Razorpay, Cashfree in RBI’s crosshairs; Meta takes down Indian firm’s spyware network

Also in this letter:

■ Meta takes down spyware network run by Indian firm

■ Indian brands corner more than half of wearables market

■ Nykaa, Paytm’s surprise corporate actions spark scrutiny

RBI asks Razorpay, Cashfree to stop onboarding new merchants

The Reserve Bank of India (RBI) has asked payment gateway firms Razorpay and Cashfree, which had received in-principle nod from the regulator for a payment aggregator (PA) licence, to stop onboarding new merchants, multiple people told us.

The RBI has also asked Cashfree to step up its checks, two of the people said.

Why? According to people aware of the matter, the RBI’s decision is linked to the PA licences of these entities.

Razorpay received in-principle nod for a PA licence in July, while Cashfree received it in September.

“Razorpay has received a notification earlier this week to submit a SAR (suspicious activity report) system audit report to the regulator. Once the RBI is satisfied with the findings, Razorpay can then start onboarding new merchants,” one of the people aware of the RBI’s communication told ET.

As for Cashfree, one of the sources said the payment gateway has slowed down enterprise onboarding until it gets a go-ahead from RBI on its licence.

Response: A spokesperson for Razorpay said, “As part of the process for the final authorisation of our PA/PG licence for which we received the in-principle approval from RBI in July, we are now required to share additional details with RBI to aid in the final licence process. As part of this process, RBI has suggested that we temporarily withhold onboarding new online merchants till such details are submitted.”.

Paytm, too: In late November we reported the RBI had asked Paytm to reapply for a payment aggregator licence for its subsidiary Paytm Payments Services Ltd within 120 days, in response to its initial application. It also directed the payments firm to stop signing up new online merchants.

Meta takes down spyware network run by Indian firm CyberRoot Risk Advisory

Social media giant Meta said on Thursday that it has taken down a significant spyware and surveillance-for-hire network run by an Indian company called CyberRoot Risk Advisory.

During its investigations into threats across its platforms, Meta said it found that CyberRoot Risk Advisory had a network of more than 40 accounts on Facebook and Instagram, which it used to lure users from across the globe into phishing attacks and to spy on them for its clients.

The firm was among the most active and persistent groups active online across platforms of Meta as well as other social media intermediaries, the company said.

How the scam worked: CyberRoot’s method of operation was to create fake accounts that were designed to gain the trust of users around the world. These personas impersonated journalists, business executives and media personalities, Meta said.

It said the company also spoofed domains of major online service providers such as Gmail, Zoom, Facebook, Dropbox, Yahoo, OneDrive, and targets’ corporate email servers to conduct phishing attacks.

CyberRoot’s playbook was similar to that of another Indian surveillance-for-hire firm called BellTroX, Meta said. The social media company detected and disbanded BellTrox’s accounts across its platforms in 2021.

Zoom out: Between 2017 and November 2022, Meta said it had taken down 200 networks in China, Russia, Israel, the US and India that engaged in coordinated inauthentic behaviour, covert influence operations, cyber-espionage campaigns, spam and scam campaigns, and surveillance-for-hire.

Indian brands corner more than half of wearables market

Indian brands, which have been pushed to the fringes in the smartphone segment, are dominating the Rs 60,000-crore accessories market, which includes wearables, hearables and power accessories.

Even as smartphone makers cut production amid troubling times for the global economy, Indian wearable brands are doubling down on expansion and manufacturing plans in the hopes of seeing strong growth.

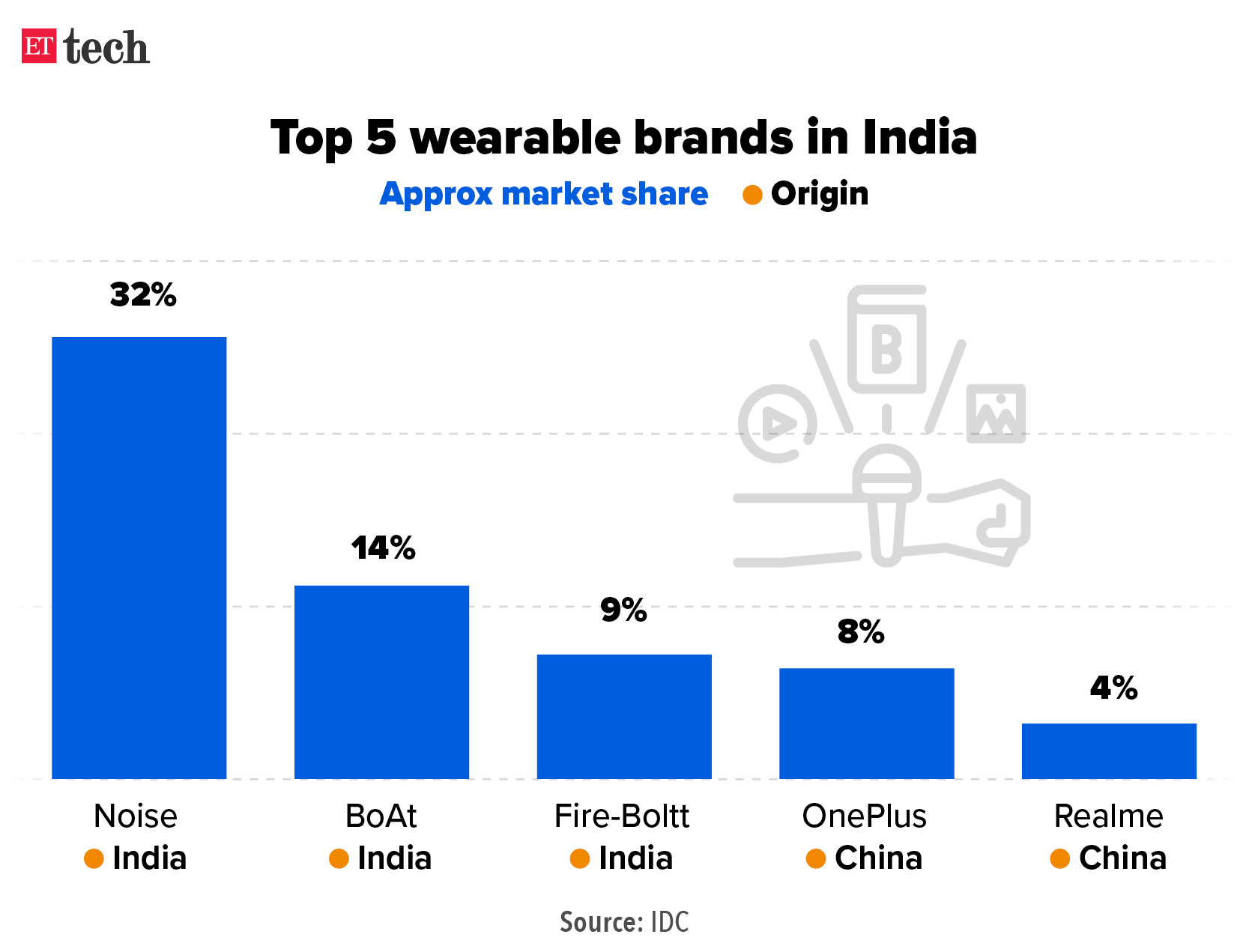

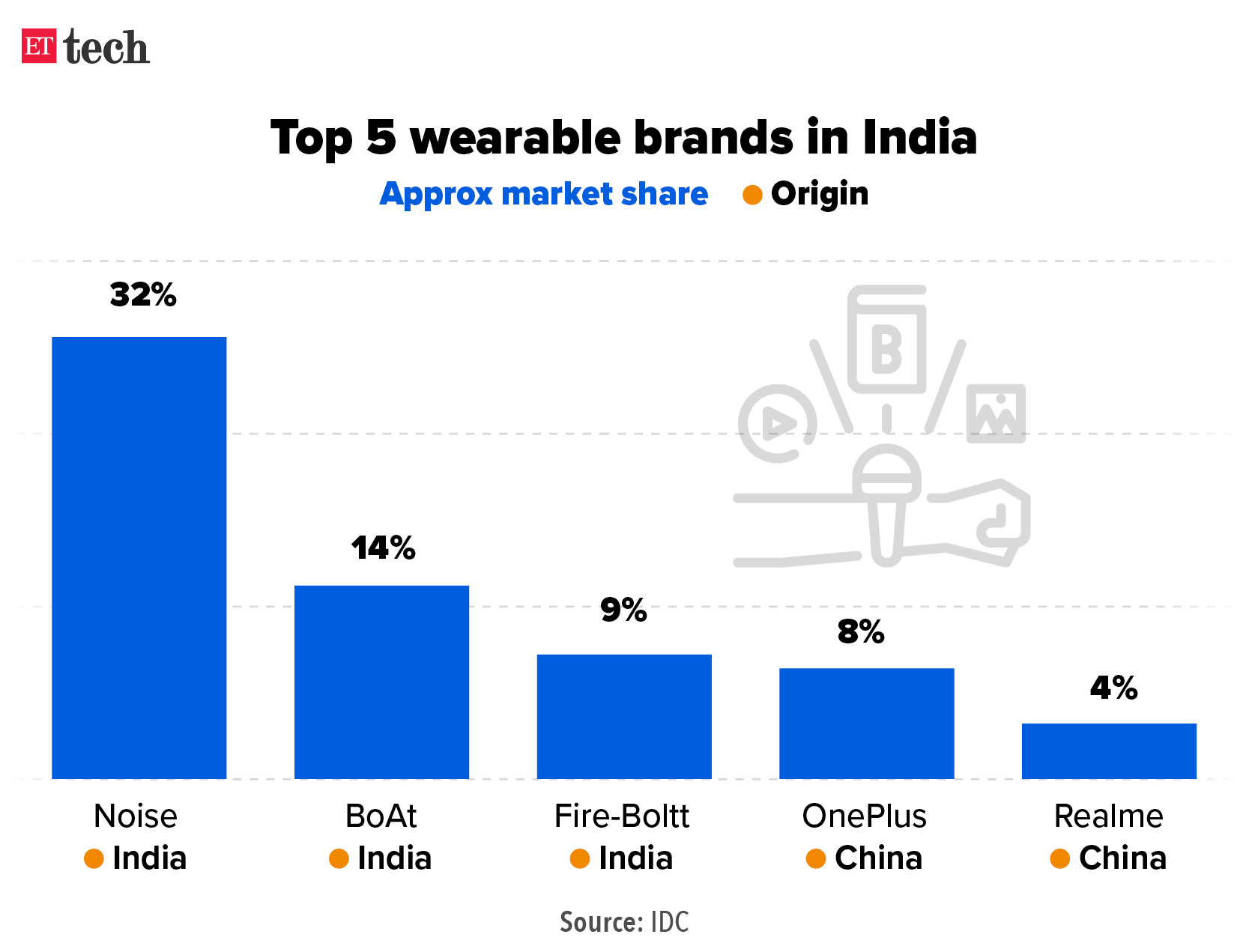

Infographic Insight: India’s top three accessories brands are local. Imagine Marketing (BoAt) has over 32% of the market, Nexxbase (Noise) has nearly 14%, and Fire-Boltt has about 9%, for a combined 55% combined share of the market, according to IDC India. Chinese rivals OnePlus (over 8%) and Realme (over 4%) make up the top five.

That is in sharp contrast to the smartphone market, where Chinese brands Xiaomi, Realme, Oppo and Vivo dominate the top five with over 62% of the market, while Indian brands such as Lava have less than 1%.

Nykaa, Paytm’s surprise corporate actions spark scrutiny

The relentless rout in shares of India’s tech darlings since their much-hyped initial public offerings last year has caused some of them to use surprise tactics to arrest the slide.

These actions have drawn scrutiny from investors and market experts, Bloomberg reported on Friday.

What’s happening? FSN E-Commerce Ventures, the parent firm of Nykaa, announced a bonus share issue to coincide with the expiry of an IPO lockup on key investors in November that risked extending the stock’s slump.

This month the parent firm of Paytm somewhat baffled investors with its decision to buy back shares a little over a year after its listing.

Reaction: While within the rules, several market experts say these actions reveal an obsession with their stock prices among newly listed firms.

“I am not in agreement with the methods used by some of the newly listed companies to improve or sustain value of their capital,” said Shyam Sekhar, founder of ithought Financial Consulting LLP in Chennai. “I see these methods are expedient in nature.”

Former Myntra CEO’s startup Virgio raises $37 million in funding

Fast fashion startup Virgio, founded by former Myntra CEO Amar Nagaram, said it has raised $37 million in a funding round co-led by Prosus Ventures, Alpha Wave Partner and Accel Partners. This is a significant infusion of capital by institutional investors in an early-stage round, given the ongoing funding winter.

We first reported in September that the venture arm of Dutch-listed internet major Prosus was in advanced talks to invest in Virgio, joining the likes of Accel and Alpha Wave. While the round has been constructed in phases, Virgio’s valuation is estimated to be around $160 million after the infusion, according to people briefed on the matter.

The company said it would use the money to invest in technology and hire more people.

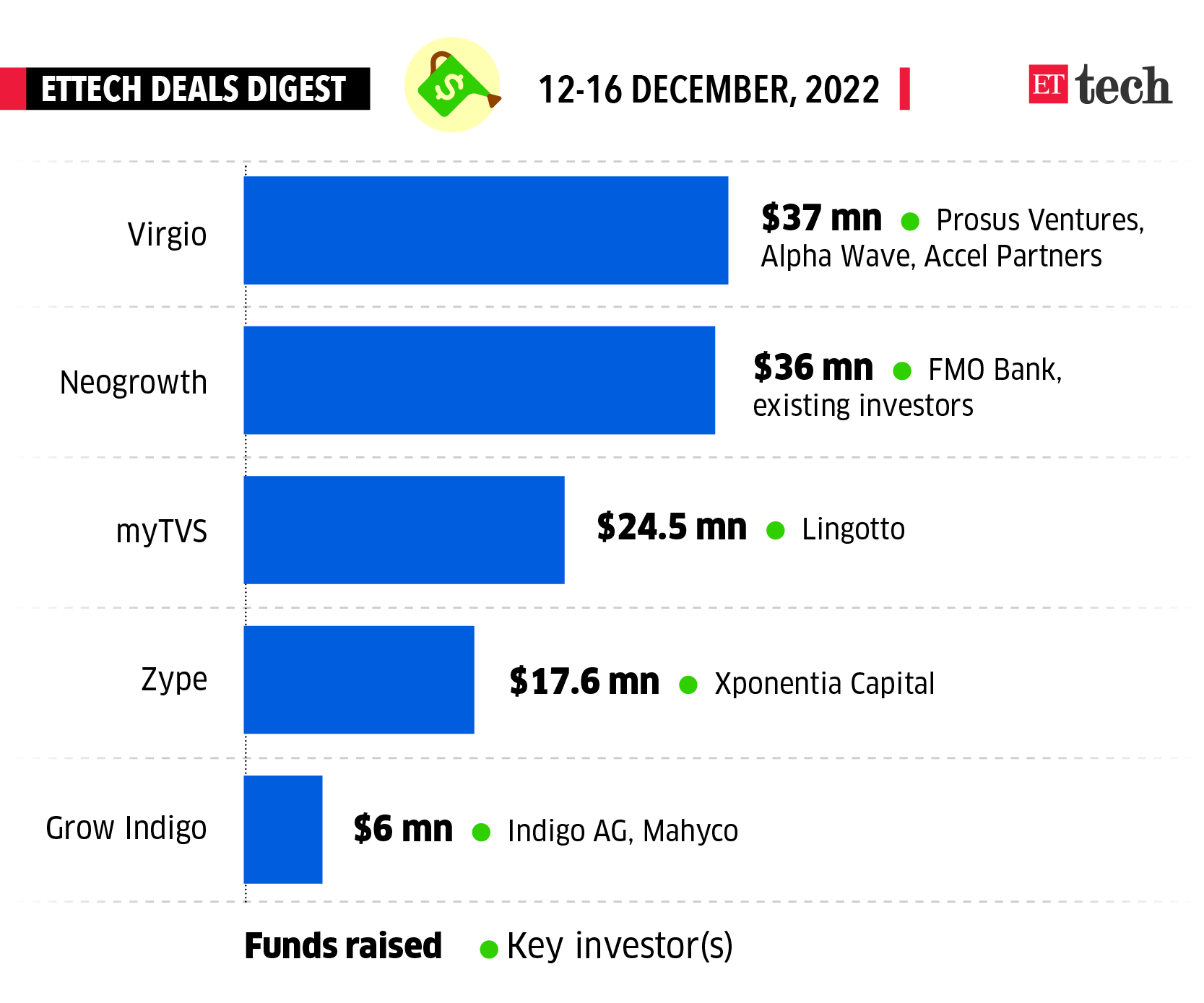

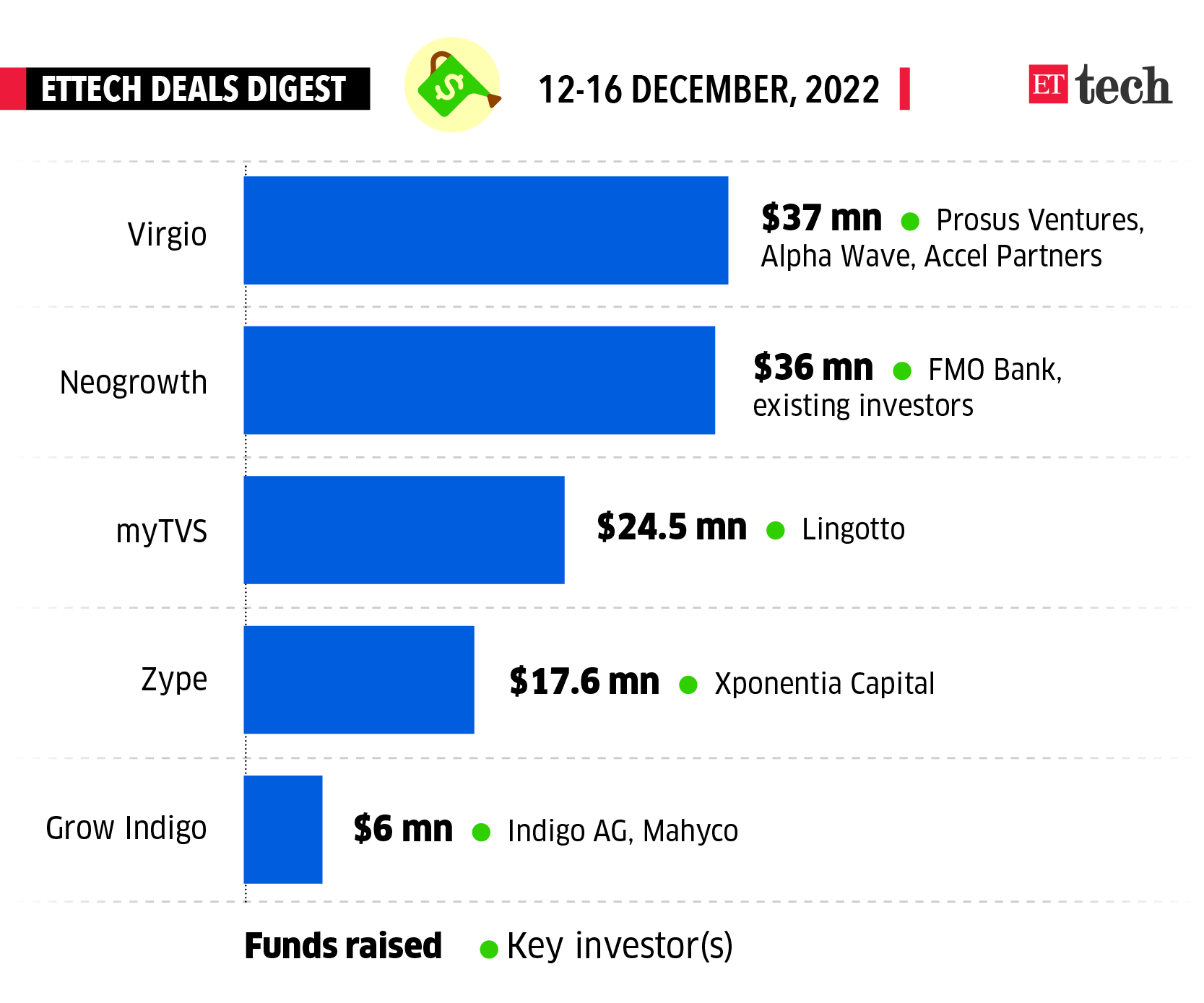

ETtech Deals Digest | Uptick in early-stage investing

Funding sources for Indian startups have been almost completely frozen amid the ongoing tech winter, but there has been a trickly of investment towards the end of the year.

This week, fast-fashion startup Virgio, founded by former Myntra CEO Amar Nagaram, raised $37 million in funding from Prosus Ventures, Accel Partners and Alpha Wave.

Here is a list of startups that raised funds this week.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Siddharth Shama in Bengaluru. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ Meta takes down spyware network run by Indian firm

■ Indian brands corner more than half of wearables market

■ Nykaa, Paytm’s surprise corporate actions spark scrutiny

RBI asks Razorpay, Cashfree to stop onboarding new merchants

The Reserve Bank of India (RBI) has asked payment gateway firms Razorpay and Cashfree, which had received in-principle nod from the regulator for a payment aggregator (PA) licence, to stop onboarding new merchants, multiple people told us.

The RBI has also asked Cashfree to step up its checks, two of the people said.

Why? According to people aware of the matter, the RBI’s decision is linked to the PA licences of these entities.

Razorpay received in-principle nod for a PA licence in July, while Cashfree received it in September.

“Razorpay has received a notification earlier this week to submit a SAR (suspicious activity report) system audit report to the regulator. Once the RBI is satisfied with the findings, Razorpay can then start onboarding new merchants,” one of the people aware of the RBI’s communication told ET.

As for Cashfree, one of the sources said the payment gateway has slowed down enterprise onboarding until it gets a go-ahead from RBI on its licence.

Response: A spokesperson for Razorpay said, “As part of the process for the final authorisation of our PA/PG licence for which we received the in-principle approval from RBI in July, we are now required to share additional details with RBI to aid in the final licence process. As part of this process, RBI has suggested that we temporarily withhold onboarding new online merchants till such details are submitted.”.

Paytm, too: In late November we reported the RBI had asked Paytm to reapply for a payment aggregator licence for its subsidiary Paytm Payments Services Ltd within 120 days, in response to its initial application. It also directed the payments firm to stop signing up new online merchants.

Meta takes down spyware network run by Indian firm CyberRoot Risk Advisory

Social media giant Meta said on Thursday that it has taken down a significant spyware and surveillance-for-hire network run by an Indian company called CyberRoot Risk Advisory.

During its investigations into threats across its platforms, Meta said it found that CyberRoot Risk Advisory had a network of more than 40 accounts on Facebook and Instagram, which it used to lure users from across the globe into phishing attacks and to spy on them for its clients.

The firm was among the most active and persistent groups active online across platforms of Meta as well as other social media intermediaries, the company said.

How the scam worked: CyberRoot’s method of operation was to create fake accounts that were designed to gain the trust of users around the world. These personas impersonated journalists, business executives and media personalities, Meta said.

It said the company also spoofed domains of major online service providers such as Gmail, Zoom, Facebook, Dropbox, Yahoo, OneDrive, and targets’ corporate email servers to conduct phishing attacks.

CyberRoot’s playbook was similar to that of another Indian surveillance-for-hire firm called BellTroX, Meta said. The social media company detected and disbanded BellTrox’s accounts across its platforms in 2021.

Zoom out: Between 2017 and November 2022, Meta said it had taken down 200 networks in China, Russia, Israel, the US and India that engaged in coordinated inauthentic behaviour, covert influence operations, cyber-espionage campaigns, spam and scam campaigns, and surveillance-for-hire.

Indian brands corner more than half of wearables market

Indian brands, which have been pushed to the fringes in the smartphone segment, are dominating the Rs 60,000-crore accessories market, which includes wearables, hearables and power accessories.

Even as smartphone makers cut production amid troubling times for the global economy, Indian wearable brands are doubling down on expansion and manufacturing plans in the hopes of seeing strong growth.

Infographic Insight: India’s top three accessories brands are local. Imagine Marketing (BoAt) has over 32% of the market, Nexxbase (Noise) has nearly 14%, and Fire-Boltt has about 9%, for a combined 55% combined share of the market, according to IDC India. Chinese rivals OnePlus (over 8%) and Realme (over 4%) make up the top five.

That is in sharp contrast to the smartphone market, where Chinese brands Xiaomi, Realme, Oppo and Vivo dominate the top five with over 62% of the market, while Indian brands such as Lava have less than 1%.

Nykaa, Paytm’s surprise corporate actions spark scrutiny

The relentless rout in shares of India’s tech darlings since their much-hyped initial public offerings last year has caused some of them to use surprise tactics to arrest the slide.

These actions have drawn scrutiny from investors and market experts, Bloomberg reported on Friday.

What’s happening? FSN E-Commerce Ventures, the parent firm of Nykaa, announced a bonus share issue to coincide with the expiry of an IPO lockup on key investors in November that risked extending the stock’s slump.

This month the parent firm of Paytm somewhat baffled investors with its decision to buy back shares a little over a year after its listing.

Reaction: While within the rules, several market experts say these actions reveal an obsession with their stock prices among newly listed firms.

“I am not in agreement with the methods used by some of the newly listed companies to improve or sustain value of their capital,” said Shyam Sekhar, founder of ithought Financial Consulting LLP in Chennai. “I see these methods are expedient in nature.”

Former Myntra CEO’s startup Virgio raises $37 million in funding

Fast fashion startup Virgio, founded by former Myntra CEO Amar Nagaram, said it has raised $37 million in a funding round co-led by Prosus Ventures, Alpha Wave Partner and Accel Partners. This is a significant infusion of capital by institutional investors in an early-stage round, given the ongoing funding winter.

We first reported in September that the venture arm of Dutch-listed internet major Prosus was in advanced talks to invest in Virgio, joining the likes of Accel and Alpha Wave. While the round has been constructed in phases, Virgio’s valuation is estimated to be around $160 million after the infusion, according to people briefed on the matter.

The company said it would use the money to invest in technology and hire more people.

ETtech Deals Digest | Uptick in early-stage investing

Funding sources for Indian startups have been almost completely frozen amid the ongoing tech winter, but there has been a trickly of investment towards the end of the year.

This week, fast-fashion startup Virgio, founded by former Myntra CEO Amar Nagaram, raised $37 million in funding from Prosus Ventures, Accel Partners and Alpha Wave.

Here is a list of startups that raised funds this week.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Siddharth Shama in Bengaluru. Graphics and illustrations by Rahul Awasthi.