New-age consumer brands pulling in funds, tech no bar; and other top stories this week

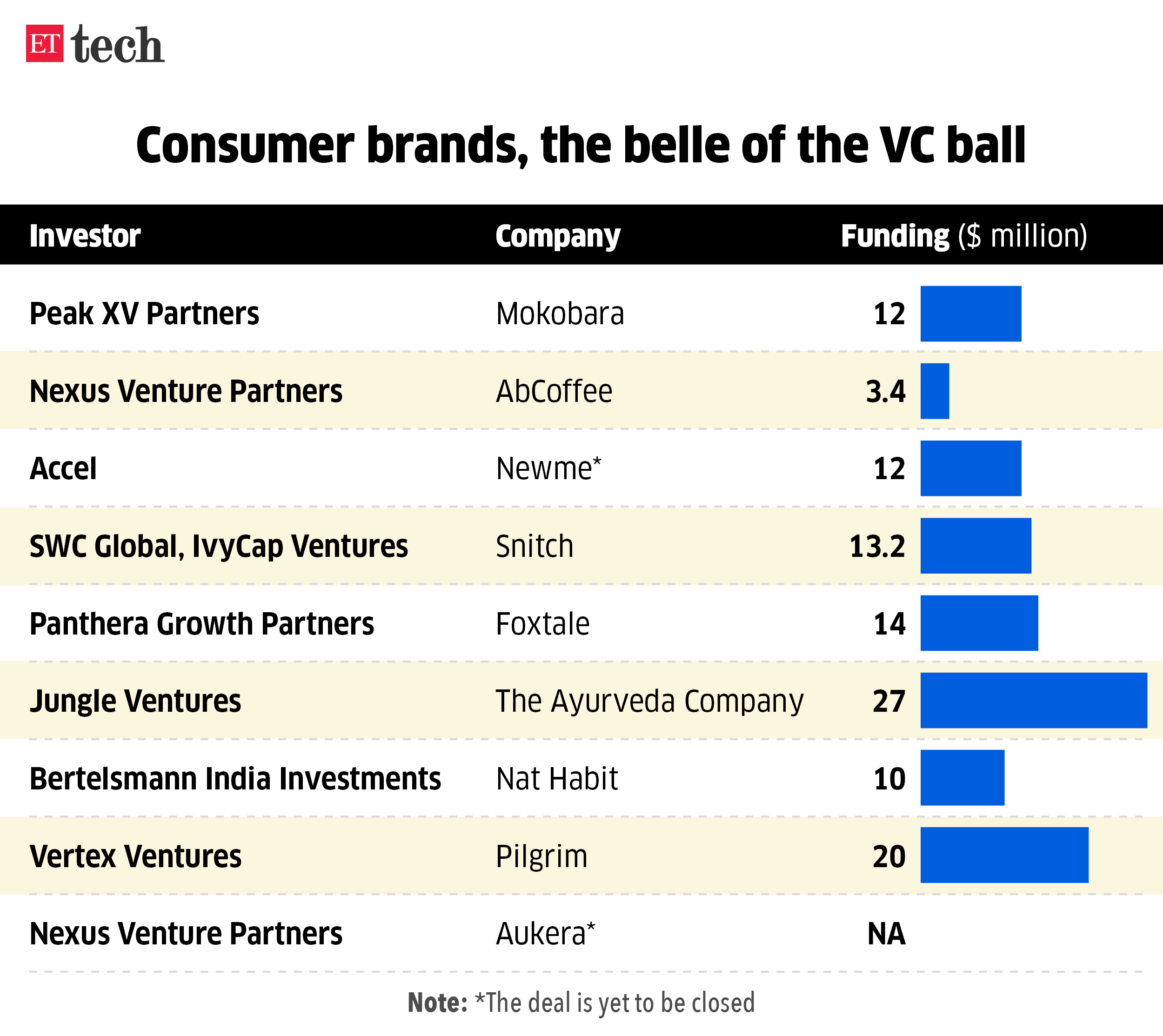

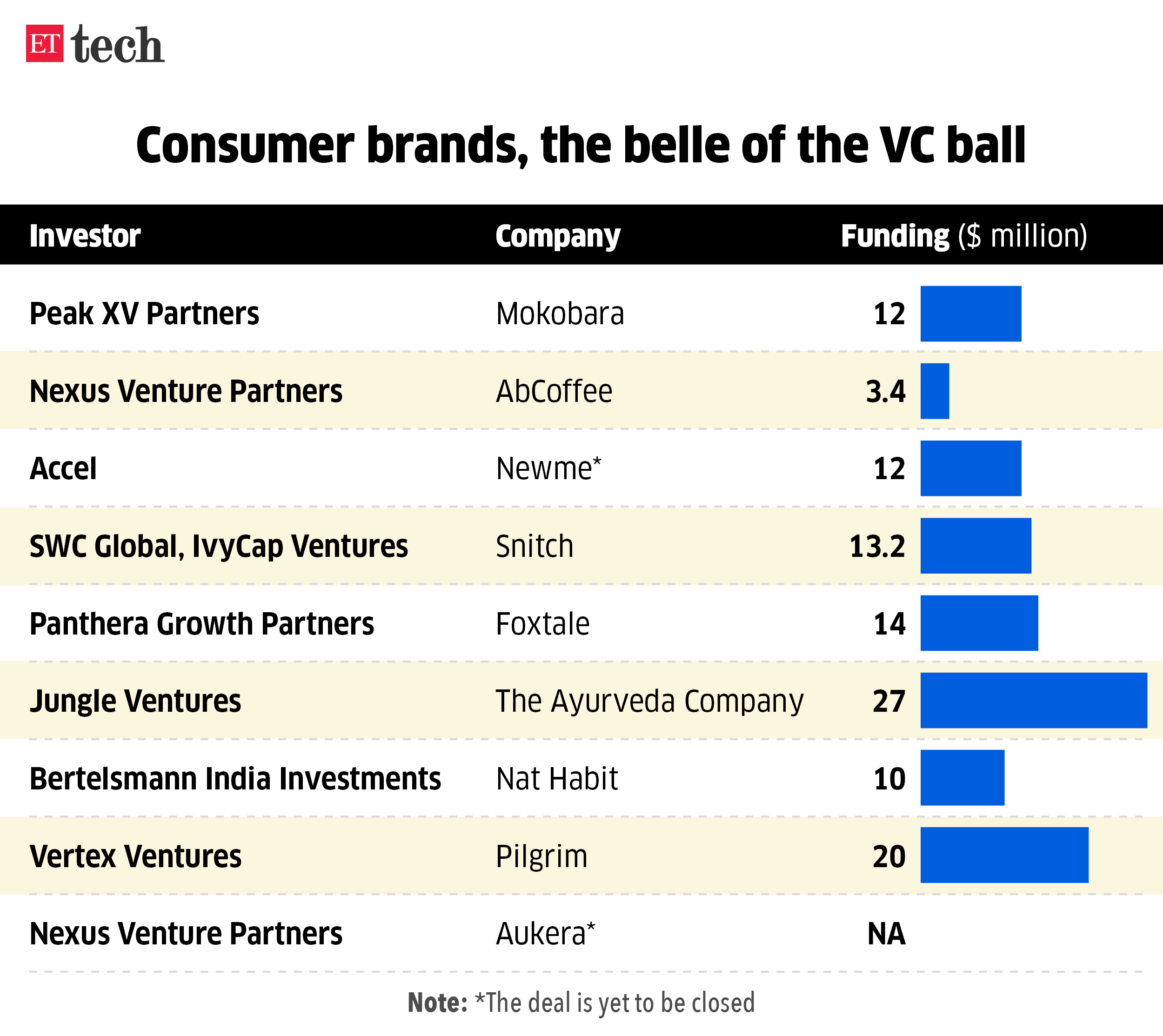

At the peak of the funding winter last year, an investor told me that the pace of investment deals will continue to be slow, but the nature of companies grabbing new cash will be different. The next obvious question was: what kind of companies? Consumer brands, the person said.

Cut to March 2024, and the trend is now well established among tech-first venture capital funds increasingly backing brands selling products and services to a wide range of consumers. Sure, they’re new-age and rely on technology, but that’s not the core of these companies.

For example, one of the first such early-stage deals in the works last year was Peak XV Partners (formerly Sequoia Capital India) investing in luggage brand Mokobara. It sells travel-related products through online and offline stores. Peak XV has been an investor in direct-to-consumer Mamaearth’s parent too, but over the past year venture funds are no longer looking at startups only through the ‘technology-first’ lens.

ET reported on Friday that Nexus Venture Partners is the latest fund in advanced stages to back two new consumer brands – specialty coffee chain AbCoffee and lab-grown diamond maker Aukera.

Newme, Snitch, Foxtale, The Ayurveda Company, The Souled Store are among new consumer brands that have raised funding from venture investors and are engaged in new fundraise talks too. According to several media reports, other new consumer brand ventures – run by former grocery or ecommerce executives – are also stitching up similar funding deals from venture capital funds.

“Mamaearth, Boat have been the first set of digital-first brands who started via Flipkart or Amazon and have become established consumer brands. They are going where consumers are available. Across categories – food, fashion, beauty, coffee – the same is playing with new companies,” an investor who has reviewed several pitches said. According to him, the overall market size is much bigger offline and Covid-19-induced gains for ecommerce have tapered off.

“These businesses are also economically sound in early-stages – compared to some tech-first startups relying on burn to grow – making it more viable to build a profitable venture. Increasingly, investors are trying to find these brands and sectors seeing good growth in a sustainable manner,” this person said.

Also read | Specialty coffee chain AbCoffee raises $3.4 million in funding led by Nexus Venture Partners

AbCoffee founder Abhijeet Anand said the majority of his stores are profitable at an operating level and it’s been able to do that by leveraging technology in its operations.

“Their (AbCoffee) innovative tech model, coupled with their focus on high-quality, ethically sourced beans and efficient brewing methods, allows them to offer premium coffee experiences at surprisingly affordable prices. We believe this unique approach has the potential to disrupt the Indian coffee market and make premium coffee beverages a mainstream beverage enjoyed by everyone,” said Suvir Sujan, managing director at Nexus Venture Partners.

A seasoned D2C brand founder said a common problem with major brands being online-first is they hit a plateau beyond a certain scale of, say $100 million or so in sales. “So, you have to then go offline and figure out the model. We realised we can make more money through various offline channels than online and marketplace fees are high. In offline, I can have much more visibility for my brand too. The more I sell, the better my negotiations with the store owners,” this entrepreneur said.

We have been reporting through last year that ecommerce sales have seen softness in certain quarters as offline retail is fully back. “We have more say in pricing as well as what stock will go online and what will remain in my stores first,” a senior executive at one of top retail firms said on the changing dynamics between ecommerce platforms and brands.

“Young and affluent – that’s the customer base these upstarts are going after. They spend more now than you and I did when we were younger. They are going out and experiencing these new brands – for travel needs or trying a new apparel brand,” another seasoned ecommerce executive said, underscoring why these consumer brands are finding traction among users.

The funding winter may still be around for some time, but clearly funds are ready to sign cheques for new-age brands – tech is not a must-have or priority.

Funding Trends

Meesho in talks for secondary deal with Peak XV, Tiger Global at $3.5-3.9 billion valuation: Peak XV Partners (formerly Sequoia Capital India) and Tiger Global are among a bunch of investors that have held talks to acquire a stake in SoftBank-backed ecommerce firm Meesho in a secondary deal, people in the know said. The transaction is likely to take place at a valuation of $3.5-3.9 billion, depending on the final terms.

Tech-first VCs line up for new-age consumer brands, offline businesses: In the latest instance of tech-first venture capital firms investing in new-age consumer brands with offline presence, Nexus Venture Partners, known for SaaS expertise, is set to lead a $5 million funding round in specialty coffee brand AbCoffee, people in the know said. The round will see the coffee brand’s valuation treble to about $15 million in less than six months.

VCs hire experts to help with exits as LPs look for returns: One of the major concerns voiced by investors regarding India consistently has been the lack of exit liquidity opportunities. To take on this problem, over the last two years, leading venture capital funds including Lightspeed, Accel and Matrix Partners India have sought out professionals with investment banking expertise.

Top Reads This Week

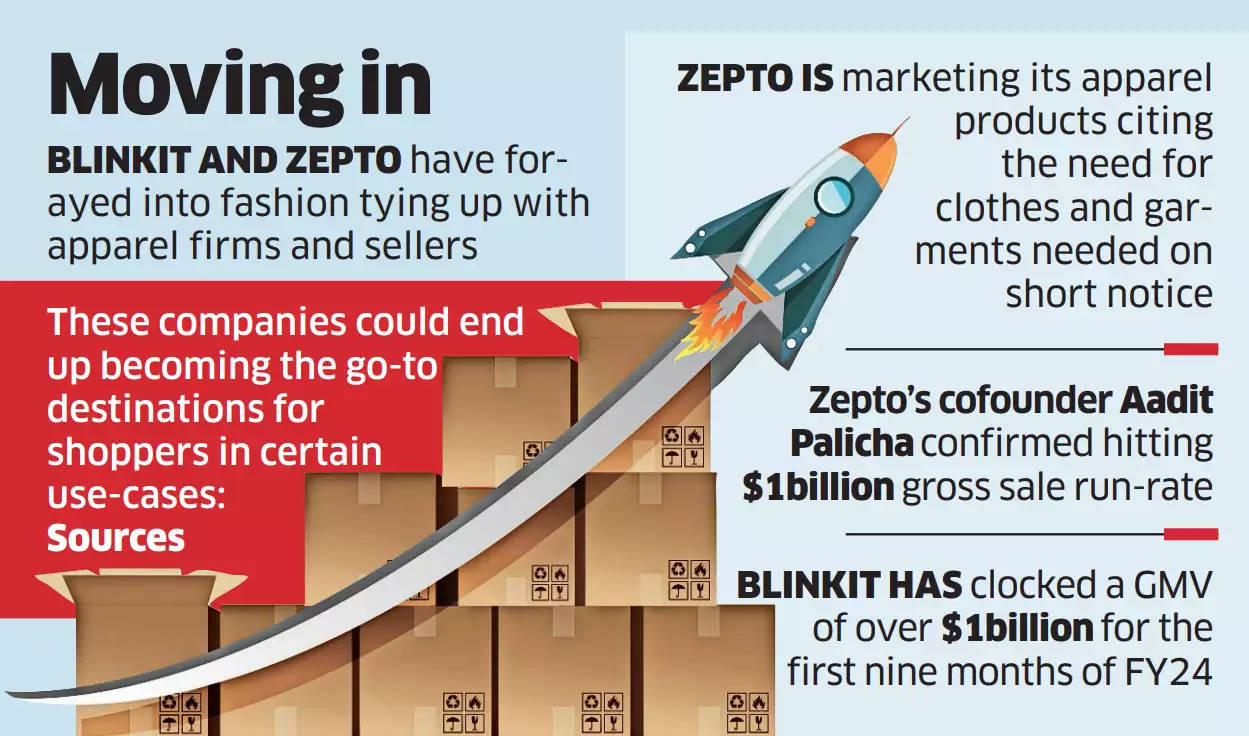

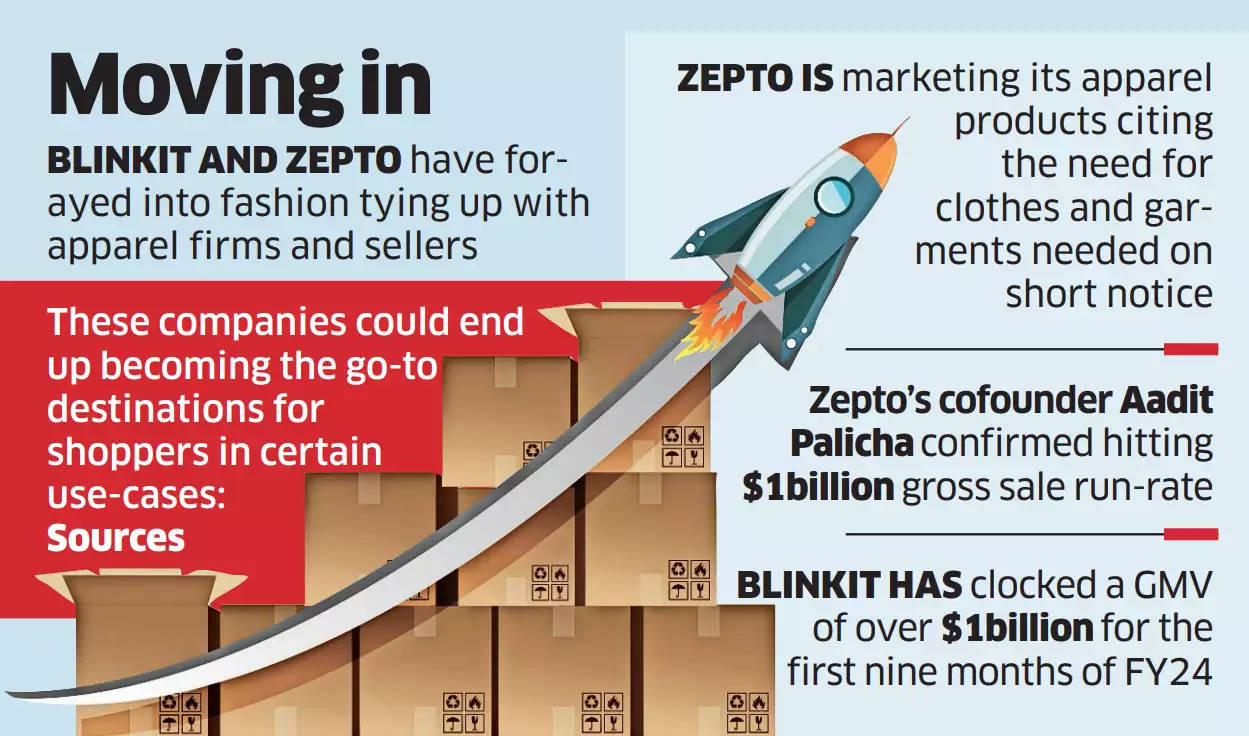

Zepto, Blinkit adding fashion, electronics, beauty and more: Two of the largest quick commerce platforms—Zomato-owned Blinkit and Mumbai-based upstart Zepto—are fast entering ecommerce territory and are set to add several categories like fashion, beauty, electronics, toys, home and kitchen among other segments.

Meanwhile, Tata Digital-owned online supermarket BigBasket said it is not in a rush to broaden its product portfolio and will continue to focus primarily on grocery.

Flipkart to roll out quick-commerce venture soon: Flipkart is planning to launch a quick-commerce service in a few months, people in the know of the matter said. The delivery timeline targeted by the ecommerce major and the number of cities it plans to launch the venture in are not yet known.

Also read | Flipkart launches UPI service in partnership with Axis Bank

Indian SaaS products to corner 8% global market share by 2028: report | As Indian software startups continue to target international markets, the global market share of SaaS products from India is expected to reach 8% by 2028, a report from advisory firm 1Lattice and venture investor Sorin Investments led by veteran dealmaker Sanjay Nayar said.

Real-money gaming companies look for an ace to beat tax blues: Companies that run online games like poker, rummy and fantasy sports where real money is wagered are experimenting with new models that discourage users from frequently withdrawing their money, as they seek to minimise the impact of increased indirect tax and boost their earnings.

Much excite, very wow: Meme coin volumes jump on local bourses: Trading of meme coins has spiked on Indian cryptocurrency exchanges, taking a cue from a resurgence in the global crypto market where the blue-chip Bitcoin and Ethereum currencies have scaled to new record highs after a year and half of falling prices.

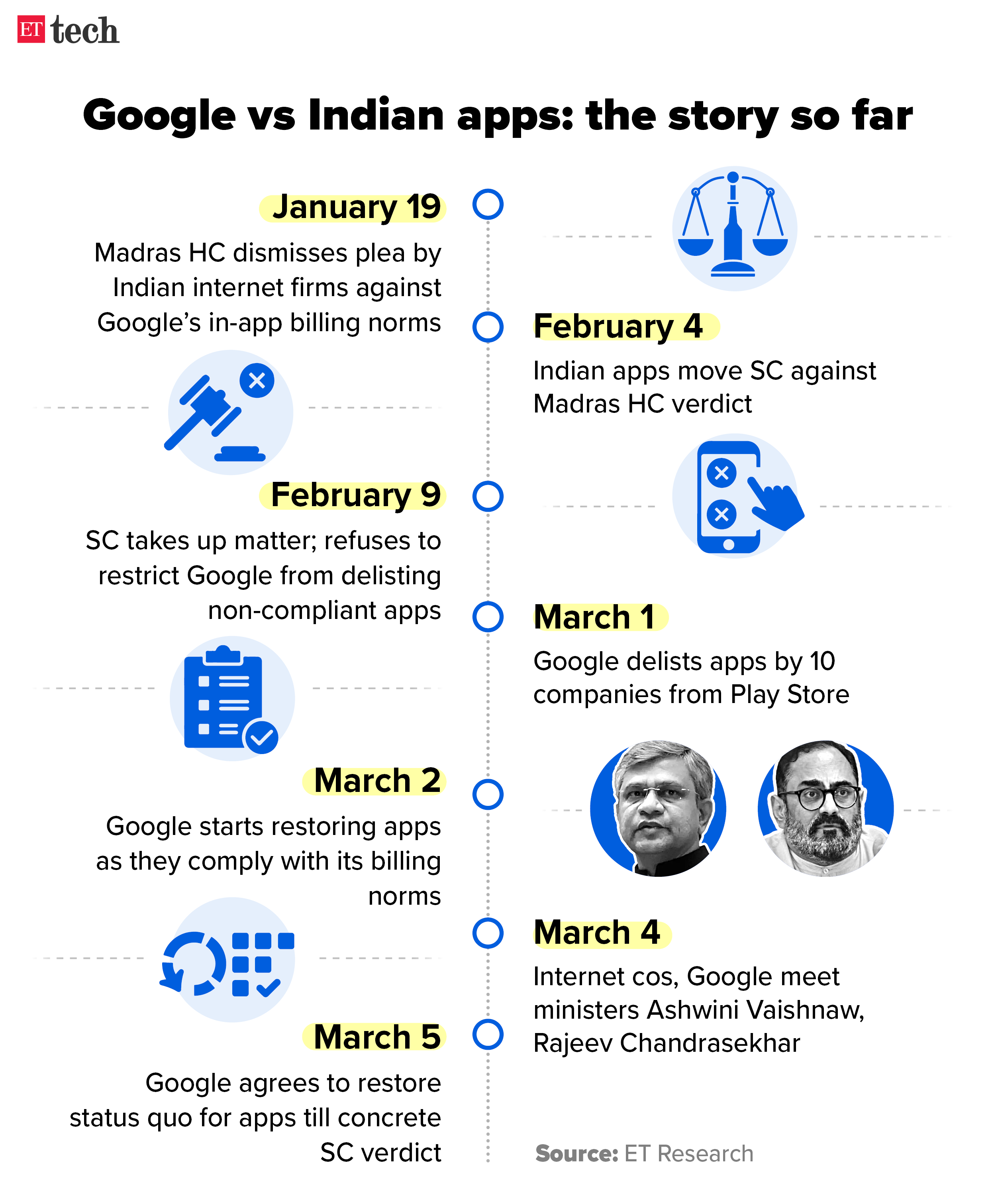

Google vs Indian apps

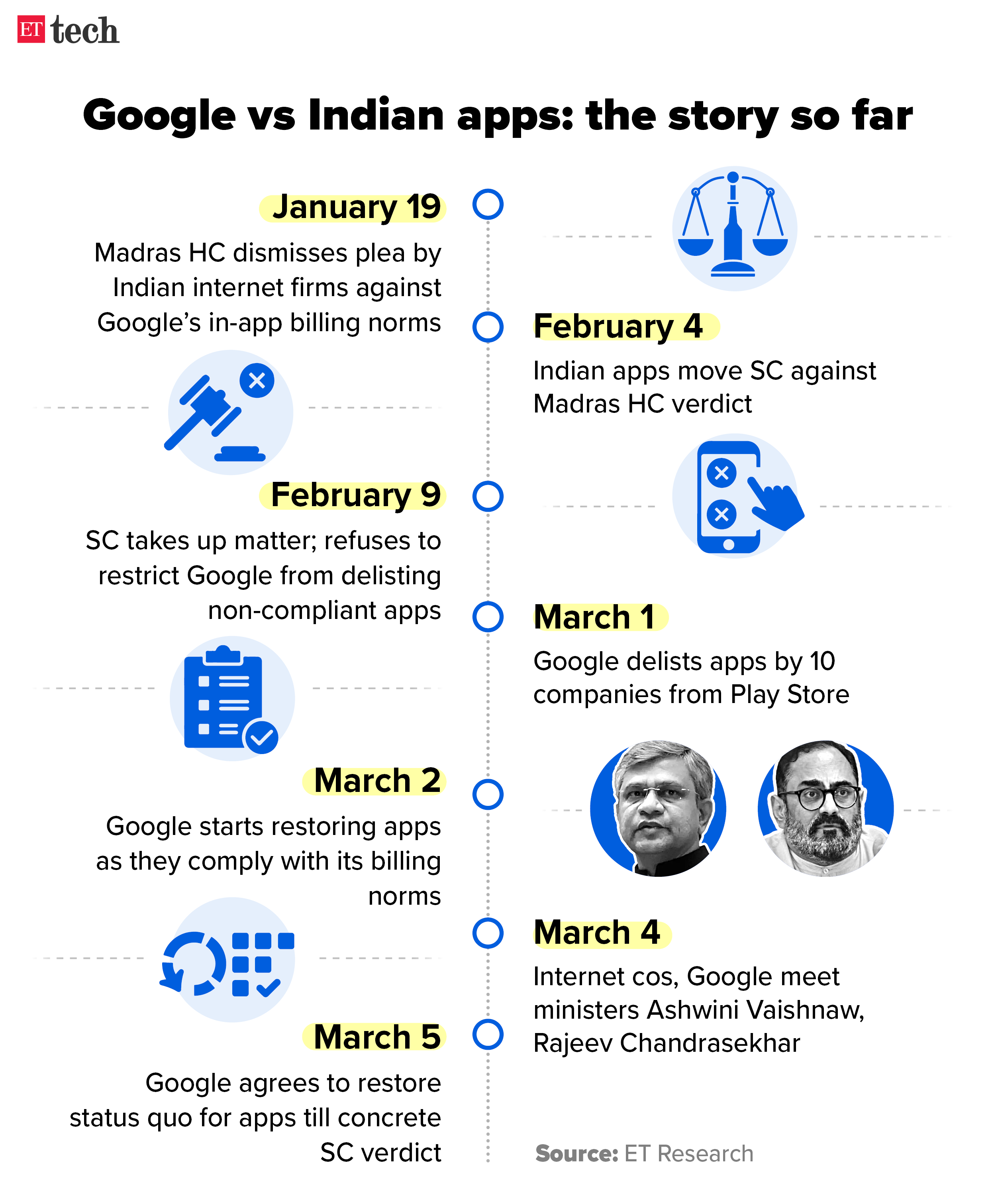

Google was logged into a battle with Indian internet companies after the tech giant delisted several prominent apps by ten Indian developers from its marketplace Play Store for “non-compliance with billing policies”.

Some of these were Info Edge’s flagship apps Naukri and 99acres, Bharat Matrimony, Telugu Matrimony, Tamil Matrimony, Marathi Matrimony as well as Matrimony.com’s Jodii and People Group’s Shaadi.com.

Also read | Real-money Gaming Firms Look for Cues in Google Billing Row

Indian entrepreneurs have opposed the commission, ranging from 11-26%, saying it would make their business models unsustainable.

After days of going back and forth, the Indian government intervened and got both conflicting parties to the table. They both agreed to a four-month extension in the timeline for payment of service fees to the Android maker. Google also reinstated the delisted apps.

Google also said it will invoice its full applicable service fee in the interim, with an extended payment timeline for these ten companies. Meanwhile, founders and executives at Indian internet firms said the fight between them and Google is far from over.

Also read | ETtech Full Stack: No point Googling ‘swadeshi’

Fintech News

RBI diktat to banks, credit card companies set to upend long-term integrations: The Reserve Bank of India’s latest diktat to banks and card schemes like Visa and Mastercard to refrain from entering into exclusive arrangements could disrupt long-term symbiotic relationships between these two sectors.

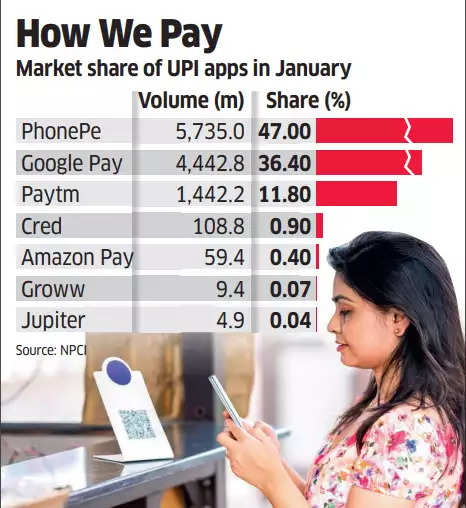

NPCI, startups brainstorm on ways to mitigate concentration risk on UPI: From creating specialised incentive structures for small players on the Unified Payments Interface to enabling a sort of a reservation system among third-party apps to help the weaker ones grow, multiple ideas came up to mitigate the concentration risk on UPI during a meeting on Tuesday.

Also read | NPCI eyes a more evenly sliced UPI pie

Tech and Policy

ETtech Done Deals: Startup funding dips 18% to $121 million this week

At the peak of the funding winter last year, an investor told me that the pace of investment deals will continue to be slow, but the nature of companies grabbing new cash will be different. The next obvious question was: what kind of companies? Consumer brands, the person said.

Cut to March 2024, and the trend is now well established among tech-first venture capital funds increasingly backing brands selling products and services to a wide range of consumers. Sure, they’re new-age and rely on technology, but that’s not the core of these companies.

For example, one of the first such early-stage deals in the works last year was Peak XV Partners (formerly Sequoia Capital India) investing in luggage brand Mokobara. It sells travel-related products through online and offline stores. Peak XV has been an investor in direct-to-consumer Mamaearth’s parent too, but over the past year venture funds are no longer looking at startups only through the ‘technology-first’ lens.

ET reported on Friday that Nexus Venture Partners is the latest fund in advanced stages to back two new consumer brands – specialty coffee chain AbCoffee and lab-grown diamond maker Aukera.

Newme, Snitch, Foxtale, The Ayurveda Company, The Souled Store are among new consumer brands that have raised funding from venture investors and are engaged in new fundraise talks too. According to several media reports, other new consumer brand ventures – run by former grocery or ecommerce executives – are also stitching up similar funding deals from venture capital funds.

“Mamaearth, Boat have been the first set of digital-first brands who started via Flipkart or Amazon and have become established consumer brands. They are going where consumers are available. Across categories – food, fashion, beauty, coffee – the same is playing with new companies,” an investor who has reviewed several pitches said. According to him, the overall market size is much bigger offline and Covid-19-induced gains for ecommerce have tapered off.

“These businesses are also economically sound in early-stages – compared to some tech-first startups relying on burn to grow – making it more viable to build a profitable venture. Increasingly, investors are trying to find these brands and sectors seeing good growth in a sustainable manner,” this person said.

Also read | Specialty coffee chain AbCoffee raises $3.4 million in funding led by Nexus Venture Partners

AbCoffee founder Abhijeet Anand said the majority of his stores are profitable at an operating level and it’s been able to do that by leveraging technology in its operations.

“Their (AbCoffee) innovative tech model, coupled with their focus on high-quality, ethically sourced beans and efficient brewing methods, allows them to offer premium coffee experiences at surprisingly affordable prices. We believe this unique approach has the potential to disrupt the Indian coffee market and make premium coffee beverages a mainstream beverage enjoyed by everyone,” said Suvir Sujan, managing director at Nexus Venture Partners.

A seasoned D2C brand founder said a common problem with major brands being online-first is they hit a plateau beyond a certain scale of, say $100 million or so in sales. “So, you have to then go offline and figure out the model. We realised we can make more money through various offline channels than online and marketplace fees are high. In offline, I can have much more visibility for my brand too. The more I sell, the better my negotiations with the store owners,” this entrepreneur said.

We have been reporting through last year that ecommerce sales have seen softness in certain quarters as offline retail is fully back. “We have more say in pricing as well as what stock will go online and what will remain in my stores first,” a senior executive at one of top retail firms said on the changing dynamics between ecommerce platforms and brands.

“Young and affluent – that’s the customer base these upstarts are going after. They spend more now than you and I did when we were younger. They are going out and experiencing these new brands – for travel needs or trying a new apparel brand,” another seasoned ecommerce executive said, underscoring why these consumer brands are finding traction among users.

The funding winter may still be around for some time, but clearly funds are ready to sign cheques for new-age brands – tech is not a must-have or priority.

Funding Trends

Meesho in talks for secondary deal with Peak XV, Tiger Global at $3.5-3.9 billion valuation: Peak XV Partners (formerly Sequoia Capital India) and Tiger Global are among a bunch of investors that have held talks to acquire a stake in SoftBank-backed ecommerce firm Meesho in a secondary deal, people in the know said. The transaction is likely to take place at a valuation of $3.5-3.9 billion, depending on the final terms.

Tech-first VCs line up for new-age consumer brands, offline businesses: In the latest instance of tech-first venture capital firms investing in new-age consumer brands with offline presence, Nexus Venture Partners, known for SaaS expertise, is set to lead a $5 million funding round in specialty coffee brand AbCoffee, people in the know said. The round will see the coffee brand’s valuation treble to about $15 million in less than six months.

VCs hire experts to help with exits as LPs look for returns: One of the major concerns voiced by investors regarding India consistently has been the lack of exit liquidity opportunities. To take on this problem, over the last two years, leading venture capital funds including Lightspeed, Accel and Matrix Partners India have sought out professionals with investment banking expertise.

Top Reads This Week

Zepto, Blinkit adding fashion, electronics, beauty and more: Two of the largest quick commerce platforms—Zomato-owned Blinkit and Mumbai-based upstart Zepto—are fast entering ecommerce territory and are set to add several categories like fashion, beauty, electronics, toys, home and kitchen among other segments.

Meanwhile, Tata Digital-owned online supermarket BigBasket said it is not in a rush to broaden its product portfolio and will continue to focus primarily on grocery.

Flipkart to roll out quick-commerce venture soon: Flipkart is planning to launch a quick-commerce service in a few months, people in the know of the matter said. The delivery timeline targeted by the ecommerce major and the number of cities it plans to launch the venture in are not yet known.

Also read | Flipkart launches UPI service in partnership with Axis Bank

Indian SaaS products to corner 8% global market share by 2028: report | As Indian software startups continue to target international markets, the global market share of SaaS products from India is expected to reach 8% by 2028, a report from advisory firm 1Lattice and venture investor Sorin Investments led by veteran dealmaker Sanjay Nayar said.

Real-money gaming companies look for an ace to beat tax blues: Companies that run online games like poker, rummy and fantasy sports where real money is wagered are experimenting with new models that discourage users from frequently withdrawing their money, as they seek to minimise the impact of increased indirect tax and boost their earnings.

Much excite, very wow: Meme coin volumes jump on local bourses: Trading of meme coins has spiked on Indian cryptocurrency exchanges, taking a cue from a resurgence in the global crypto market where the blue-chip Bitcoin and Ethereum currencies have scaled to new record highs after a year and half of falling prices.

Google vs Indian apps

Google was logged into a battle with Indian internet companies after the tech giant delisted several prominent apps by ten Indian developers from its marketplace Play Store for “non-compliance with billing policies”.

Some of these were Info Edge’s flagship apps Naukri and 99acres, Bharat Matrimony, Telugu Matrimony, Tamil Matrimony, Marathi Matrimony as well as Matrimony.com’s Jodii and People Group’s Shaadi.com.

Also read | Real-money Gaming Firms Look for Cues in Google Billing Row

Indian entrepreneurs have opposed the commission, ranging from 11-26%, saying it would make their business models unsustainable.

After days of going back and forth, the Indian government intervened and got both conflicting parties to the table. They both agreed to a four-month extension in the timeline for payment of service fees to the Android maker. Google also reinstated the delisted apps.

Google also said it will invoice its full applicable service fee in the interim, with an extended payment timeline for these ten companies. Meanwhile, founders and executives at Indian internet firms said the fight between them and Google is far from over.

Also read | ETtech Full Stack: No point Googling ‘swadeshi’

Fintech News

RBI diktat to banks, credit card companies set to upend long-term integrations: The Reserve Bank of India’s latest diktat to banks and card schemes like Visa and Mastercard to refrain from entering into exclusive arrangements could disrupt long-term symbiotic relationships between these two sectors.

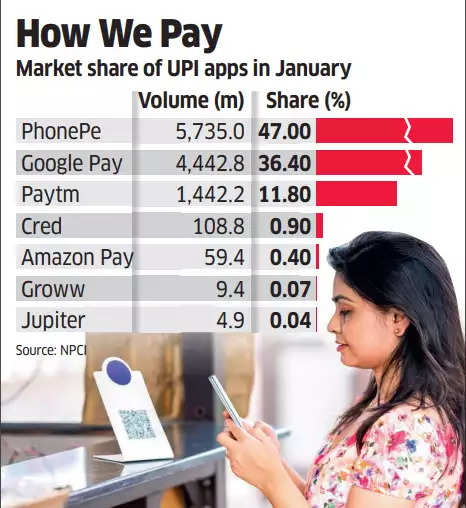

NPCI, startups brainstorm on ways to mitigate concentration risk on UPI: From creating specialised incentive structures for small players on the Unified Payments Interface to enabling a sort of a reservation system among third-party apps to help the weaker ones grow, multiple ideas came up to mitigate the concentration risk on UPI during a meeting on Tuesday.

Also read | NPCI eyes a more evenly sliced UPI pie

Tech and Policy

ETtech Done Deals: Startup funding dips 18% to $121 million this week