Wife Has “Escape Money” But Doesn’t Tell Husband Even After His Injury And Him Working 3 Jobs

For better, for worse, for richer, for poorer, in sickness and in health… right? Well, it seems that not everyone remembers the solemn vows they made before the altar when they bound their lives together with their partner for eternity.

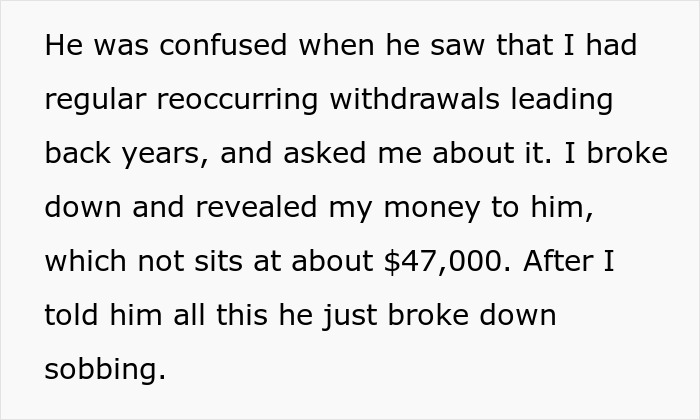

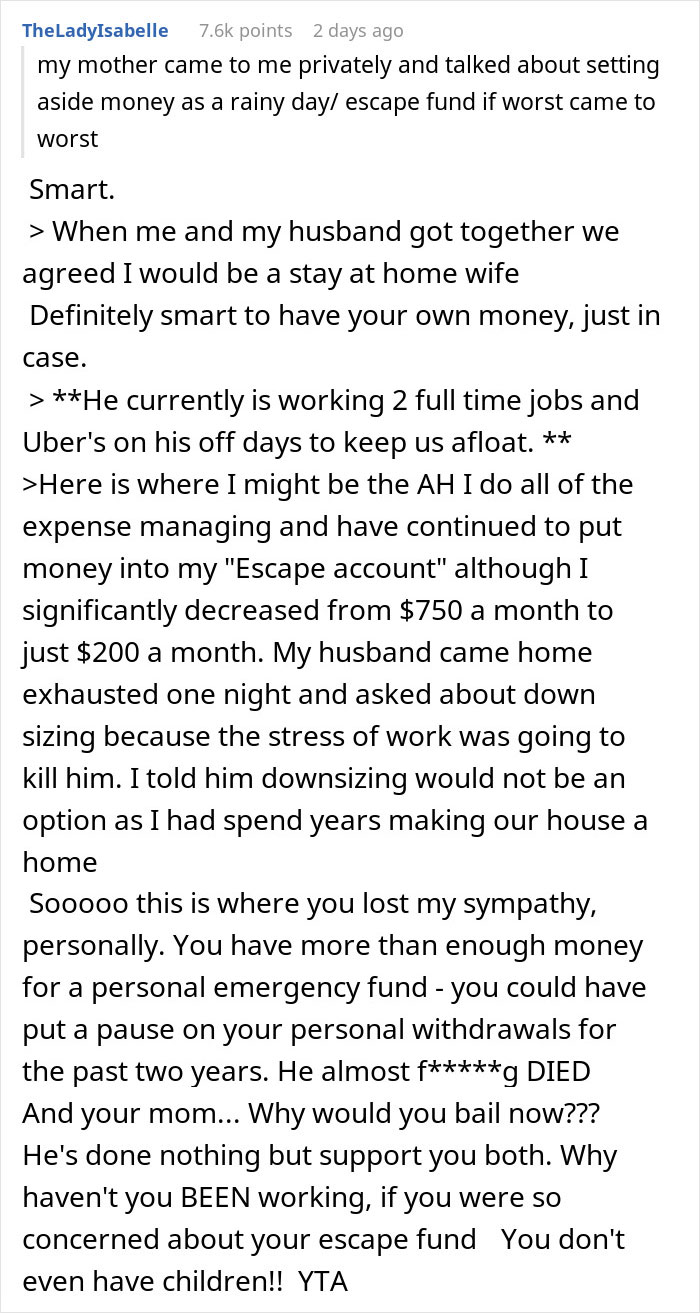

Like the redditor TraditionalFuel6104 who refused to give up her secret “getaway fund” to help her struggling husband keep the household afloat. He began to think she was treating him like a predator, sucking his money dry. But despite her excuses, he left the house feeling hurt in every way imaginable.

Scroll down to find the full story and a conversation with financial therapist Ed Coambs who kindly agreed to tell us more about financial infidelity.

Couples are supposed to lift each other up when times are hard

Image credits: kryzhov (not the actual photo)

But this wife refused to dip in her secret $47,000 savings to help out her struggling husband working three jobs

Image credits: Tima Miroshnichenko (not the actual photo)

Image credits: LightFieldStudios (not the actual photo)

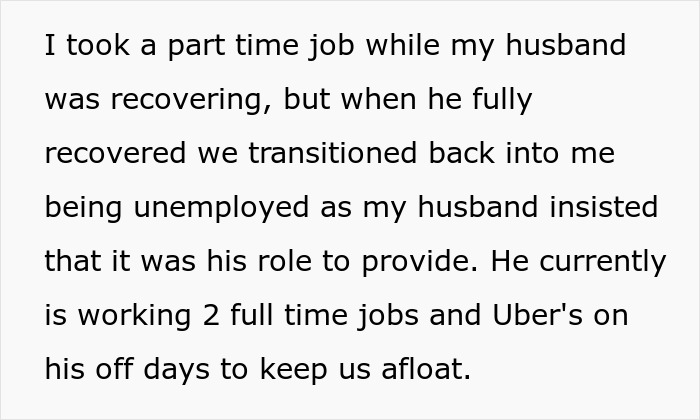

Image credits: TraditionalFuel6104

Couples manage their finances in the way that’s convenient for them

“For richer, for poorer…” These four little words in wedding vows can carry a lot of substance. Unless they’re like in that song “young dumb and broke,” most newlyweds don’t expect to become poverty-stricken when entering a marriage. Instead, they hope to prosper and lift each other before they creep up too close to the deficit line.

How every couple manages their income depends on their preferences, whether that would be separately, jointly, or a combination of both. Bored Panda reached out to the award-winning author in financial therapy Ed Coambs to learn more about shared finances.

Some spouses like those in this story might feel comfortable having a household with one income. For instance, one takes the role of being a stay-at-home wife or husband while the other goes to work and provides for the family. However, in the long run, it can become exhausting being the sole breadwinner of the house, especially when the family runs into unpredictable expenses that puts them in an unfortunate financial situation with relatively no way out.

Coambs tells us that despite these difficulties, a one-income household can be achievable. “One-income households exist for a number of reasons and they can definitely work. Assuming there are two adults, they will want to practice and learn how to communicate openly with each other about their finances. I encourage both adults to think in terms of teamwork and collaboration.

The adults’ creativity and collaboration are the best ways to figure out ways to make a one-income household successful. Respect for both partners’ contributions to the household is also essential.”

Keeping the money divided may be a comfortable starting point for couples, especially when they’re used to managing their spending and don’t have shared expenses yet. This may help to avoid any income differences, debts, and potential overspending conflicts. It can also encourage more open communication about finances and who pays for what. Some may want to split expenses down the middle while others might decide to give their part according to what they earn.

Sharing the income and having a joint account may simplify this process. Everything is paid out of the family budget, is easier to track, and there’s no need to determine income differences. With a mix of both, any savings, debts, and retirement money are managed mutually but each person also has a private account into which a set amount is put each month and can be spent on gifts or during “treat yourself” moments.

However, no one is really safe from financial infidelity

Whichever path a couple chooses to go in their shared money journey, sometimes financial infidelity is unavoidable. This happens when a couple that has chosen to combine their income lies to each other about it. For instance, one partner may hide significant debts or make substantial payments or purchases without the other person knowing.

Telltale signs of this occurring include excessive spending on gifts, trips, gambling, or larger-than-normal cash withdrawals from joint accounts. Hiding bank statements or getting defensive when the subject of money is brought up could be another indication of this taking place.

When asked how couples should deal with such unfortunate situations, Coambs said, “The journey of addressing financial infidelity will take personal reflection and responsibility. I encourage couples to become curious about what relationship dynamics made it uncomfortable to talk openly and honestly about their financial decisions.”

It might have happened because of the fear of disappointing their partner, being criticized for their money decisions, or being controlled. They also may overhear stories in which people advise not to trust others with their money.

Coambs notes that, “Often, the patterns of financial infidelity did not start with the couple, but was something that was seen or experienced in the families of the couples. Financial infidelity is a symptom of underlying relationship issues and patterns like insecure attachment.”

Financial cheating has the potential to irreversibly harm a relationship and make the couple lose trust in each other. According to the financial therapist, taking responsibility for what one has done and acknowledging the pain it has created is an important first step.

“Sometimes, because of the shame a person feels, it can be hard to see or acknowledge the full impact of their decisions. Building and rebuilding trust is an ongoing process after financial infidelity.”

The wife was titled wrong, to say the least

[ad_2]

For better, for worse, for richer, for poorer, in sickness and in health… right? Well, it seems that not everyone remembers the solemn vows they made before the altar when they bound their lives together with their partner for eternity.

Like the redditor TraditionalFuel6104 who refused to give up her secret “getaway fund” to help her struggling husband keep the household afloat. He began to think she was treating him like a predator, sucking his money dry. But despite her excuses, he left the house feeling hurt in every way imaginable.

Scroll down to find the full story and a conversation with financial therapist Ed Coambs who kindly agreed to tell us more about financial infidelity.

Couples are supposed to lift each other up when times are hard

Image credits: kryzhov (not the actual photo)

But this wife refused to dip in her secret $47,000 savings to help out her struggling husband working three jobs

Image credits: Tima Miroshnichenko (not the actual photo)

Image credits: LightFieldStudios (not the actual photo)

Image credits: TraditionalFuel6104

Couples manage their finances in the way that’s convenient for them

“For richer, for poorer…” These four little words in wedding vows can carry a lot of substance. Unless they’re like in that song “young dumb and broke,” most newlyweds don’t expect to become poverty-stricken when entering a marriage. Instead, they hope to prosper and lift each other before they creep up too close to the deficit line.

How every couple manages their income depends on their preferences, whether that would be separately, jointly, or a combination of both. Bored Panda reached out to the award-winning author in financial therapy Ed Coambs to learn more about shared finances.

Some spouses like those in this story might feel comfortable having a household with one income. For instance, one takes the role of being a stay-at-home wife or husband while the other goes to work and provides for the family. However, in the long run, it can become exhausting being the sole breadwinner of the house, especially when the family runs into unpredictable expenses that puts them in an unfortunate financial situation with relatively no way out.

Coambs tells us that despite these difficulties, a one-income household can be achievable. “One-income households exist for a number of reasons and they can definitely work. Assuming there are two adults, they will want to practice and learn how to communicate openly with each other about their finances. I encourage both adults to think in terms of teamwork and collaboration.

The adults’ creativity and collaboration are the best ways to figure out ways to make a one-income household successful. Respect for both partners’ contributions to the household is also essential.”

Keeping the money divided may be a comfortable starting point for couples, especially when they’re used to managing their spending and don’t have shared expenses yet. This may help to avoid any income differences, debts, and potential overspending conflicts. It can also encourage more open communication about finances and who pays for what. Some may want to split expenses down the middle while others might decide to give their part according to what they earn.

Sharing the income and having a joint account may simplify this process. Everything is paid out of the family budget, is easier to track, and there’s no need to determine income differences. With a mix of both, any savings, debts, and retirement money are managed mutually but each person also has a private account into which a set amount is put each month and can be spent on gifts or during “treat yourself” moments.

However, no one is really safe from financial infidelity

Whichever path a couple chooses to go in their shared money journey, sometimes financial infidelity is unavoidable. This happens when a couple that has chosen to combine their income lies to each other about it. For instance, one partner may hide significant debts or make substantial payments or purchases without the other person knowing.

Telltale signs of this occurring include excessive spending on gifts, trips, gambling, or larger-than-normal cash withdrawals from joint accounts. Hiding bank statements or getting defensive when the subject of money is brought up could be another indication of this taking place.

When asked how couples should deal with such unfortunate situations, Coambs said, “The journey of addressing financial infidelity will take personal reflection and responsibility. I encourage couples to become curious about what relationship dynamics made it uncomfortable to talk openly and honestly about their financial decisions.”

It might have happened because of the fear of disappointing their partner, being criticized for their money decisions, or being controlled. They also may overhear stories in which people advise not to trust others with their money.

Coambs notes that, “Often, the patterns of financial infidelity did not start with the couple, but was something that was seen or experienced in the families of the couples. Financial infidelity is a symptom of underlying relationship issues and patterns like insecure attachment.”

Financial cheating has the potential to irreversibly harm a relationship and make the couple lose trust in each other. According to the financial therapist, taking responsibility for what one has done and acknowledging the pain it has created is an important first step.

“Sometimes, because of the shame a person feels, it can be hard to see or acknowledge the full impact of their decisions. Building and rebuilding trust is an ongoing process after financial infidelity.”

The wife was titled wrong, to say the least

Read original article here