UK car market down 15.8% in April

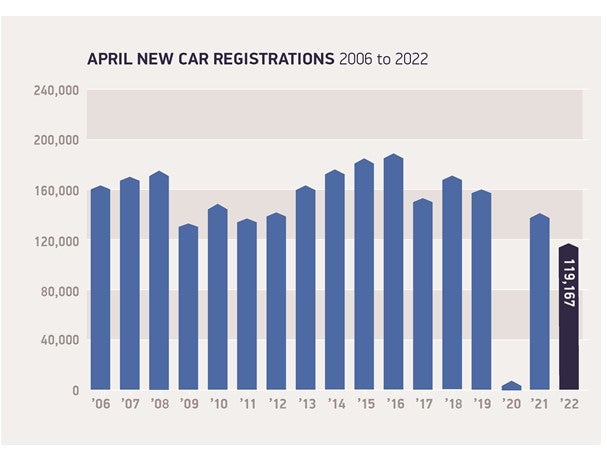

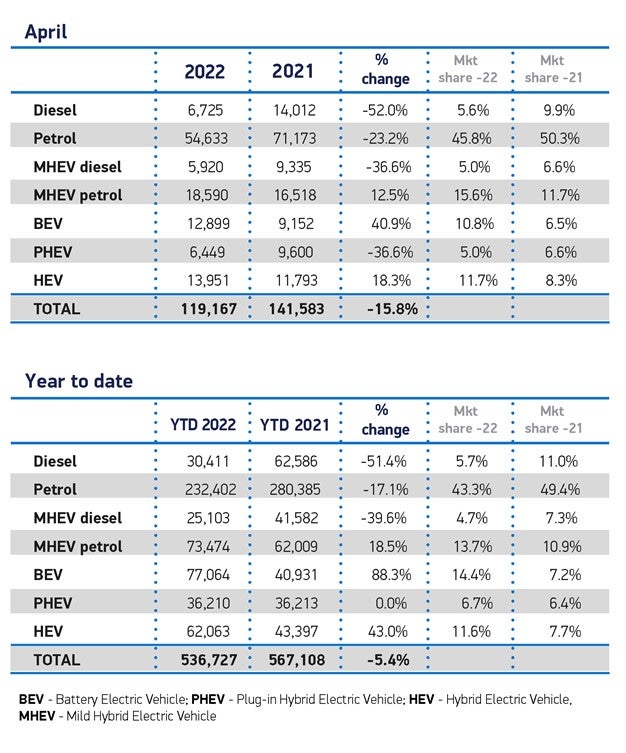

UK new car registrations fell by 15.8% to 119,167 units in April, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Despite showrooms being open for the entire month, unlike the previous year which saw lockdown restrictions in place until 12 April, global supply chain shortages, of which semiconductors are the most notable, have continued to constrain the sales of new vehicles.

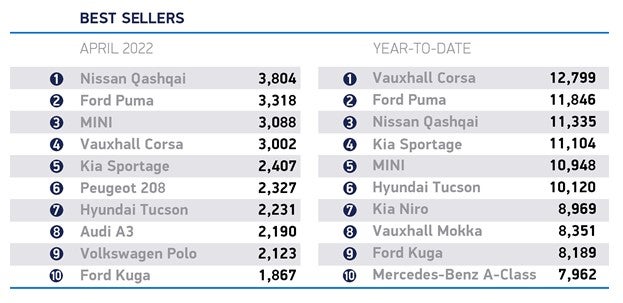

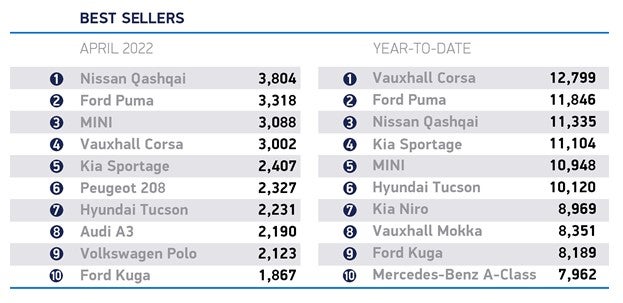

April’s decline was driven primarily by a 33.3% decrease in large fleet registrations, with manufacturers continuing to prioritise private consumers given robust demand, which helped this market segment see a modest increase of 4.8%. Smaller business registration volumes fared better, growing by 15.4%.

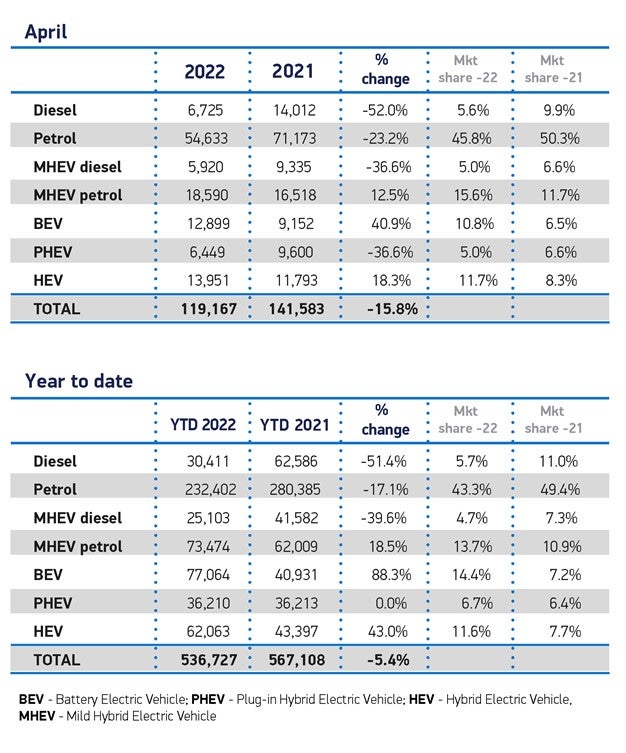

On a positive note, manufacturers appear to be successfully prioritizing sales of higher margin electric vehicles. Battery electric vehicles (BEVs) registrations continued to grow in April, up 40.9% to 12,899 units for a 10.8% market share, up from 6.5% last year. While registrations of hybrids (HEVs) also rose by 18.3%, the number of new plug-in hybrid (PHEV) registrations decreased by a third (down 32.8%). As a result, electrified vehicles comprised 27.9% of all new car registrations during April.

The SMMT noted that the UK’s car market faces further economic headwinds, with rising inflation hitting household real incomes and further supply chain and other uncertainties arising from the global political situation and the effects of the Russian invasion of Ukraine.

Given the ongoing impact of supply chain constraints and broader macro-economic factors, SMMT has revised its market outlook for 2022, with 1.72 million new cars new cars now expected to be registered during the year, down from the 1.89 million outlook in January. While this still represents a 4.5% rise on 2021, it highlights the effect the semiconductor shortage is still having on supply as well as anticipated impacts from rising living costs. The outlook for plug-in vehicles also was downgraded with the forecast for BEV registrations now at 289,000 units, down from 307,000; and PHEVs at 144,000, down from 163,000. HEVs also saw their outlook fall from 198,000 to 193,000. This means that plug-in electric cars are now expected to account for a quarter of all registrations (25.2%) during the year, with BEVs alone comprising around one in six new cars on the road.

Mike Hawes, SMMT Chief Executive, said: “The worldwide semiconductor shortage continues to drag down the market, with global geopolitical issues threatening to undermine both supply and demand in the coming months. Manufacturers are doing everything they can to deliver the latest low and zero emission vehicles, and those considering purchase should look to place their orders now to benefit from incentives, low interest rates and reduced running costs. Accelerating the transformation of the new car market and the carbon savings demanded of road transport in such difficult times requires not just the resolution of supply issues, however, but a broader package of measures that encourages customer demand and addresses obstacles, the biggest of which remains charging anxiety.”

UK new car registrations fell by 15.8% to 119,167 units in April, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Despite showrooms being open for the entire month, unlike the previous year which saw lockdown restrictions in place until 12 April, global supply chain shortages, of which semiconductors are the most notable, have continued to constrain the sales of new vehicles.

April’s decline was driven primarily by a 33.3% decrease in large fleet registrations, with manufacturers continuing to prioritise private consumers given robust demand, which helped this market segment see a modest increase of 4.8%. Smaller business registration volumes fared better, growing by 15.4%.

On a positive note, manufacturers appear to be successfully prioritizing sales of higher margin electric vehicles. Battery electric vehicles (BEVs) registrations continued to grow in April, up 40.9% to 12,899 units for a 10.8% market share, up from 6.5% last year. While registrations of hybrids (HEVs) also rose by 18.3%, the number of new plug-in hybrid (PHEV) registrations decreased by a third (down 32.8%). As a result, electrified vehicles comprised 27.9% of all new car registrations during April.

The SMMT noted that the UK’s car market faces further economic headwinds, with rising inflation hitting household real incomes and further supply chain and other uncertainties arising from the global political situation and the effects of the Russian invasion of Ukraine.

Given the ongoing impact of supply chain constraints and broader macro-economic factors, SMMT has revised its market outlook for 2022, with 1.72 million new cars new cars now expected to be registered during the year, down from the 1.89 million outlook in January. While this still represents a 4.5% rise on 2021, it highlights the effect the semiconductor shortage is still having on supply as well as anticipated impacts from rising living costs. The outlook for plug-in vehicles also was downgraded with the forecast for BEV registrations now at 289,000 units, down from 307,000; and PHEVs at 144,000, down from 163,000. HEVs also saw their outlook fall from 198,000 to 193,000. This means that plug-in electric cars are now expected to account for a quarter of all registrations (25.2%) during the year, with BEVs alone comprising around one in six new cars on the road.

Mike Hawes, SMMT Chief Executive, said: “The worldwide semiconductor shortage continues to drag down the market, with global geopolitical issues threatening to undermine both supply and demand in the coming months. Manufacturers are doing everything they can to deliver the latest low and zero emission vehicles, and those considering purchase should look to place their orders now to benefit from incentives, low interest rates and reduced running costs. Accelerating the transformation of the new car market and the carbon savings demanded of road transport in such difficult times requires not just the resolution of supply issues, however, but a broader package of measures that encourages customer demand and addresses obstacles, the biggest of which remains charging anxiety.”