Indian startups rush to withdraw funds from Silicon Valley Bank; top level exits at Infosys concerning, say analysts

This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ Infosys top level exits concerning but long-term stability expected, say analysts

■ IT services growth no longer linked to US economy, McKinsey leaders say

■ BharatPe, Grovers get more time to file responses in Delhi HC lawsuit

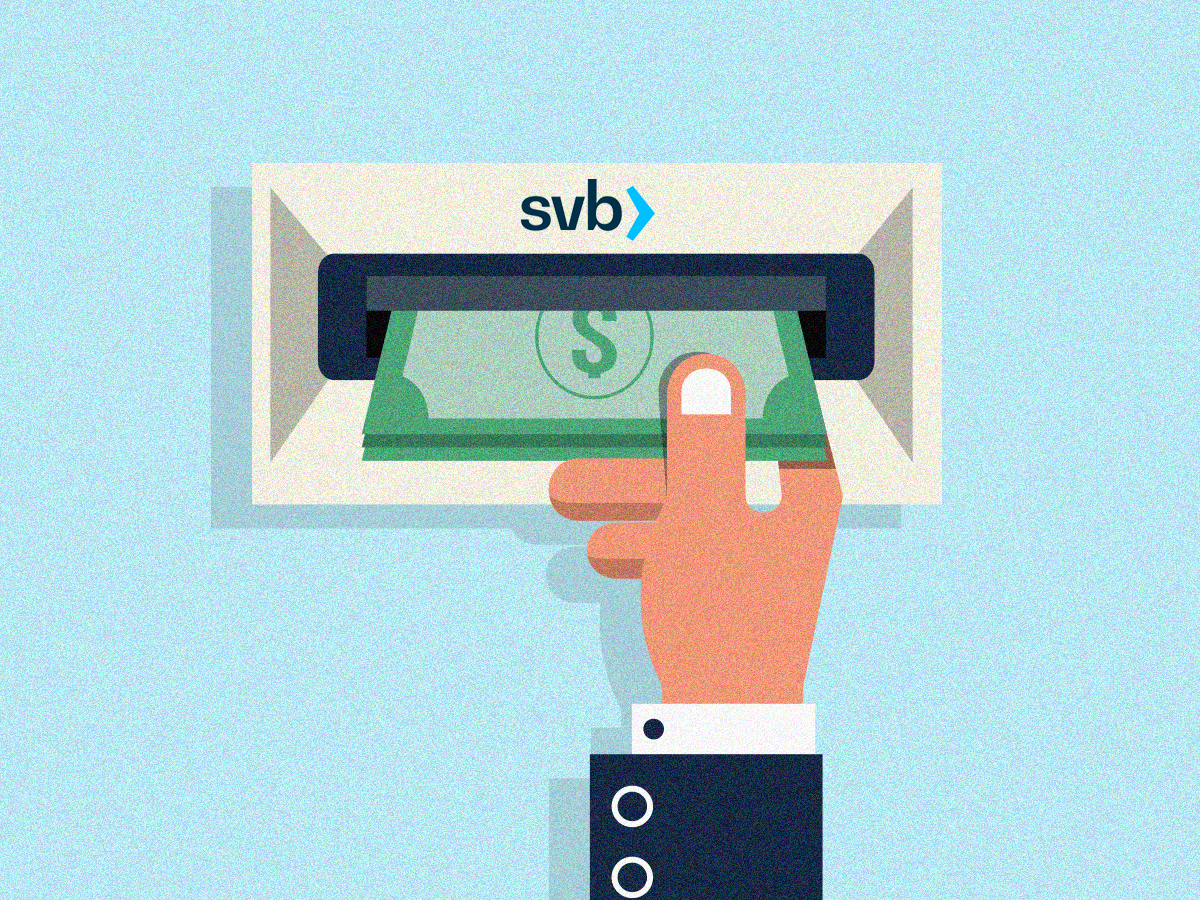

Startups move fast to transfer funds out of Silicon Valley Bank

Indian startups with funds in the now shut Silicon Valley Bank (SVB) swung into action after the US regulators announced that the deposits will be accessible from Monday onwards. Indian startups affected by the SVB crisis told ET that the panic over their deposits had settled for now. Their finance teams are finalising ways through which funds from SVB can be transferred to other banks.

GIFT Bank accounts: RBL Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank and HSBC are among the top names working with startups to open GIFT accounts, according to founders and associated investors who spoke with ET.

Some founders are opening GIFT Bank accounts so that the transfers can take place at the earliest. These firms are also exploring transferring their deposits to neobanks like Brex as well as traditional banks such as JPMorgan Chase, HSBC and CitiGroup.

Startups exploring options: “There are multiple options – for people who have alternative accounts in the US, they will most likely move money to a bigger bank. It’s usually not easy to open accounts there because the process requires a social security number and a physical presence in the US, which is why startups used to bank with SVB because it was friendly in that way,” Ayush Pateria, cofounder and CEO of Bengaluru-based startup Snazzy, told ET.

SVB UK sold: Meanwhile, HSBC said on Monday it is acquiring the UK subsidiary of Silicon Valley Bank for £1 hours after US regulators said all deposits are safe.

Infosys top-level exits concerning but long-term stability expected: analysts

Analysts have identified the departure of two senior-level executives from Infosys, India’s second-largest software firm, in the past six months as a “short-term” risk to the company.

The exits: Experts have expressed concerns that Mohit Joshi’s departure from Infosys to join smaller rival Tech Mahindra as CEO and MD could potentially affect Infosys’ ability to secure major deals in an uncertain macroeconomic climate.

Additionally, Infosys’ COO and president, Ravi Kumar S, resigned in October and joined Cognizant as its CEO, resulting in two top leaders of Infosys now heading two of its major competitors. This development has been viewed as concerning by industry experts.

Quote unquote: “Nandan and Salil have a strong layer of emerging young leaders who will quickly fill the void, in my opinion. Infosys leadership style has never been to make radical changes in personnel, and I do not foresee a major exodus of talent as a result,” Phil Fersht, founder of HFS Research had told ET earlier.

IT services growth no longer linked to US economy, McKinsey leaders say

The Indian IT services industry may not be affected by the impending economic slowdown because the changing role of technology in business has resulted in a delinking between the US economy and the growth of IT services, senior McKinsey leaders said.

‘Great decoupling’: According to Vikash Daga, a senior partner at McKinsey & Co, the role of technology in business has changed and it is now a key enabler. This is unlike the financial crisis of 2008-09, when IT services growth plummeted as a result of the dip in the US GDP growth rate.

Continued cloud investment: McKinsey forecasts that companies will persist in investing in cloud services, resulting in the market expanding from roughly $250 billion to $450 billion by 2025.

The specific segment of cloud services is expected to experience an annual growth rate of 20-30%, increasing from $20-25 billion to $60-65 billion by 2027.

Additionally, by 2025, approximately 40% of cloud expenditures will be allocated to new services such as Edge, IoT, AR/VR, and others, which is an increase from the current 30%.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

BharatPe, Grovers get more time to file responses in Delhi HC lawsuit

The Delhi High Court granted more time to Ashneer Grover, his wife Madhuri Jain and others to file additional responses to the notices issued on a lawsuit filed by BharatPe, which has accused them of financial irregularities when they were at the helm of the company.

Details: The digital payments firm has sought Rs 88 crore in damages from cofounder and former managing director Grover, his wife and some of their family members for alleged misappropriation of funds and causing reputational harm to the company.

Previous hearing: The single-judge bench during the previous hearing on January 9 had also extended the time for the defendants to file their response. It had also restrained Grover from speaking against the company’s top executives.

Who are the defendants? Grover, Madhuri Jain who was the former head of controls at BharatPe, her brother Shwetank Jain, sister’s husband Deepak Gupta and father Suresh Jain are the defendants in BharatPe’s suit. A judge had in January asked them to file written statements in response to the main suit.

TWEET OF THE DAY

ETtech Done Deals

The Ayurveda Co raises Rs 100 crore in funding

The Ayurveda Co, a direct-to-consumer Ayurveda brand, has secured Rs 100 crore in a Series A funding round. The funds will be utilised for various purposes, including expanding their offline presence, improving their product manufacturing, expanding their research and development, and accelerating digital awareness of the company.

The company: The company claims to have grown over 300% over the past 10 months, driven by a portfolio of 100 unique products backed by an omnichannel distributor network across over 20 exclusive brand outlets and over 5,000 retail touch points. It also has a strong online presence.

Legaltech firm Fightright launches Rs 100-crore fund for HNIs

Fightright Technologies, a legaltech company that utilises analytics supported by AI and ML to finance commercial litigations, has introduced a fund that manages claims worth Rs100 crore.

What’s the funding for? The fund, which is a special purpose vehicle, will allocate capital in 15-20 commercial cases that have an average size of Rs 5-7 crore and are expected to run for two to three years.

The fund provides an investment opportunity to high net worth individuals to invest in these legal cases, where the anticipated annualised return on investment is more than 30%.

The company: The firm’s funding model covers litigation expenses such as legal fees and court costs, and assumes the associated risks. Recovery of investments is solely dependent on the success of the claim. This approach alleviates clients’ financial burdens and equips them with the resources necessary for a favourable resolution.

Global Picks We are Reading

■ The Silicon Valley Bank Contagion Is Just Beginning (Wired)

■ Samsung caught faking zoom photos of the Moon (The Verge)

■ Tim Cook bets on Apple’s mixed-reality headset to secure his legacy (Financial Times)

(Graphics & illustrations by Rahul Awasthi)

This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ Infosys top level exits concerning but long-term stability expected, say analysts

■ IT services growth no longer linked to US economy, McKinsey leaders say

■ BharatPe, Grovers get more time to file responses in Delhi HC lawsuit

Startups move fast to transfer funds out of Silicon Valley Bank

Indian startups with funds in the now shut Silicon Valley Bank (SVB) swung into action after the US regulators announced that the deposits will be accessible from Monday onwards. Indian startups affected by the SVB crisis told ET that the panic over their deposits had settled for now. Their finance teams are finalising ways through which funds from SVB can be transferred to other banks.

GIFT Bank accounts: RBL Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank and HSBC are among the top names working with startups to open GIFT accounts, according to founders and associated investors who spoke with ET.

Some founders are opening GIFT Bank accounts so that the transfers can take place at the earliest. These firms are also exploring transferring their deposits to neobanks like Brex as well as traditional banks such as JPMorgan Chase, HSBC and CitiGroup.

Startups exploring options: “There are multiple options – for people who have alternative accounts in the US, they will most likely move money to a bigger bank. It’s usually not easy to open accounts there because the process requires a social security number and a physical presence in the US, which is why startups used to bank with SVB because it was friendly in that way,” Ayush Pateria, cofounder and CEO of Bengaluru-based startup Snazzy, told ET.

SVB UK sold: Meanwhile, HSBC said on Monday it is acquiring the UK subsidiary of Silicon Valley Bank for £1 hours after US regulators said all deposits are safe.

Infosys top-level exits concerning but long-term stability expected: analysts

Analysts have identified the departure of two senior-level executives from Infosys, India’s second-largest software firm, in the past six months as a “short-term” risk to the company.

The exits: Experts have expressed concerns that Mohit Joshi’s departure from Infosys to join smaller rival Tech Mahindra as CEO and MD could potentially affect Infosys’ ability to secure major deals in an uncertain macroeconomic climate.

Additionally, Infosys’ COO and president, Ravi Kumar S, resigned in October and joined Cognizant as its CEO, resulting in two top leaders of Infosys now heading two of its major competitors. This development has been viewed as concerning by industry experts.

Quote unquote: “Nandan and Salil have a strong layer of emerging young leaders who will quickly fill the void, in my opinion. Infosys leadership style has never been to make radical changes in personnel, and I do not foresee a major exodus of talent as a result,” Phil Fersht, founder of HFS Research had told ET earlier.

IT services growth no longer linked to US economy, McKinsey leaders say

The Indian IT services industry may not be affected by the impending economic slowdown because the changing role of technology in business has resulted in a delinking between the US economy and the growth of IT services, senior McKinsey leaders said.

‘Great decoupling’: According to Vikash Daga, a senior partner at McKinsey & Co, the role of technology in business has changed and it is now a key enabler. This is unlike the financial crisis of 2008-09, when IT services growth plummeted as a result of the dip in the US GDP growth rate.

Continued cloud investment: McKinsey forecasts that companies will persist in investing in cloud services, resulting in the market expanding from roughly $250 billion to $450 billion by 2025.

The specific segment of cloud services is expected to experience an annual growth rate of 20-30%, increasing from $20-25 billion to $60-65 billion by 2027.

Additionally, by 2025, approximately 40% of cloud expenditures will be allocated to new services such as Edge, IoT, AR/VR, and others, which is an increase from the current 30%.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

BharatPe, Grovers get more time to file responses in Delhi HC lawsuit

The Delhi High Court granted more time to Ashneer Grover, his wife Madhuri Jain and others to file additional responses to the notices issued on a lawsuit filed by BharatPe, which has accused them of financial irregularities when they were at the helm of the company.

Details: The digital payments firm has sought Rs 88 crore in damages from cofounder and former managing director Grover, his wife and some of their family members for alleged misappropriation of funds and causing reputational harm to the company.

Previous hearing: The single-judge bench during the previous hearing on January 9 had also extended the time for the defendants to file their response. It had also restrained Grover from speaking against the company’s top executives.

Who are the defendants? Grover, Madhuri Jain who was the former head of controls at BharatPe, her brother Shwetank Jain, sister’s husband Deepak Gupta and father Suresh Jain are the defendants in BharatPe’s suit. A judge had in January asked them to file written statements in response to the main suit.

TWEET OF THE DAY

ETtech Done Deals

The Ayurveda Co raises Rs 100 crore in funding

The Ayurveda Co, a direct-to-consumer Ayurveda brand, has secured Rs 100 crore in a Series A funding round. The funds will be utilised for various purposes, including expanding their offline presence, improving their product manufacturing, expanding their research and development, and accelerating digital awareness of the company.

The company: The company claims to have grown over 300% over the past 10 months, driven by a portfolio of 100 unique products backed by an omnichannel distributor network across over 20 exclusive brand outlets and over 5,000 retail touch points. It also has a strong online presence.

Legaltech firm Fightright launches Rs 100-crore fund for HNIs

Fightright Technologies, a legaltech company that utilises analytics supported by AI and ML to finance commercial litigations, has introduced a fund that manages claims worth Rs100 crore.

What’s the funding for? The fund, which is a special purpose vehicle, will allocate capital in 15-20 commercial cases that have an average size of Rs 5-7 crore and are expected to run for two to three years.

The fund provides an investment opportunity to high net worth individuals to invest in these legal cases, where the anticipated annualised return on investment is more than 30%.

The company: The firm’s funding model covers litigation expenses such as legal fees and court costs, and assumes the associated risks. Recovery of investments is solely dependent on the success of the claim. This approach alleviates clients’ financial burdens and equips them with the resources necessary for a favourable resolution.

Global Picks We are Reading

■ The Silicon Valley Bank Contagion Is Just Beginning (Wired)

■ Samsung caught faking zoom photos of the Moon (The Verge)

■ Tim Cook bets on Apple’s mixed-reality headset to secure his legacy (Financial Times)

(Graphics & illustrations by Rahul Awasthi)