Warner Bros Discovery-Paramount merger would be ‘desperate’: analysts

The glut of streaming services that have popped up over the last several years has produced a decidedly crowded marketplace. These days, consumers can subscribe to Netflix, Max, Hulu, Disney+, Paramount+, Amazon Prime, Peacock, Apple TV+, and many more. But with the recent consolidation of Discovery and Warner Bros., and now rumored discussions of a potential merger between Warner Bros. Discovery (WBD) and Paramount Global, it looks as if the industry is quickly reversing course.

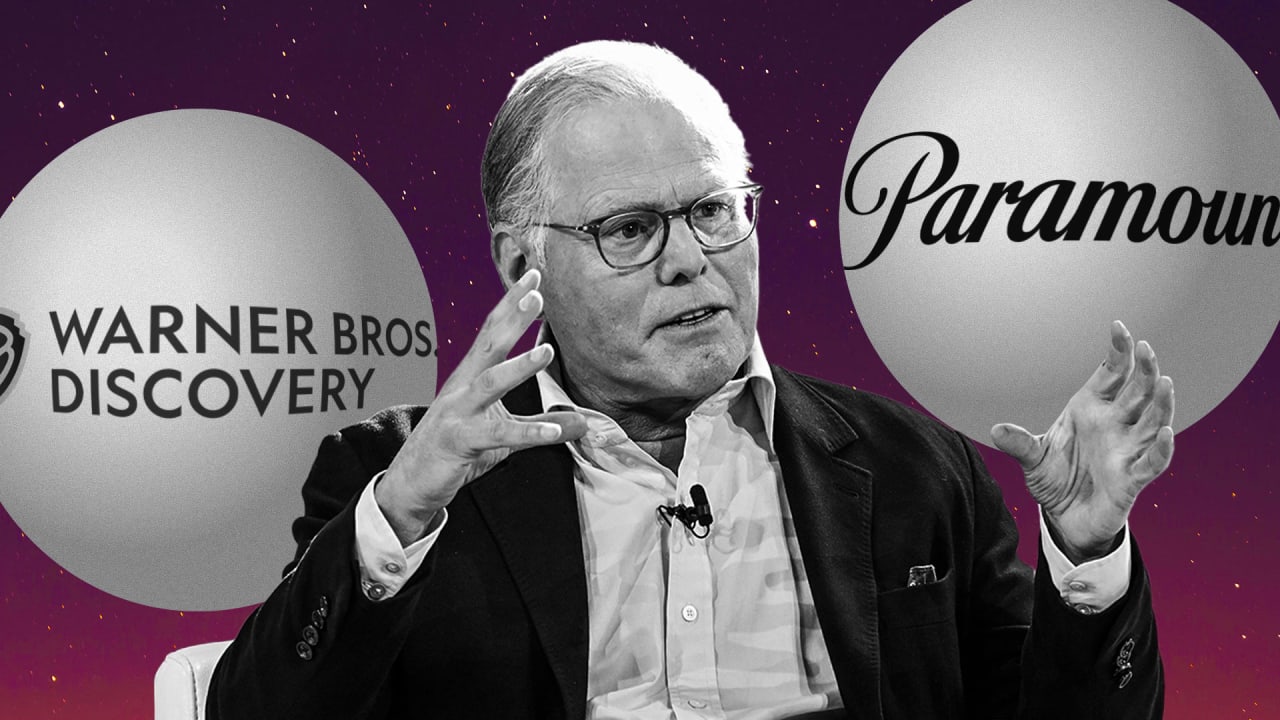

The rumored merger talks between WBD and Paramount were first reported by Axios earlier this week. WBD CEO David Zaslav and Paramount Global CEO Bob Bakish reportedly met on Tuesday to discuss the idea. While a lot is happening behind the scenes, if the two companies were to combine, and thus combine their streaming services Max and Paramount+, they could create a heavyweight player that stands a better chance of going toe-to-toe with Netflix or Disney.

Fast Company reached out to Paramount and WBD for comment. At the time of this writing, Paramount declined to comment and WBD did not respond.

As for how the potential merger is being perceived, at least one media analyst firm is skeptical of the idea.

“In short, we think these desperate times for media companies are leading them to explore desperate measures,” a research brief published on Thursday by MoffettNathanson reads.

While a case could be made for the merger—such as providing more scale and cost-savings for the companies’ similar operations, like CNN and CBS News—there are also numerous potential downsides, the analysts say. Paramount is saddled with $15 billion in debt, for one, and WBD would effectively be paying a lot for a linear TV business that is in decline.

“As pressure mounts from growing secular linear TV advertising headwinds, cord-cutting acceleration and a weaker macro backdrop putting more burden on sustainable cash flows, and leverage moving in the wrong direction for [Paramount], we still question why any company would try to catch a falling knife?” the brief reads.

This all happens, too, as the Biden administration has taken a more skeptical eye toward corporate mergers than previous administrations have. So, there could be regulatory issues standing in the way of a merger if it gets that far. For now, though, the analysts at MoffettNathanson say this may be the first of many potential merger rumors and talks in the industry.

“While we do not know if WBD will look to formally pursue a deal with PARA, we know for sure that 2024 will kick off where 2023 is ending up . . . lots more reports on potential consolidation scenarios,” the brief reads. “And the more desperate these media companies and executives get in the weeks and months ahead, the more likely some deal will happen in 2024, even without any fundamental reason for it.”

Shares of both companies were down more than 2% Thursday in midday trading.

The glut of streaming services that have popped up over the last several years has produced a decidedly crowded marketplace. These days, consumers can subscribe to Netflix, Max, Hulu, Disney+, Paramount+, Amazon Prime, Peacock, Apple TV+, and many more. But with the recent consolidation of Discovery and Warner Bros., and now rumored discussions of a potential merger between Warner Bros. Discovery (WBD) and Paramount Global, it looks as if the industry is quickly reversing course.

The rumored merger talks between WBD and Paramount were first reported by Axios earlier this week. WBD CEO David Zaslav and Paramount Global CEO Bob Bakish reportedly met on Tuesday to discuss the idea. While a lot is happening behind the scenes, if the two companies were to combine, and thus combine their streaming services Max and Paramount+, they could create a heavyweight player that stands a better chance of going toe-to-toe with Netflix or Disney.

Fast Company reached out to Paramount and WBD for comment. At the time of this writing, Paramount declined to comment and WBD did not respond.

As for how the potential merger is being perceived, at least one media analyst firm is skeptical of the idea.

“In short, we think these desperate times for media companies are leading them to explore desperate measures,” a research brief published on Thursday by MoffettNathanson reads.

While a case could be made for the merger—such as providing more scale and cost-savings for the companies’ similar operations, like CNN and CBS News—there are also numerous potential downsides, the analysts say. Paramount is saddled with $15 billion in debt, for one, and WBD would effectively be paying a lot for a linear TV business that is in decline.

“As pressure mounts from growing secular linear TV advertising headwinds, cord-cutting acceleration and a weaker macro backdrop putting more burden on sustainable cash flows, and leverage moving in the wrong direction for [Paramount], we still question why any company would try to catch a falling knife?” the brief reads.

This all happens, too, as the Biden administration has taken a more skeptical eye toward corporate mergers than previous administrations have. So, there could be regulatory issues standing in the way of a merger if it gets that far. For now, though, the analysts at MoffettNathanson say this may be the first of many potential merger rumors and talks in the industry.

“While we do not know if WBD will look to formally pursue a deal with PARA, we know for sure that 2024 will kick off where 2023 is ending up . . . lots more reports on potential consolidation scenarios,” the brief reads. “And the more desperate these media companies and executives get in the weeks and months ahead, the more likely some deal will happen in 2024, even without any fundamental reason for it.”

Shares of both companies were down more than 2% Thursday in midday trading.