The more, the better? Why market share often has little impact on profits

How are profitability, market share, and the digitalization of a company connected? To get to the bottom of this question, the researchers developed a new profitability model based on over 6,000 cases from around 800 US companies from the last 25 years. In order to measure the degree of digitalization, the companies’ annual financial statements were combed for certain keywords that indicate digitalization.

“Overall, it was clear that the importance of digitalization is increasing for almost all companies,” says Felix Sklenarz, co-author of the study, “but there are also very clear differences in the degree of digitalization of individual companies.”

The significance of market share for profitability declines sharply

When examining the various cases in the new profitability model, it became clear that the influence of market share on profitability is decreasing significantly, especially for highly digitalized companies.

There are various reasons for this. “One example: the digital transformation with its opportunities for automation is replacing learning effects that were previously generated by sheer size—i.e., market share,” says Alexander Himme. Market share was also a signal of quality and a barrier to market entry.

“However, digitalization is diminishing the power of the market leaders; customers can compare prices quickly and easily online, for example.” This makes it more difficult for the “big players” to operate more profitably than their “small” competitors—who can also compete on a global level thanks to e-commerce platforms and fulfillment service providers and pursue multichannel sales strategies.

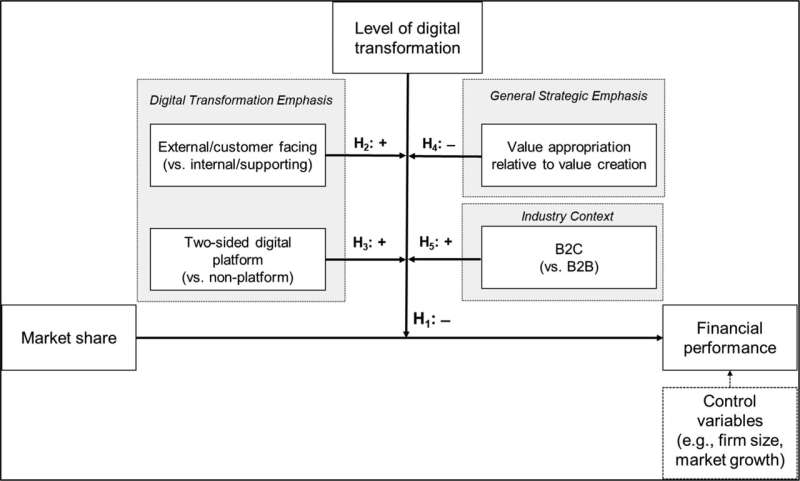

Various factors influence the extent to which the declining influence of market share affects the profitability of digital companies. These include whether companies focus their digital transformation on internal or external processes, where their general strategic focus lies (value creation for customers through innovation versus monetization of value delivered to customers), and whether they are active in the B2B or B2C sector.

“The bottom line is that endless growth is by no means the right path for all companies,” says Alexander Himme. “It also shows that companies benefit from digitalization to varying degrees depending on their size. Small companies with a smaller market share often have more to gain.” Managers of highly digital companies, in particular, should, therefore, take a close look at the KPIs they use to measure their company’s success.

The paper is published in the International Journal of Research in Marketing.

More information:

Felix Anton Sklenarz et al, Does bigger still mean better? How digital transformation affects the market share–profitability relationship, International Journal of Research in Marketing (2024). DOI: 10.1016/j.ijresmar.2024.01.004

Citation:

The more, the better? Why market share often has little impact on profits (2024, March 21)

retrieved 21 March 2024

from https://phys.org/news/2024-03-impact-profits.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

How are profitability, market share, and the digitalization of a company connected? To get to the bottom of this question, the researchers developed a new profitability model based on over 6,000 cases from around 800 US companies from the last 25 years. In order to measure the degree of digitalization, the companies’ annual financial statements were combed for certain keywords that indicate digitalization.

“Overall, it was clear that the importance of digitalization is increasing for almost all companies,” says Felix Sklenarz, co-author of the study, “but there are also very clear differences in the degree of digitalization of individual companies.”

The significance of market share for profitability declines sharply

When examining the various cases in the new profitability model, it became clear that the influence of market share on profitability is decreasing significantly, especially for highly digitalized companies.

There are various reasons for this. “One example: the digital transformation with its opportunities for automation is replacing learning effects that were previously generated by sheer size—i.e., market share,” says Alexander Himme. Market share was also a signal of quality and a barrier to market entry.

“However, digitalization is diminishing the power of the market leaders; customers can compare prices quickly and easily online, for example.” This makes it more difficult for the “big players” to operate more profitably than their “small” competitors—who can also compete on a global level thanks to e-commerce platforms and fulfillment service providers and pursue multichannel sales strategies.

Various factors influence the extent to which the declining influence of market share affects the profitability of digital companies. These include whether companies focus their digital transformation on internal or external processes, where their general strategic focus lies (value creation for customers through innovation versus monetization of value delivered to customers), and whether they are active in the B2B or B2C sector.

“The bottom line is that endless growth is by no means the right path for all companies,” says Alexander Himme. “It also shows that companies benefit from digitalization to varying degrees depending on their size. Small companies with a smaller market share often have more to gain.” Managers of highly digital companies, in particular, should, therefore, take a close look at the KPIs they use to measure their company’s success.

The paper is published in the International Journal of Research in Marketing.

More information:

Felix Anton Sklenarz et al, Does bigger still mean better? How digital transformation affects the market share–profitability relationship, International Journal of Research in Marketing (2024). DOI: 10.1016/j.ijresmar.2024.01.004

Citation:

The more, the better? Why market share often has little impact on profits (2024, March 21)

retrieved 21 March 2024

from https://phys.org/news/2024-03-impact-profits.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.