Binance Might Not Buy FTX After All

Somehow, things might be even worse than they first appeared at the crashing cryptocurrency exchange FTX. The blockchain firm, which up until very recently had been ranked as the third largest crypto platform, announced Tuesday that it was being acquired by rival exchange Binance.

Star Wars: Shatterpoint Announcement Trailer

02:27

The First Things To Do In VR, Part 3

Today 9:39AM

Now, that deal is falling apart. Cracks in the acquisition first emerged in a report from Coin Desk that cited an unnamed “person familiar with the matter.” Binance eventually confirmed that it does in fact plan to walk away from the deal. “Our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,” the exchange first told the Wall Street Journal.

Then, Binance spokesperson Ismael Garcia also confirmed the company’s intent to abandon the deal in an email to Gizmodo. “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com,” Garcia wrote.

Early November whispers and an allegedly leaked financial document indicated that FTX and its severed, corporate sibling Alameda Research might not have as much money as claimed. From there things snowballed, crypto pundits speculated, and the value of FTX’s token, FTT, plummeted. Currently, it’s sitting around $3.72, down from about $22 on Monday.

As his coin value dropped, FTX founder and CEO Sam Bankman-Fried allegedly went asking around for $1 billion in bail out money from multiple Silicon Valley and Wall Street big wigs to try to salvage his exchange. And most of the blockchain platform’s legal and compliance staff abruptly quit on Tuesday, according to a report from Semafor.

G/O Media may get a commission

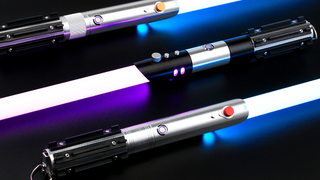

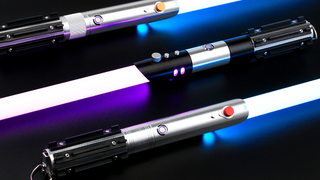

*lightsaber hum*

SabersPro

For the Star Wars fan with everything.

These lightsabers powered by Neopixels, LED strips that run inside the blade shape that allow for adjustable colors, interactive sounds, and changing animation effects when dueling.

Amid the chaos, Binance CEO Chengpeng Zhao stepped with an offer to buy up FTX. “To protect users, we signed a non-binding LIO [letter of intent], intending to fully acquire FTX.com and help cover the liquidity crunch,” he tweeted in a statement yesterday. “We will be conducting a full DD [due diligence] in the coming days.” In non-crypto terms, “liquidity crunch” means that FTX is running out of cash to finance its own transactions. The exchange stopped processing withdrawals yesterday morning.

In a longer post made Wednesday morning, Zhao added that “FTX going down is not good for anyone in the industry. Do not view it as a ‘win for us.’” Bankman-Fried also tweeted about the acquisition. “I know that there have been rumors in media of conflict between our two exchanges, however Binance has shown time and time again that they are committed to a more decentralized global economy…We are in the best of hands,” he wrote.

Yet, apparently Binance’s brief peek into FTX’s finances was enough to stop the acquisition deal in its tracks, regardless of any negative reverberations FTX’s downfall could have for other crypto firms.

“Roughly half a day into that process of reviewing FTX’s internal data and loan commitments has led Binance to strongly lean against completing the transaction, [our source] said,” Coin Desk initially wrote—a sentiment confirmed by the company to Gizmodo.

FTX.com did respond to Gizmodo’s request for comment. Assuming the the rescue deal is now moot, FTX is set to become one of multiple blockchain projects to crumble in this year’s “crypto winter.” Unfortunately, it also means that Martin Shkreli was right about something.

Update 11/09/2022, 4:42 p.m. Eastern: This story has been updated with comment from Binance.

Update 11/09/2022, 4:05 p.m. Eastern: This story has been updated with additional information from a Wall Street Journal report.

Somehow, things might be even worse than they first appeared at the crashing cryptocurrency exchange FTX. The blockchain firm, which up until very recently had been ranked as the third largest crypto platform, announced Tuesday that it was being acquired by rival exchange Binance.

Star Wars: Shatterpoint Announcement Trailer

02:27

The First Things To Do In VR, Part 3

Today 9:39AM

Now, that deal is falling apart. Cracks in the acquisition first emerged in a report from Coin Desk that cited an unnamed “person familiar with the matter.” Binance eventually confirmed that it does in fact plan to walk away from the deal. “Our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,” the exchange first told the Wall Street Journal.

Then, Binance spokesperson Ismael Garcia also confirmed the company’s intent to abandon the deal in an email to Gizmodo. “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com,” Garcia wrote.

Early November whispers and an allegedly leaked financial document indicated that FTX and its severed, corporate sibling Alameda Research might not have as much money as claimed. From there things snowballed, crypto pundits speculated, and the value of FTX’s token, FTT, plummeted. Currently, it’s sitting around $3.72, down from about $22 on Monday.

As his coin value dropped, FTX founder and CEO Sam Bankman-Fried allegedly went asking around for $1 billion in bail out money from multiple Silicon Valley and Wall Street big wigs to try to salvage his exchange. And most of the blockchain platform’s legal and compliance staff abruptly quit on Tuesday, according to a report from Semafor.

G/O Media may get a commission

*lightsaber hum*

SabersPro

For the Star Wars fan with everything.

These lightsabers powered by Neopixels, LED strips that run inside the blade shape that allow for adjustable colors, interactive sounds, and changing animation effects when dueling.

Amid the chaos, Binance CEO Chengpeng Zhao stepped with an offer to buy up FTX. “To protect users, we signed a non-binding LIO [letter of intent], intending to fully acquire FTX.com and help cover the liquidity crunch,” he tweeted in a statement yesterday. “We will be conducting a full DD [due diligence] in the coming days.” In non-crypto terms, “liquidity crunch” means that FTX is running out of cash to finance its own transactions. The exchange stopped processing withdrawals yesterday morning.

In a longer post made Wednesday morning, Zhao added that “FTX going down is not good for anyone in the industry. Do not view it as a ‘win for us.’” Bankman-Fried also tweeted about the acquisition. “I know that there have been rumors in media of conflict between our two exchanges, however Binance has shown time and time again that they are committed to a more decentralized global economy…We are in the best of hands,” he wrote.

Yet, apparently Binance’s brief peek into FTX’s finances was enough to stop the acquisition deal in its tracks, regardless of any negative reverberations FTX’s downfall could have for other crypto firms.

“Roughly half a day into that process of reviewing FTX’s internal data and loan commitments has led Binance to strongly lean against completing the transaction, [our source] said,” Coin Desk initially wrote—a sentiment confirmed by the company to Gizmodo.

FTX.com did respond to Gizmodo’s request for comment. Assuming the the rescue deal is now moot, FTX is set to become one of multiple blockchain projects to crumble in this year’s “crypto winter.” Unfortunately, it also means that Martin Shkreli was right about something.

Update 11/09/2022, 4:42 p.m. Eastern: This story has been updated with comment from Binance.

Update 11/09/2022, 4:05 p.m. Eastern: This story has been updated with additional information from a Wall Street Journal report.