New research finds women and minorities likely to pay higher auto loan premiums

New research has found that women and minorities are more likely to pay higher premiums when they take out auto loans. A new study conducted by researchers at three leading universities found that women and minorities pay a statistically significant and greater dealer interest rate markup than men and non-minorities.

The study, published in Marketing Science, is called “Frontiers: Inequalities in Dealers’ Interest Rate Markups? A Gender- and Race-Based Analysis.” The study’s authors are O. Cem Ozturk of the University of South Carolina, Cheng He of the University of Wisconsin-Madison, and Pradeep K. Chintagunta of the University of Chicago.

“While vehicle pricing tends to be more transparent than ever, there is still a good deal of mystery for consumers surrounding automotive financing,” says He.

“Financing negotiations typically occur after the actual vehicle price negotiations. While consumers negotiate vehicle prices with their salesperson, they negotiate financing with the dealership’s finance manager either directly or indirectly. In the course of this process, dealer markups are less transparent, giving the dealer more latitude in the actual interest rates car buyers pay.”

Because auto dealers have such leeway, the researchers sought to find out if they charge women and minorities higher markups than they charge men and non-minorities and what consumer- or dealer-specific factors influence differential markups that are based on gender or race.

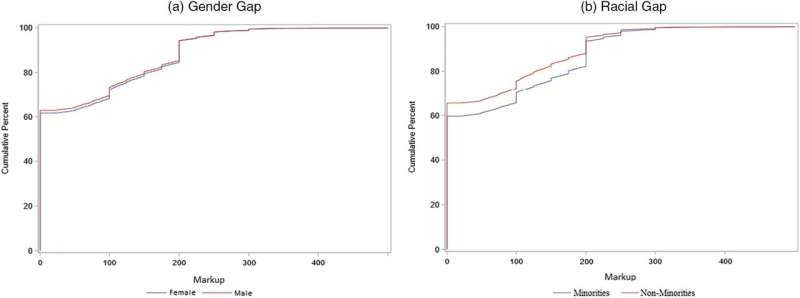

“We found that dealers charge 0.6% greater markups for women than they do for men,” says Ozturk. “This amounts to an average annual value of $40.3 million nationwide in the differential between men and women. Our results show that women are 0.5% more likely to be charged with markup, which suggests that 20,256 women would not have been charged with a markup each year if they were men.”

The researchers’ study relied on unique individual-level transaction data: A 20% random sample of a U.S. auto dealership census between 2004 and 2015. In measuring the gender gap, they compared markups between women and men from the same postal code who were purchasing identical vehicles, which included the same make, model, model year, and even the trim from the same dealer in the same week.

To analyze the racial gap, the researchers used the same structure and computed the differences between census block groups with high- versus low-percentage minority populations.

“We found that buyers in census block groups with a high percentage of minority populations paid 2.6% more for dealer markups,” says Chintagunta. “This means that minority borrowers were paying collectively $226.3 million more per year. However, differences in payment rates for minorities and women decline over time.”

More information:

O. Cem Ozturk et al, Frontiers: Inequalities in Dealers’ Interest Rate Markups? A Gender- and Race-Based Analysis, Marketing Science (2023). DOI: 10.1287/mksc.2022.0295

Citation:

New research finds women and minorities likely to pay higher auto loan premiums (2024, February 12)

retrieved 12 February 2024

from https://phys.org/news/2024-02-women-minorities-pay-higher-auto.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

New research has found that women and minorities are more likely to pay higher premiums when they take out auto loans. A new study conducted by researchers at three leading universities found that women and minorities pay a statistically significant and greater dealer interest rate markup than men and non-minorities.

The study, published in Marketing Science, is called “Frontiers: Inequalities in Dealers’ Interest Rate Markups? A Gender- and Race-Based Analysis.” The study’s authors are O. Cem Ozturk of the University of South Carolina, Cheng He of the University of Wisconsin-Madison, and Pradeep K. Chintagunta of the University of Chicago.

“While vehicle pricing tends to be more transparent than ever, there is still a good deal of mystery for consumers surrounding automotive financing,” says He.

“Financing negotiations typically occur after the actual vehicle price negotiations. While consumers negotiate vehicle prices with their salesperson, they negotiate financing with the dealership’s finance manager either directly or indirectly. In the course of this process, dealer markups are less transparent, giving the dealer more latitude in the actual interest rates car buyers pay.”

Because auto dealers have such leeway, the researchers sought to find out if they charge women and minorities higher markups than they charge men and non-minorities and what consumer- or dealer-specific factors influence differential markups that are based on gender or race.

“We found that dealers charge 0.6% greater markups for women than they do for men,” says Ozturk. “This amounts to an average annual value of $40.3 million nationwide in the differential between men and women. Our results show that women are 0.5% more likely to be charged with markup, which suggests that 20,256 women would not have been charged with a markup each year if they were men.”

The researchers’ study relied on unique individual-level transaction data: A 20% random sample of a U.S. auto dealership census between 2004 and 2015. In measuring the gender gap, they compared markups between women and men from the same postal code who were purchasing identical vehicles, which included the same make, model, model year, and even the trim from the same dealer in the same week.

To analyze the racial gap, the researchers used the same structure and computed the differences between census block groups with high- versus low-percentage minority populations.

“We found that buyers in census block groups with a high percentage of minority populations paid 2.6% more for dealer markups,” says Chintagunta. “This means that minority borrowers were paying collectively $226.3 million more per year. However, differences in payment rates for minorities and women decline over time.”

More information:

O. Cem Ozturk et al, Frontiers: Inequalities in Dealers’ Interest Rate Markups? A Gender- and Race-Based Analysis, Marketing Science (2023). DOI: 10.1287/mksc.2022.0295

Citation:

New research finds women and minorities likely to pay higher auto loan premiums (2024, February 12)

retrieved 12 February 2024

from https://phys.org/news/2024-02-women-minorities-pay-higher-auto.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.