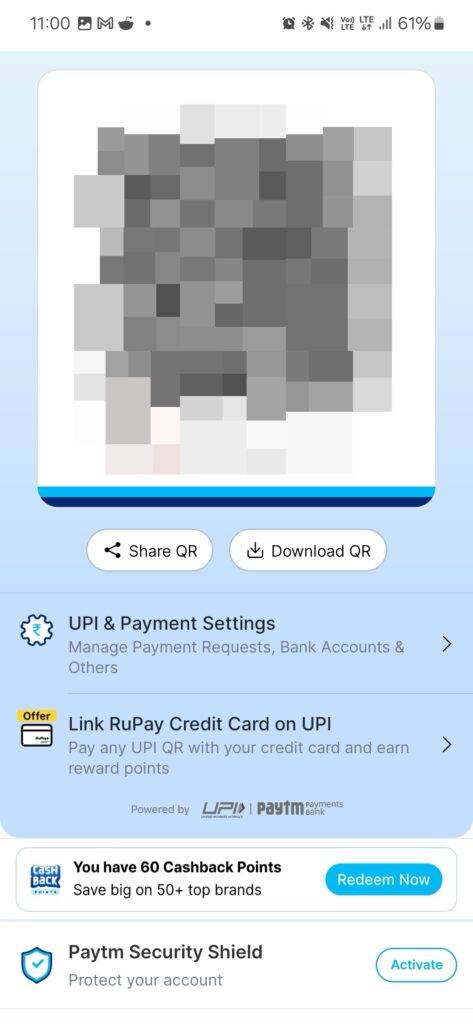

Step 2: Tap on your profile picture icon on the top left corner of the Paytm homescreen.

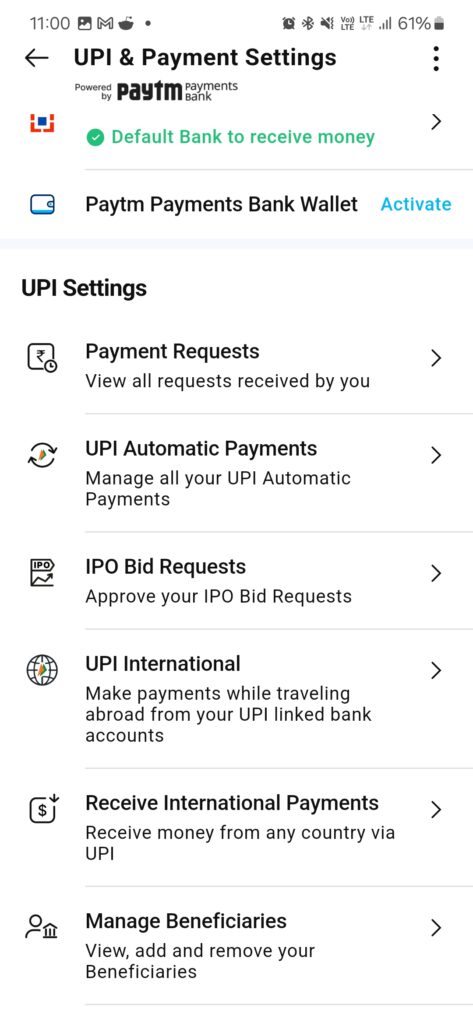

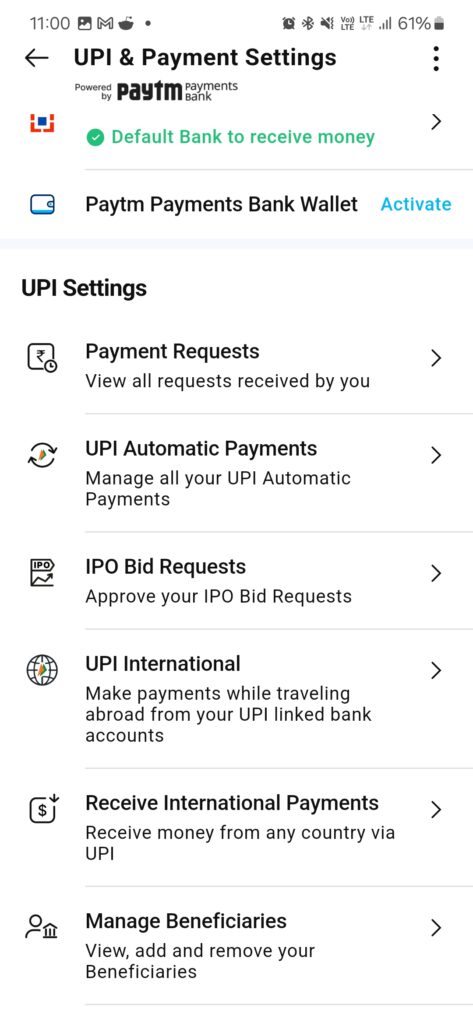

Step 3: Tap on the UPI and Payment Settings.

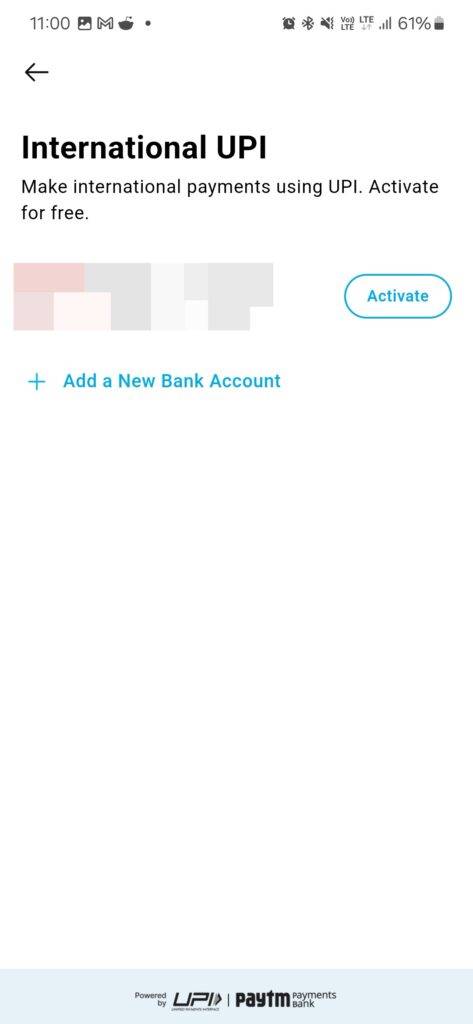

Step 4: Scroll to the UPI Settings and then tap on the UPI International option.

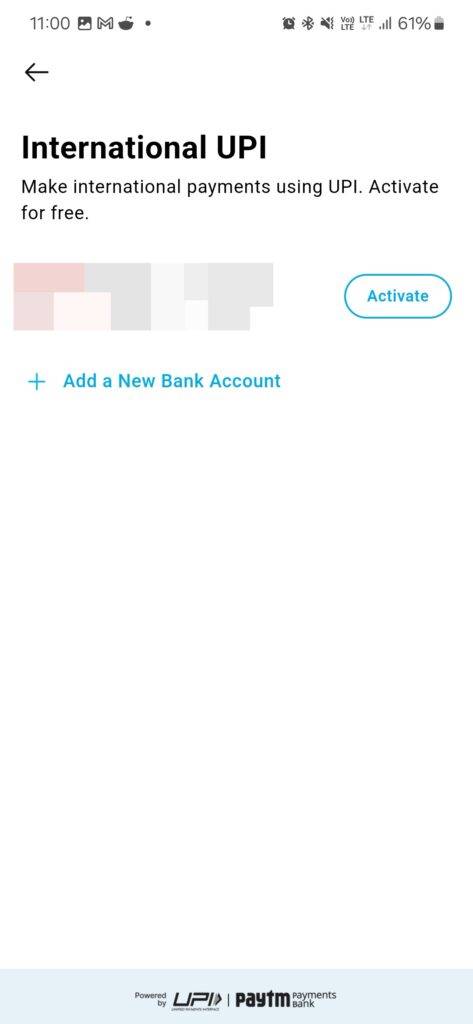

Step 5: Tap on the Activate button right next to your bank account.

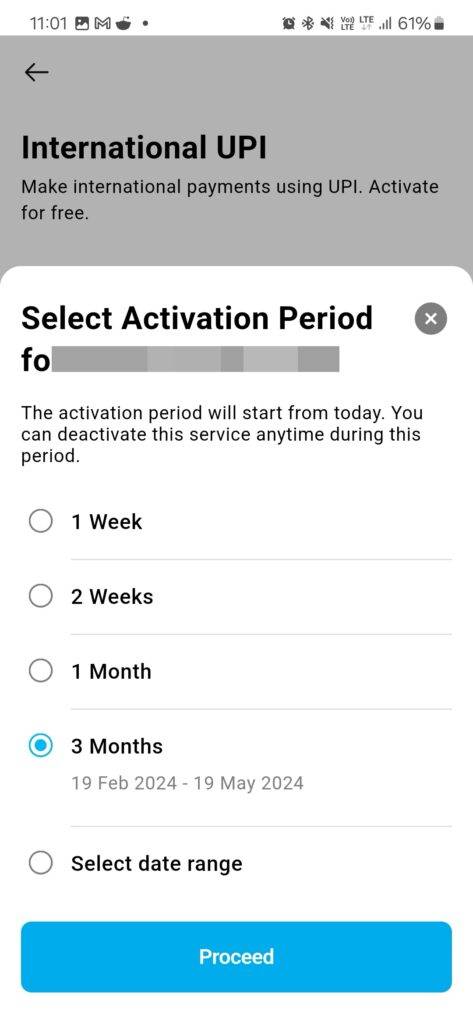

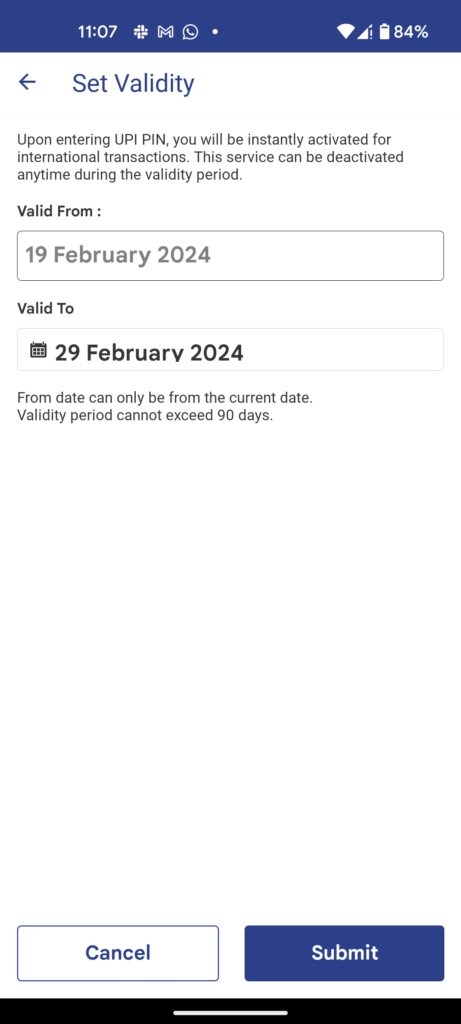

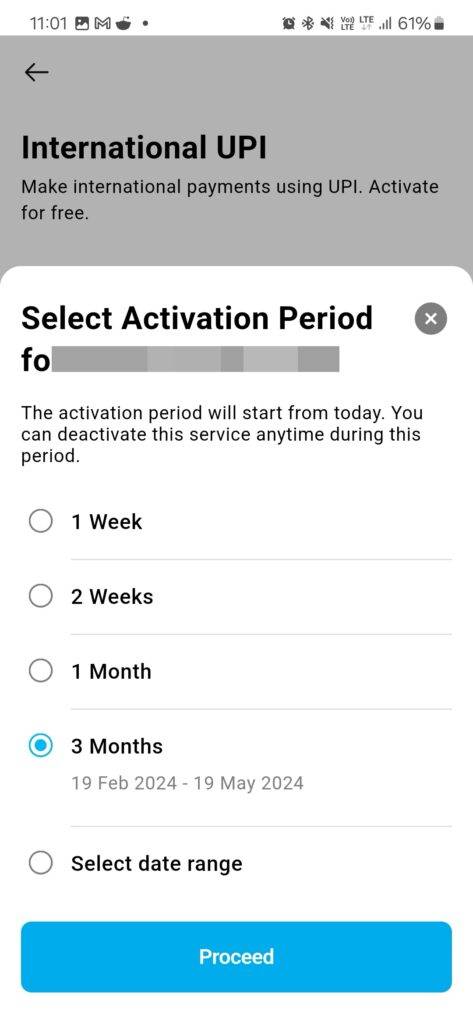

Step 6: You can choose the duration for which you want it to stay activated.

Step 7: Enter the UPI PIN to enable it.

Use UPI International on Paytm

Step 1: Open the Paytm app.

Step 2: Tap on Scan QR Code.

Step 3: Enter the amount.

Step 4: Ensure the right bank account is selected and tap on the Pay button.

Step 5: Enter the UPI PIN to send money.

Activate UPI International on BHIM

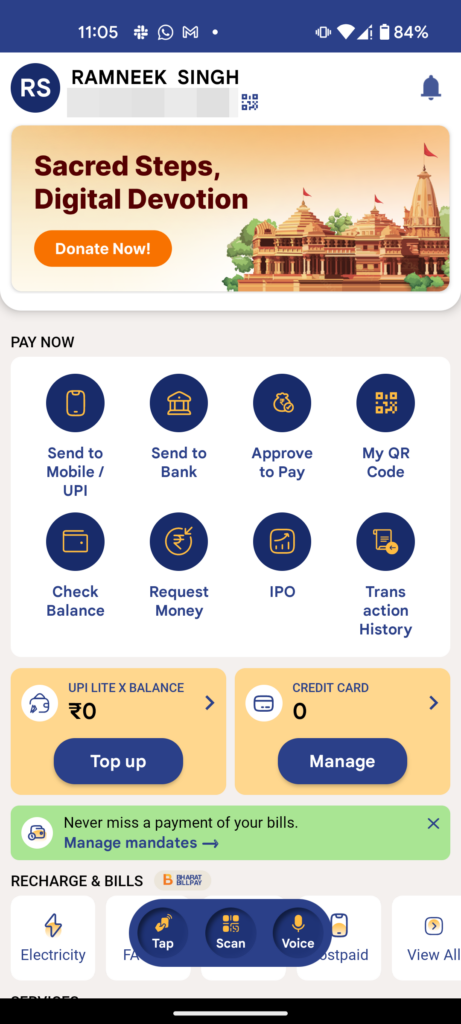

Step 1: Open BHIM on your phone.

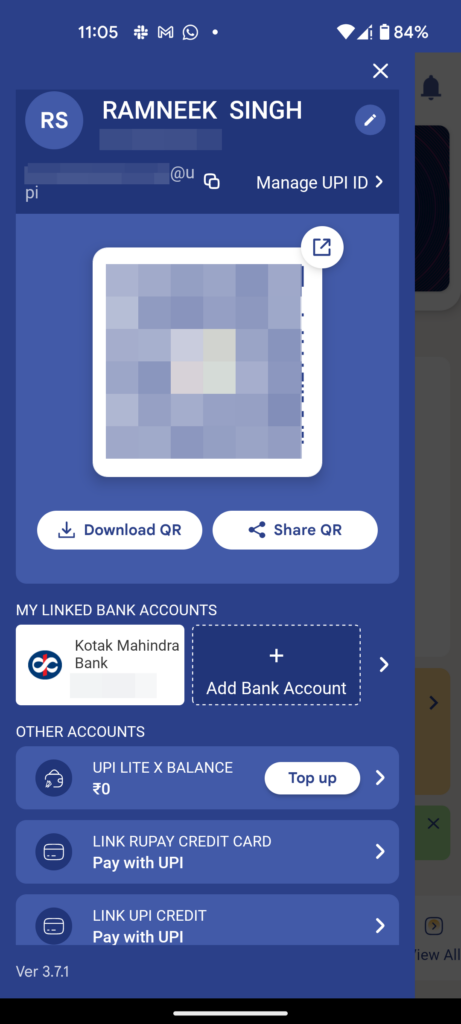

Step 2: Go to your profile section.

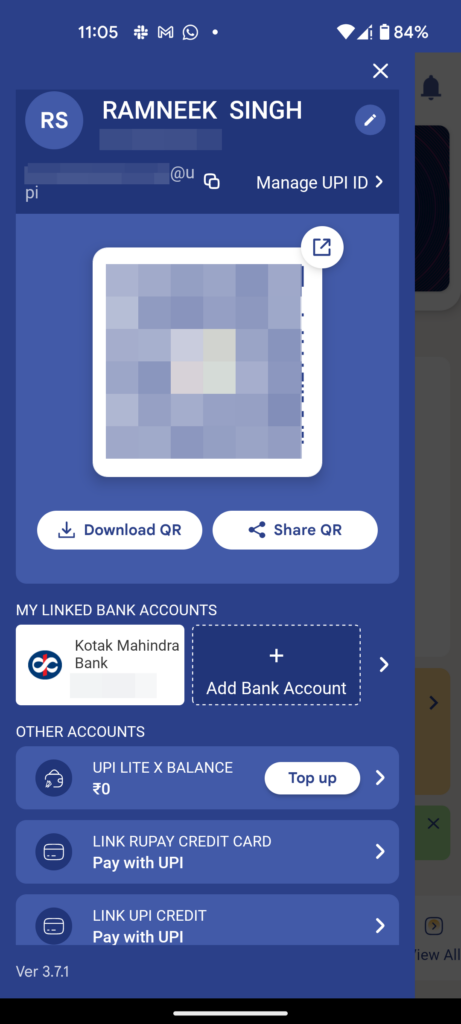

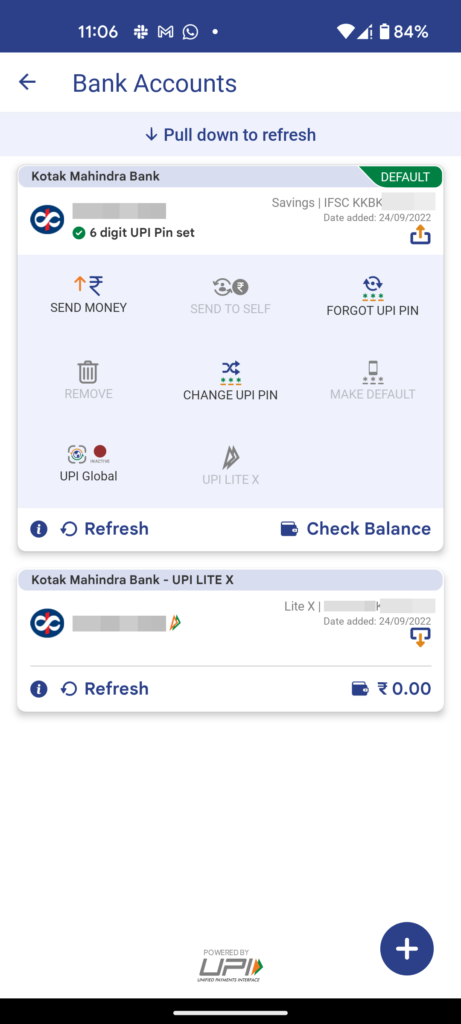

Step 3: Select your bank account within the My Linked Bank Accounts section.

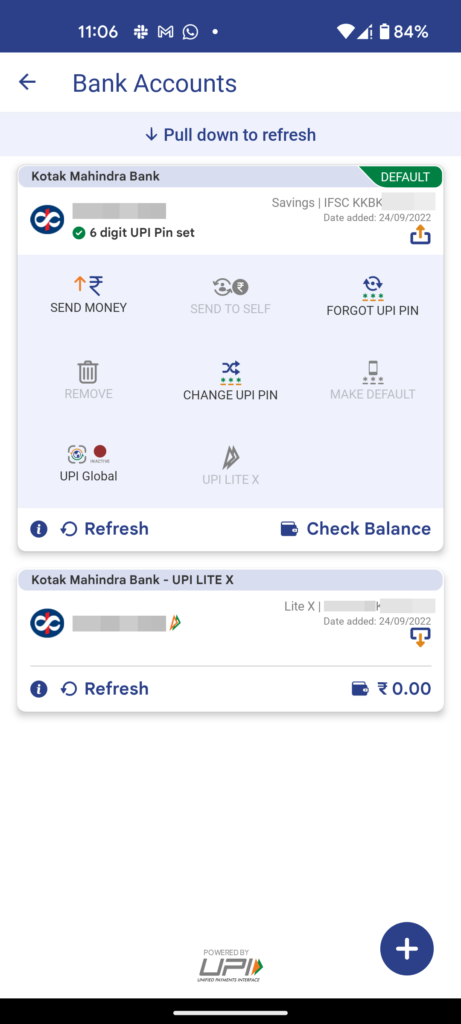

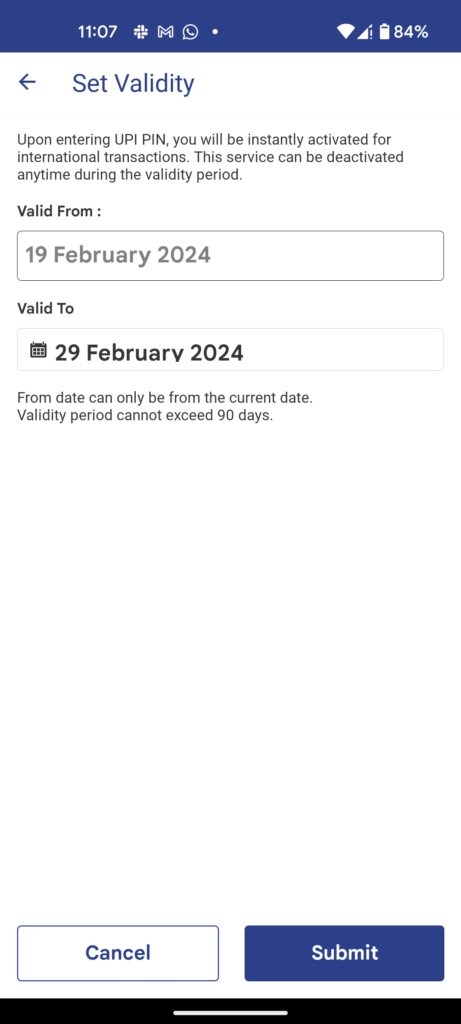

Step 4: Tap on UPI Global. Choose the maximum validity for the feature.

Step 5: Enter UPI PIN.

Use UPI International on BHIM

Step 1: Open BHIM on your phone.

Step 2: Tap the Scan QR code option.

Step 3: Scan the foreign merchant’s QR code and enter the amount in the foreign currency denomination.

Step 4: Select the bank account, which will have a green dot.

Step 5: Enter the UPI PIN.

How to receive international transfers using UPI

Step 1: Share your Virtual Payment Address (VPA) or UPI ID with the sender.

Step 2: The sender has to enter this VPA in the UPI ID field on any of the aforementioned apps he/she uses.

Step 3: The sender enters the amount and selects the bank account.

Step 4: He or she enters the UPI PIN and the amount gets transferred to your account.

FAQs

Can I cancel UPI International payments?

No, once initiated, you can’t cancel a UPI International payment since it is a direct bank-to-bank transfer.

Why am I not able to activate or use UPI International?

It may not be available in the foreign country you are currently in. Or it could be that yours or the merchant bank doesn’t support UPI International. If you don’t think these are the issues, then contact the customer support of the UPI app you are using. They will tell you why it is not enabled for you and give you solutions to fix it if it is possible.

How NRIs can use UPI?

NRIs will have to enter an NRE or NRO account on the UPI app and also give their Indian phone number and bank account to link the account. Once this is done, they can send money to any UPI ID and the transaction will be carried out through their registered Indian bank.

Which are the countries accepting UPI International?

Google Pay offers UPI International in countries such as Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the USA, Saudi Arabia, the UAE, and the UK. PhonePe, on the other hand, extends its services to the UAE, Singapore, Nepal, and Bhutan. Paytm, while supporting UPI International payments, has yet to disclose the specific countries in its network. BHIM offers UPI Global in Singapore, the UAE, Mauritius, Nepal, and Bhutan.

Now, you can use UPI (Unified Payments Interface) internationally as well, using BHIM and other third-party apps such as Google Pay, Paytm, and PhonePe. This grants you financial freedom to conduct transactions without the need to carry foreign currency or cards. Below is an easy step-by-step guide on how to activate UPI International and make payments online. So without further ado, let’s explore the process along with how UPI International works and how to use the feature.

Note: For this feature to work, both your and the foreign merchant’s bank must support UPI International. So far, only seven countries accept UPI payments.

Activate UPI International on Google Pay

Step 1: Open the Google Pay app on your phone.

Step 2: Tap on the Scan QR code option.

Step 3: Scan the foreign merchant’s QR code.

Step 4: Enter the amount to be paid in foreign currency. The Google Pay UI will show you the real-time conversion in INR and the incurred bank fees.

Step 5: You will have to tap on the Activate UPI International button at the bottom.

The amount will be deducted from your domestic bank in INR. The amount includes the aforementioned bank charges.

Also, note this activation lasts for 7 days and you will have to do the above process again to reactivate it.

Use UPI International on Google Pay

Step 1: Open Google Pay on your phone.

Step 2: Tap the Scan QR code option.

Step 3: Scan the foreign merchant’s QR code and enter the amount in the foreign currency denomination to make the payment.

Step 4: Choose the bank account from which you want to make the payment.

Step 5: Enter your UPI PIN to authenticate the transaction.

That’s it.

Activate UPI International on PhonePe

Step 1: Open PhonePe on your phone.

Step 2: Tap your profile picture icon on the Phonepe homescreen.

Step 3: Scroll to the Payment Settings section and select the UPI International option.

Step 4: Right next to the bank account from which you want to make the payment, you should see an Activate button.

Step 5: Enter your UPI PIN to authenticate it.

You can deactivate by going into PhonePe Payment Settings > UPI International. You’ll have to enter the UPI PIN to disable it.

Use UPI International on PhonePe

Step 1: Open PhonePe.

Step 2: Tap on the Scan QR Code option.

Step 3: Enter the payable amount in foreign currency. You will see the amount in both foreign currency and INR.

Step 4: Tap on the Pay button.

Step 5: Enter the UPI PIN and submit.

Activate UPI International on Paytm

Step 1: Open Paytm on your phone.

Step 2: Tap on your profile picture icon on the top left corner of the Paytm homescreen.

Step 3: Tap on the UPI and Payment Settings.

Step 4: Scroll to the UPI Settings and then tap on the UPI International option.

Step 5: Tap on the Activate button right next to your bank account.

Step 6: You can choose the duration for which you want it to stay activated.

Step 7: Enter the UPI PIN to enable it.

Use UPI International on Paytm

Step 1: Open the Paytm app.

Step 2: Tap on Scan QR Code.

Step 3: Enter the amount.

Step 4: Ensure the right bank account is selected and tap on the Pay button.

Step 5: Enter the UPI PIN to send money.

Activate UPI International on BHIM

Step 1: Open BHIM on your phone.

Step 2: Go to your profile section.

Step 3: Select your bank account within the My Linked Bank Accounts section.

Step 4: Tap on UPI Global. Choose the maximum validity for the feature.

Step 5: Enter UPI PIN.

Use UPI International on BHIM

Step 1: Open BHIM on your phone.

Step 2: Tap the Scan QR code option.

Step 3: Scan the foreign merchant’s QR code and enter the amount in the foreign currency denomination.

Step 4: Select the bank account, which will have a green dot.

Step 5: Enter the UPI PIN.

How to receive international transfers using UPI

Step 1: Share your Virtual Payment Address (VPA) or UPI ID with the sender.

Step 2: The sender has to enter this VPA in the UPI ID field on any of the aforementioned apps he/she uses.

Step 3: The sender enters the amount and selects the bank account.

Step 4: He or she enters the UPI PIN and the amount gets transferred to your account.

FAQs

Can I cancel UPI International payments?

No, once initiated, you can’t cancel a UPI International payment since it is a direct bank-to-bank transfer.

Why am I not able to activate or use UPI International?

It may not be available in the foreign country you are currently in. Or it could be that yours or the merchant bank doesn’t support UPI International. If you don’t think these are the issues, then contact the customer support of the UPI app you are using. They will tell you why it is not enabled for you and give you solutions to fix it if it is possible.

How NRIs can use UPI?

NRIs will have to enter an NRE or NRO account on the UPI app and also give their Indian phone number and bank account to link the account. Once this is done, they can send money to any UPI ID and the transaction will be carried out through their registered Indian bank.

Which are the countries accepting UPI International?

Google Pay offers UPI International in countries such as Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the USA, Saudi Arabia, the UAE, and the UK. PhonePe, on the other hand, extends its services to the UAE, Singapore, Nepal, and Bhutan. Paytm, while supporting UPI International payments, has yet to disclose the specific countries in its network. BHIM offers UPI Global in Singapore, the UAE, Mauritius, Nepal, and Bhutan.